- Fjord Foundry raised over $15.3 million for its native token FJO, bringing the total raised through Fjord Foundry to over $980 million.

- Fjord has generated over $28 million in fees to date.

- Some 90% of the fees generated in the future will be used to buy back and burn the FJO token.

DeFi platform Fjord Foundry conducted its largest-ever token sale on April 19, raising $15.3 million through the sale of its own token, FJO.

The sale brought the total funds raised through Fjord Foundry to over $980 million.

Fjord Foundry lets projects raise funds from users through “liquidity bootstrapping pools,” or LBPs. LBPs enable early-stage projects to raise funds while giving users the opportunity to invest at the ground level.

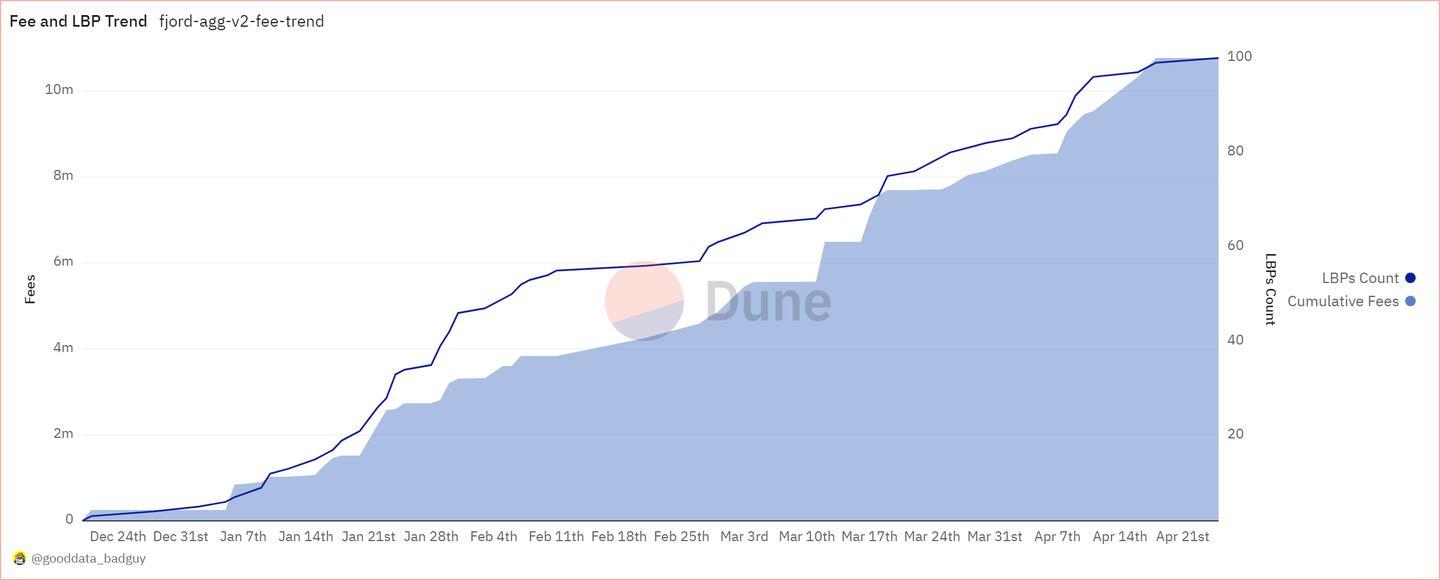

Since Fjord launched in November, it has generated over $28 million in fees, all of which went back to the Fjord team to further develop the project.

Now, with the launch of the FJO token, 90% of the fees generated by Fjord products will benefit FJO tokenholders, as those funds will be used to buy back and burn FJO tokens.

Users are charged a 2% swap fee for transactions on Fjord, and LBP pool creators are charged a 3% fee on the total raised funds.

The five most recent LBPs, conducted between April 10 and April 18, generated $937,000 in fees. Under the new FJO tokenomics, this would have resulted in $843,000 used to buy FJO on the market.

Additionally, once FJO token staking becomes available, expected in June, the allocation will be divided between buybacks and burns and staking rewards in the form of FJO.

Burning a token in crypto means to permanently remove the token from the supply.

How Fjord works

Liquidity bootstrapping pools are token sales that distribute new tokens through a mechanism that resembles a declining price auction, similar to a Dutch auction.

In LBPs, which typically last a few days, the token prices start high and can decrease over time, allowing participants to purchase at any stage during the auction. The setup differs from Dutch auctions, in that participant activity, such as purchasing tokens, can temporarily influence the price upward if demand increases.

A key aspect of LBPs is the concept of “weights,” which are ratios determining the proportion of the new token relative to a stable asset like USDC within the pool.

Initially, the weight heavily favours the new token but shifts over time toward the stable asset, facilitating a gradual reduction in the token’s price.

The strategy behind LBPs aims to mitigate the influence of large buyers and provide a more accessible entry point for a broader range of participants.

Any project can implement LBPs with specific rules and initial conditions intended to manage the sale process, influence participant behaviour, and potentially lead to a more distributed token ownership.

For example, users who participated in the FJO liquidity bootstrapping pool received an average price anywhere between $2.36 and $5.99 depending on when they purchased the token.

FJO is trading at $2.25, resulting in a market capitalization of $20 million. The total supply of FJO is 100 million, which is allocated to various entities under different terms. About 10% of the total supply is in circulation.

Seven different LBPs are live now, with another four expected to go live by Friday.

Still, participating in an LBP on Fjord Foundry carries risks, as with any token purchase.

Although the platform offers a transparent and decentralised way to offer a sale of new tokens, it doesn’t control how projects use the liquidity gained from the LBP.

Ryan Celaj is a data correspondent at DL News. Got a tip? Email him at ryan@dlnews.com.