A version of this story appeared in our The Decentralised newsletter on April 9. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Mango Markets exploiter Avraham Eisenberg is going to trial.

- Crypto lender Goldfinch suffers yet another default.

- Uniswap hits $2 trillion in swap volume — and it’s just getting started.

Mango Markets exploiter puts ‘code is law’ defense to the test

Avraham Eisenberg, the self-described “applied game theorist” who swiped $115 million from DeFi exchange Mango Markets in October 2022, is about to go to trial in the US.

Eisenberg was charged with market manipulation in December 2022 after he inflated the value of the protocol’s MNGO token. He used his stash of MNGO as collateral to borrow Mango Markets users’ funds with “no intention of repaying them,” prosecutors said.

Eisenberg claims his actions weren’t illegal because he used the Mango Markets protocol as it was designed, “even if the development team did not fully anticipate all the consequences.”

I believe all of our actions were legal open market actions, using the protocol as designed, even if the development team did not fully anticipate all the consequences of setting parameters the way they are.

— Avraham Eisenberg (@avi_eisen) October 15, 2022

The case will be a major test for the so-called code is law defense. The verdict — whatever it may be — will have a rippling effect across the DeFi legal landscape.

Code is law is the idea that the rules enforced or not enforced by smart contracts have the final say over whether onchain actions are legal.

Eisenberg isn’t the only one to stand behind the idea that code is law after exploiting a DeFi protocol.

Andean Medjedovic, who exploited DeFi protocol Indexed Finance for $15 million in October 2021, has also argued that his actions were lawful under the premise that code is law.

Goldfinch borrower Lend East defaults on $5.9m loan

Goldfinch lenders are facing another big hit after borrower Lend East defaulted on $5.9 million of its $10.2 million loan.

It’s the third time users have suffered a default since Goldfinch started operating in January 2021.

The repeated defaults have thrown into question Goldfinch’s model of letting DeFi users underwrite undercollateralised emerging-market loans.

“Underwriting emerging-market loans has always been difficult and putting them on crypto rails doesn’t change that fact,” Tze Donn Ng, an investment associate at Tioga Capital Partners, told DL News.

Goldfinch isn’t the only DeFi protocol to struggle with undercollateralised lending.

In September, Quinn Thompson, Maple Finance’s then-head of growth and capital markets, told DL News that Maple was moving away from offering undercollateralised loans after a spate of FTX-linked defaults cost the protocol’s users $36 million.

“We’re looking at the companies in the space, and we’re saying, ‘You’re not good enough for uncollateralised, you don’t make enough money,’” he said at the time.

Top DEX Uniswap hits $2tn in swap volume

Uniswap has achieved a milestone of $2 trillion in total trading volume since its launch in 2018.

The exchange’s success is just the beginning, according to Uniswap Foundation executive director Devin Walsh.

She told DL News that the Uniswap Foundation’s efforts in building a dedicated community of developers and researchers, nine cross-chain deployments, and the platform’s immutable code and minimised governance have all contributed to its growth.

There’s some big developments planned for Uniswap this year, too.

Uniswap is preparing for the rollout of Uniswap V4, which is tentatively set for the third quarter. V4 will introduce “hooks” for enhanced smart contract functionalities, a Singleton contract framework to cut gas costs, and a “flash accounting” system for streamlined transactions.

Additionally, Uniswap DAO members are discussing enabling a “fee switch,” which would direct a portion of the protocol’s fees to UNI token holders.

The DAO is expected to vote on the fee switch proposal later this month.

