- Aerodrome came out of left field to dominate DeFi on Coinbase's Base.

- The top DeFi dev on Algorand called it quits, saying projects are "uninvestable."

- Over at MakerDAO, the community is divided over higher yields. A proposal from MakerDAO co-founder Rune Christensen to use Solana's codebase ruffled feathers.

- That, and much more, in this week’s The Decentralised newsletter.

A version of this article appeared in our The Decentralised newsletter. If you want to read this or our other newsletters before your friends do, don’t hesitate to sign up.

Hey everyone, Tim here. Welcome back to The Decentralised, where we give you the low-down on last week’s top DeFi news.

First up is my story on Aerodrome, a new decentralised exchange on Coinbase’s Base blockchain. In just three days after its August 28 launch, Aerodrome hit a total value locked of over $200 million, outpacing incumbents like Uniswap and Compound to become the top DeFi protocol on Base.

Key to Aerodrome’s success is its incentive system, known in DeFi circles as ve(3,3), which was first envisioned and trialled by prolific DeFi builder Andre Cronje.

The ve(3,3) system is fairly complicated, even by crypto standards, so check out the full article here for an explanation.

Aerodrome’s initial buzz has since cooled off, and its TVL has dropped to around $170 million. DL News will be watching closely to see if Aerodrome can maintain the top spot on Base.

Next, Osato Avan-Nomayo dove into DeFi on Algorand, and the drama surrounding the blockchain’s biggest decentralised exchange, Pact.

Dojo Dujoor, the pseudonymous main contributor to Pact, said in a Discord post earlier this week that he is stepping down, and expressed fears about the inability of Algorand-native DeFi projects to secure additional investment.

“The unfortunate reality, after giving months of blood, sweat and tears, was that every single prospective party considered that anything Algorand-native was ‘currently uninvestable,’” Dujoor told DL News.

The situation at Pact hasn’t been helped by a scandal involving the protocol’s former community manager and a giveaway of 50,000 ALGO tokens.

Read the full article, and find out what the future outlook on Algorand DeFi is, here.

Rounding out last week, I wrote about MakerDAO’s Enhanced Dai Savings Rate, or in layman’s terms, the yield holders can earn on the Dai stablecoin.

MakerDAO, guided by co-founder Rune Christensen’s proposal, increased yields to a whopping 8% at the start of August, setting off a surge of Dai minting that boosted its market cap by over one billion.

The DAO has since lowered yields to 5%, and the community is split on how effective raising Dai yields ultimately is. Some argue the high yields have only brought in whales to feast on MakerDAO’s coffers, but others point to the marked increase in Dai supply as proof the initiative is working.

Whichever side of the debate you fall on, one thing’s for certain: Christensen is shaking it up at MakerDAO as he brings his planned endgame to fruition. And, as we’ll see in the governance section, a controversial idea involving Solana’s codebase could cause further division. Check out the full story here.

