- Grayscale outflows and CME open interest are stabilising, suggesting Bitcoin’s recent bout of selling is done.

- The economic outlook will have a larger impact on Bitcoin as the year progresses, Coinbase says.

- Coinbase predicts the Federal Reserve will cut rates by 100 basis points in 2024.

Bitcoin is poised to move higher in the coming weeks as the sell-off peters out, Coinbase analysts said in a report on Friday.

Outflows from Grayscale’s Bitcoin ETF are slowing down. Just over $180 million left Grayscale’s ETF on Thursday, down from a high of $640 million on January 23.

Net inflows have averaged more than $200 million a day over the last week. This brings total net inflows into Bitcoin spot ETFs to almost $1.5 billion since they launched on January 11.

Open interest at CME — the largest Bitcoin derivatives exchange in the US by volume — has also stabilised, Coinbase said, another sign that the selling has subsided.

“These data points are making market participants more comfortable holding and adding to long crypto exposure,” said Coinbase.

“Macro factors [will] become more relevant for the digital asset class in the weeks ahead, which could be supportive for performance,” the report added.

Open interest reflects the total number of outstanding futures contracts held by market participants. After peaking close to $6.5 billion in the lead-up to the ETF approval, CME open interest is currently at $4.5 billion.

Soft landing

The US economy is in good shape, and it looks like a so-called “soft landing” could be achieved.

Coinbase said the US has largely avoided sacrificing economic well-being in its effort to bring down inflation — a feat that is known as a soft landing.

Federal Reserve chair Jerome Powell was more cautious in his assessment of the economy on Wednesday, when the US central bank kept rates unchanged between 5% and 5.25%.

The central bank chief said he was “encouraged by the progress,” but wouldn’t declare victory just yet.

A cooling labour market and widening US budget deficit will likely push the central bank to cut interest rates in May, Coinbase said. The Fed previously said strong jobs data was a reason to keep rates higher for longer, but jobs have since levelled off.

The Coinbase report predicted the Fed will cut rates by 100 basis points this year, bringing rates to between 4% and 4.25%.

Lower rates would benefit Bitcoin, as risk assets tend to perform better when rates are lower. With lower rates savings become less desirable and investors need to look for returns elsewhere.

Americans will be incentivised to put their money to work once rates come down, and with new investment vehicles such as Bitcoin ETFs being offered by more advisers the digital asset will likely benefit.

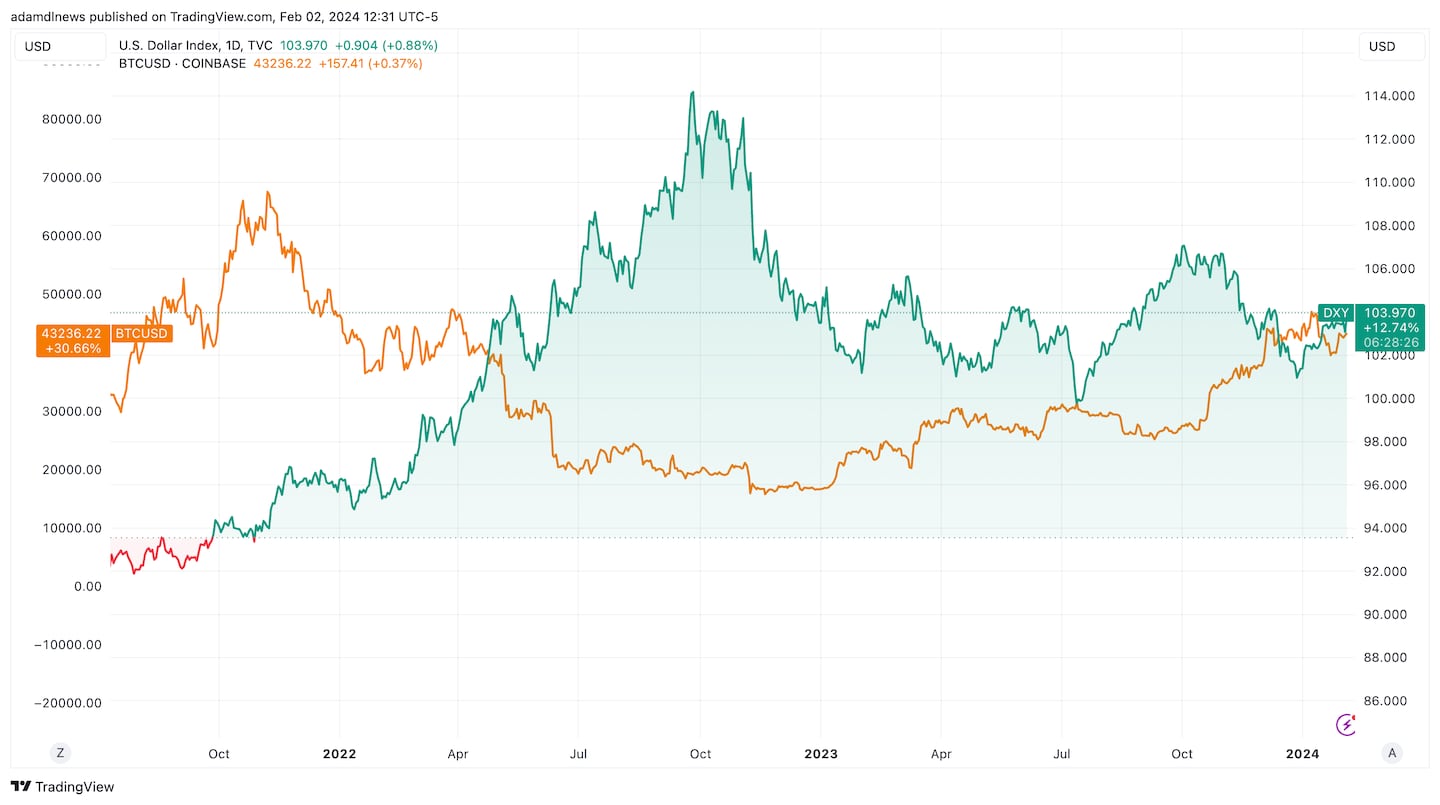

The potential for rate cuts will also weaken the dollar, making it less attractive to foreign investors. A weaker dollar is typically a positive for Bitcoin, as it mostly has an inverse relationship to the dollar.

The initial rate cuts may roughly coincide with the Bitcoin “halving,” currently scheduled for late April, predicted Coinbase. The halving — which historically has eased selling pressure from Bitcoin miners — could further push Bitcoin and the rest of the crypto ecosystem upwards.

“More advertising from ETF issuers and the inclusion of spot bitcoin ETFs in asset managers’ model portfolios [will also] unlock increased liquidity in this space,” Coinbase said.

Tom Carreras and Adam Morgan McCarthy are a markets correspondent at DL News. Got a tip about Bitcoin and markets? Reach out at tcarreras@dlnews.com or adam@dlnews.com