Data of the week — $1.3bn stablecoins added in a day

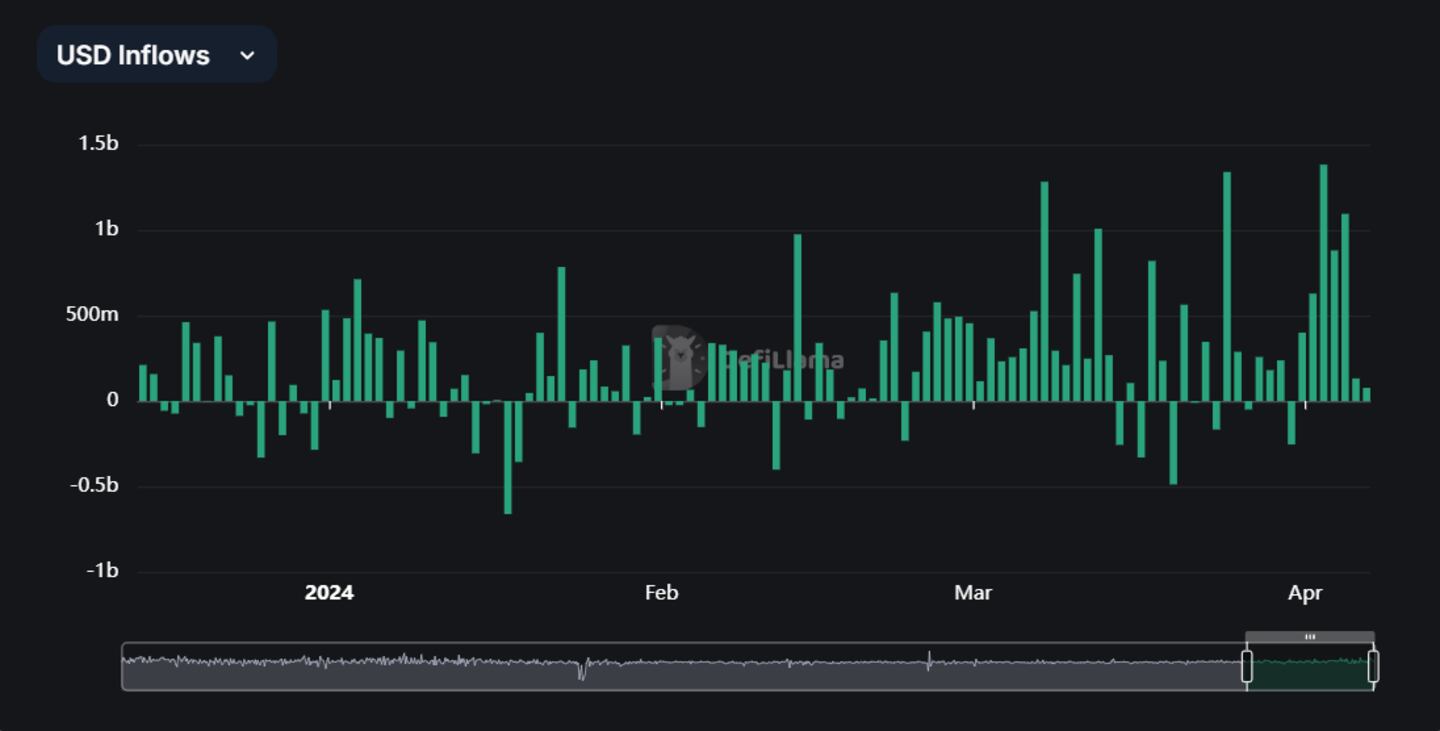

Stablecoins entering DeFi have increased since the start of April.

On April 2, over $1.3 billion worth of stablecoins were created onchain, the biggest one-day increase in over a year.

Stablecoin supply increases often mean more outside money is flowing into DeFi, and are widely considered a bullish signal.

This week in DeFi governance

VOTE: Sushi DAO split on controversial restructuring proposal

PROPOSAL: Aave DAO discusses changing risk parameters for MakerDAO’s DAI stablecoin

VOTE: Lido DAO shoots down vote to add revenue share staking

Post of the week

When X user Richard Opany thanked Worldcoin for his WRLD token airdrop, which he used to purchase a goat, he probably didn’t expect to start a new trend.

After revealing his new goat would be called Sam — after OpenAI founder and Worldcoin backer Sam Altman — it spurred multiple other X posters to send Opany money to buy more goats and name them after blockchains, popular memes, and even their friends.

@worldcoin thanks pic.twitter.com/yxl0ytlEYL

— richard opany (@OpanyRichard) April 1, 2024

What we’re watching…

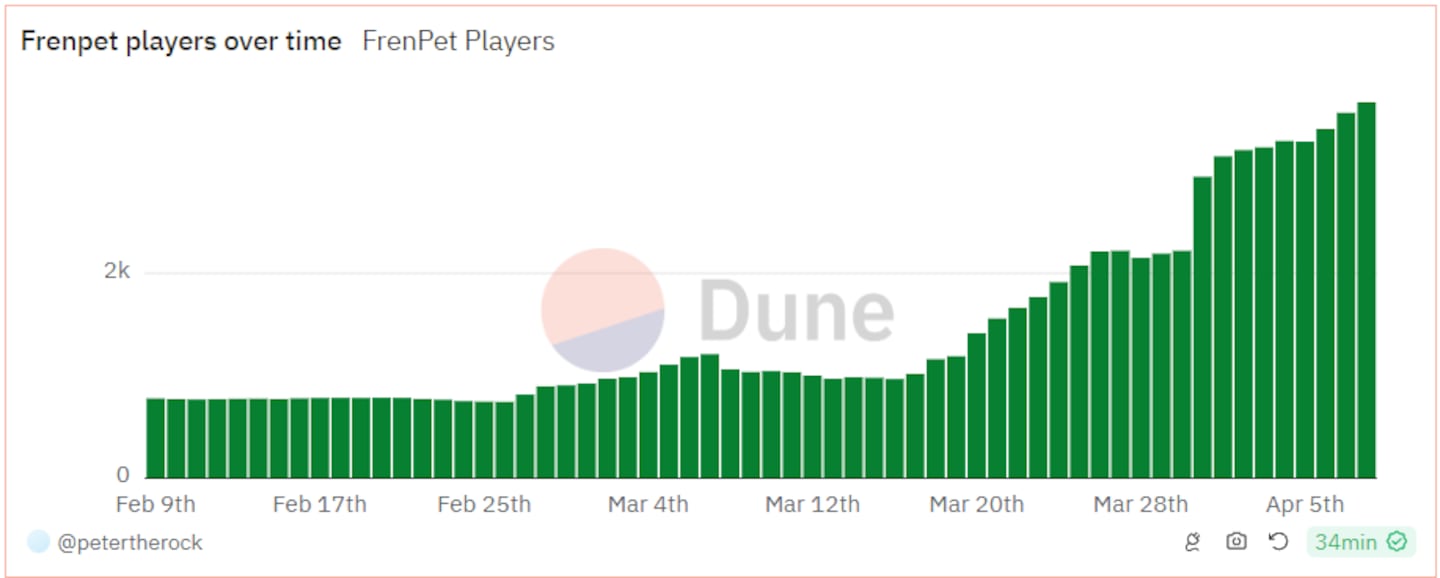

A new crypto game is making waves on Coinbase’s buzzy layer 2 Base.

Called Fren Pet, the game resembles the Tamagotchi toys popular in the 1980s — only on a blockchain.

Fren Pet players have soared since late March, sending the FP token, which is needed to play the game, up over 42% this week.

Got a tip about DeFi? Reach out at tim@dlnews.com.