Data of the week

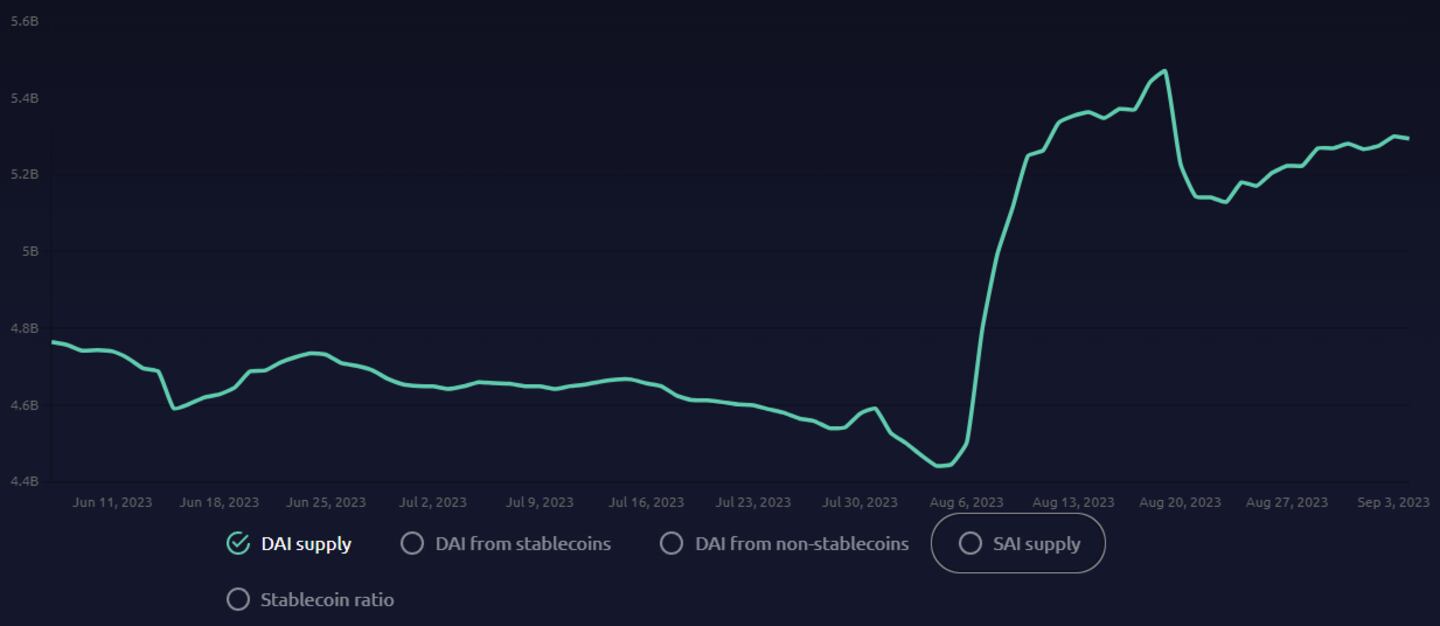

The Impact of the Enhanced Dai Savings Rate: After MakerDAO activated an 8% yield on August 6, the Dai supply jumped over one billion.

But when it lowered yields to 5% on August 20, the supply took a $300 million hit. Now the market has gotten used to the new rate, the supply of Dai is slowly creeping higher.

This week in DeFi governance

TEMP CHECK: Aave mulls onboarding TokenLogic as a service provider

TokenLogic is asking Aave for $350,000 to assist with treasury management, safety module modelling, and GHO adoption. Aave DAO voters appear receptive to TokenLogic, with 139,000 votes in favour. Voting ends September 7.

PROPOSAL: Uniswap and Zero protocol to team up for friendly fork on Polygon zkEVM

Zero Protocol wants to bring the ve(3,3) system to Polygon zkEVM using Uniswap’s V3 version as its core trading engine. A friendly fork refers to a situation in which a protocol is duplicated, creating a new version that maintains a positive and collaborative relationship with the original project.

By establishing a friendly fork relationship with Uniswap, Zero will give the Uniswap DAO 10% of the ZERO token supply, locked for 2 years as veZERO.

DISCUSSION: Rune Christensen wants to use Solana codebase for eventual MakerDAO blockchain

In his latest endgame post, Rune Christensen explores using a fork of the Solana codebase for a future MakerDAO blockchain. He says Solana’s code is the best choice because it’s “highly optimized for the purpose of operating a singular, highly efficient blockchain.”

To say this latest proposal is controversial is somewhat of an understatement — many view it as a betrayal of Ethereum.

Post of the week

Rune Christensen’s proposal to use Solana’s codebase has ruffled feathers in the Ethereum community, and may even have caught the attention of Ethereum co-founder Vitalik Buterin himself.

A day after Christensen posted his proposal, Buterin liquidated his stake in MakerDAO for Ether, marking his first sale of the MKR token in over two years.

Whether the timing was intentional or not, Buterin’s sale makes for an entertaining coincidence. Many are interpreting it as a subtle message.

Rune, you’re my ETH OG brother, I love you. But don’t ever take sides against the family again.

— state (@statelayer) September 3, 2023

-Vitalik

What we’re watching for next week

It seems that @stake exploited for 6000 ETH 👀 https://t.co/bfuAT1ZnMG pic.twitter.com/NSAYGf1UvI

— Officer's Notes (@officer_cia) September 4, 2023

Crypto casino Stake was hacked for over $41 million on Monday, the platform’s official X account confirmed. Details on how it happened are still unclear, but the leading theory from security experts is a hacker obtained the private key for one of Stake’s crypto wallets letting them withdraw funds at will.

Stake said a series of “unauthorised transactions” happened, and that all user’s funds on the platform are safe.

Have you joined our Telegram channel yet? Check out our News Feed for the latest breaking stories, community polls, and of course — the memes. https://t.me/dlnewsinfo

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.

Disclosure: Tim holds over $1,000 worth of Ether, Swell staked Ether, Redacted Cartel, and GMX. He also holds an insignificant amount in NFTs.