- If Ethereum's validator exit queue becomes congested, Lido may not be able to redeem stETH for Ether during that time.

- stETH holders must then rely on existing liquidity to sell their tokens.

- A lack of liquidity for Lido's stETH token could cause it to depeg during a period of extreme market volatility.

At the start of the year, defunct crypto lender Celsius announced it would withdraw $1.6 billion worth of Ether that it had previously staked onchain.

The move instantly clogged Ethereum’s staking withdrawal queue so no other Ether stakers could execute withdrawals.

For most stakers, waiting a few days to withdraw their Ether is nothing more than a minor inconvenience.

But according to some analysts, such a delay could become a major problem for Lido and stETH — the biggest Ether liquid staking token with over $23 billion worth in circulation.

“The decline of stETH liquidity is a serious issue,” Riyad Carey, an analyst at crypto research firm Kaiko, told DL News.

The fear is that with low levels of liquidity and a clogged exit queue, stETH, which acts as a receipt on staked Ether deposits, could break its peg with Ether again, causing mass liquidations among those leveraging the token on lending protocols.

Although there was no depeg this time, many fear that if the crypto market experiences another sudden drawdown, the Ether staking queue could quickly become extended as investors rush to unstake their Ether and cash out.

Lido maintains that stETH is sufficiently liquid, and that there are mechanisms in place to prevent another depeg.

But with stETH increasingly intertwined with the broader DeFi ecosystem, the threat posed by a potential liquidity crisis is only becoming more pronounced.

Not enough liquidity

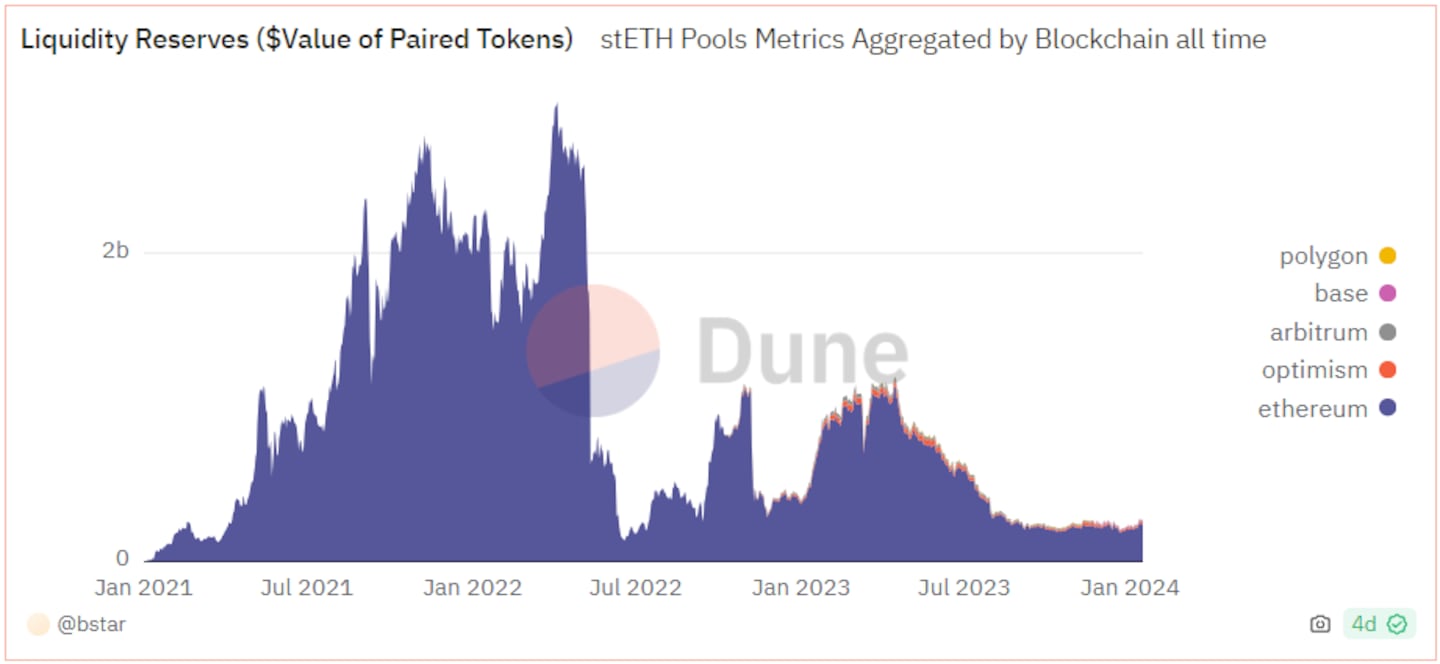

According to data from Lido’s stETH liquidity Dune dashboard, there’s currently about $274 million worth of liquidity across decentralised exchanges.

Lido’s head of protocol relations Marin Tvrdić said in a recent X post that liquidity for stETH on centralised crypto exchanges is between seven and eight figures.

Carey argues that the current stETH liquidity is insufficient.

He says that in situations where Ethereum’s validator exit queue becomes congested, there is not enough liquidity to support the more than $3 billion worth of leveraged bets on stETH on DeFi lending protocol Aave, should these positions suddenly need to unwind.

With the validator queue clogged, there’s no immediate way for Lido to convert stETH into Ether. This means it falls to trading pools that facilitate swaps between stETH and Ether to pick up the slack.

If stETH starts to break from its peg amid a demand imbalance, it could set off a cascade of liquidations on Aave. “If any large stETH holder gets impatient and sells, things could get ugly,” Carey said.

And Carey isn’t the only one who is concerned.

Ariah Klages-Mundt, co-founder of stablecoin protocol Gyroscope, said there was a “high likelihood” that stETH will depeg in the future.

“Don’t be too surprised if it happens at some point. You have to plan for things like this to happen at some point in finance,” Klages-Mundt said in a recent X post. Multiple other Ethereum thought leaders have shared similar views, though not all specifically pointed to Lido’s stETH.

Leveraging stETH on lending markets like Aave is a popular DeFi strategy to boost returns. Investors deposit stETH to Aave and borrow Ether, which they then deposit to Lido, receiving more stETH.

Repeating this loop compounds the staking yield earning on stETH, but also risks investors getting liquidated if their stETH collateral falls in value against the borrowed Ether.

A strong track record

Still, not everyone agrees Lido’s current levels of liquidity are a concern.

Adcv, a pseudonymous contributor at Lido DAO, told DL News it’s “inaccurate” to say there is insufficient stETH liquidity “in light of the observable on-chain evidence.”

“StETH has institutional-grade liquidity, both on and off chain in major trading venues on mainnet, layer 2 AMMs and major CEXs,” Adcv said.

To back his claims, Adcv pointed to Lido’s strong track record of fulfilling stETH redemptions.

Out of the 3 million Ether withdrawn from Lido since last year’s Shapella upgrade activated withdrawals, fewer than 30,000 took more than 120 hours to process, he said.

Aave, on the other hand, defers to the judgement of DAO service providers such as Chaos Labs and Gauntlet to assess the risks of letting its users leverage stETH.

In November, Chaos Labs proposed that Aave could increase the supply cap on stETH deposits by another 1.1 million tokens “without introducing significant risk to the protocol.”

But the recommendation, which was also supported by Gauntlet, came with a caveat: Chaos Lab’s risk calculation assumed no significant price divergences between Ether and stETH.

Preventative measures

According to Carey, Lido’s liquidity issues began when it stopped giving out LDO token incentives to liquidity providers of its stETH-ETH pool on Curve Finance.

Lido stopped incentivising liquidity because Ethereum’s April Shapella upgrade allowed stakers to start withdrawing their Ether from the blockchain’s staking contract.

This meant that instead of having to rely solely on the stETH liquidity on exchanges, Lido could instead redeem stETH for Ether if a supply imbalance were to occur.

Lido’s own data shows that since the Shapella upgrade, stETH liquidity on Curve Finance fell from around $800 million to $274 million.

According to Carey, Lido could do more to shore up liquidity.

“I wrote back in July that I thought Lido should consider engaging with a market maker to help boost off-chain liquidity,” he said. “While off-chain liquidity has improved since then, I do think this would still be worth exploring.”

It appears Lido is looking for ways to further secure stETH liquidity.

In August, crypto analytics platform Glass Markets posted a proposal on the Lido research forums requesting a grant to assess stETH liquidity and write a research report laying out the best way to address its recommendations.

A December post from a member of Lido DAO’s operations workstream confirmed that Glass Markets had been granted funds to pursue the research report.

DL News reached out to Glass Markets and Lido to ask about the status of the research report but did not receive an immediate response.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.