- The debt ceiling debate in the US has likely exacerbated liquidity conditions, according to Coinbase.

- Despite regulatory approval in Hong Kong, large inflows from Asia are unlikely in the short term.

With the debt ceiling standoff persisting, liquidity in crypto markets receded ahead of the holiday weekend in the US. Positive regulatory developments in Asia are unlikely to impact inflows immediately, Coinbase said on Friday.

Bitcoin’s 60% rally year-to-date has done little to improve volumes. Coinbase noted that uncertainty over the US hitting its debt ceiling on June 1 is likely further thinning out trading, amid “lingering concerns” over the ongoing credit crunch.

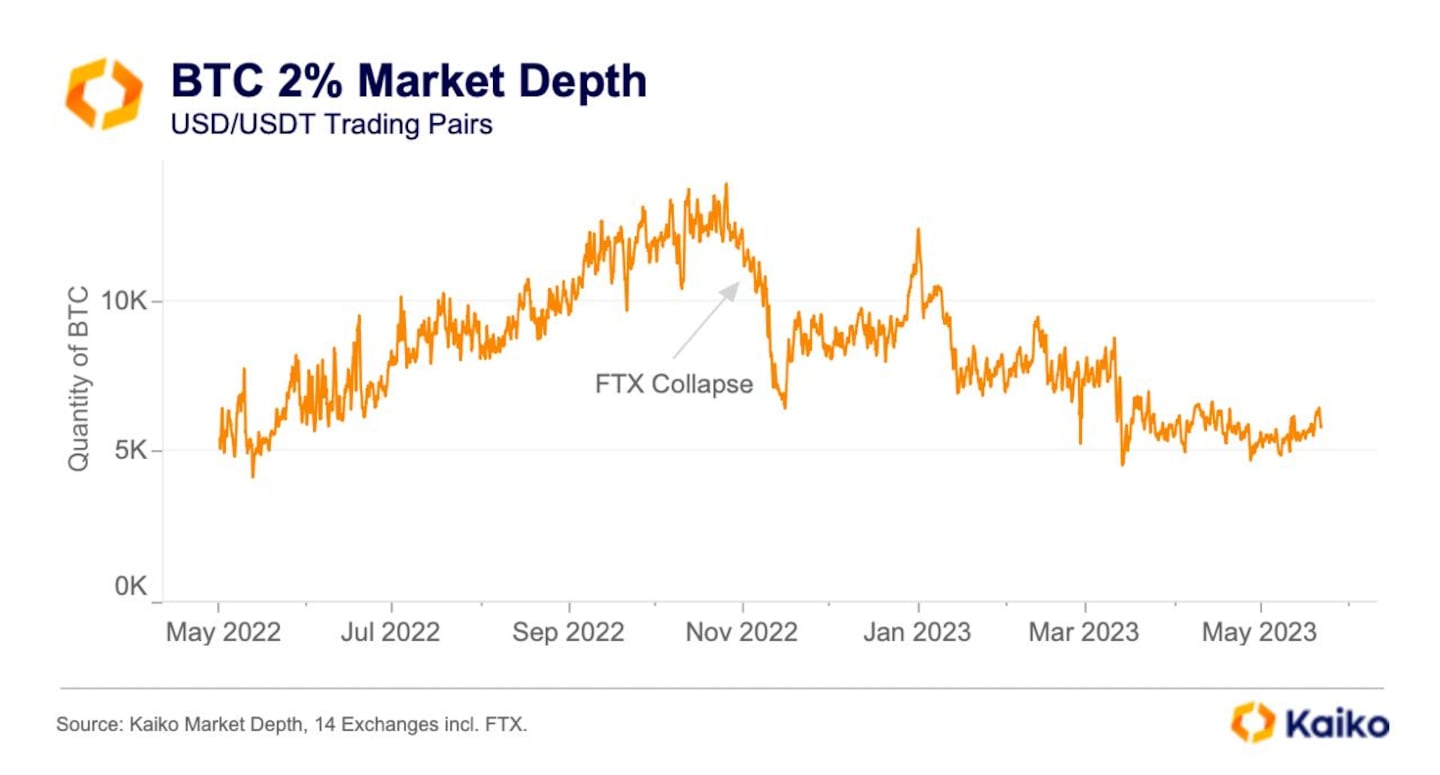

Market liquidity is the ability to carry out buy and sell orders at or near the prevailing market price. In liquid markets, a small number of transactions won’t dramatically impact price. Bitcoin markets hit a 10-month low in March, according to Kaiko research.

NOW READ: Bitcoiner Jimmy Song just won a $1.9m bet on Ethereum — or did he?

Liquidity has yet to recover from these lows, Kaiko’s latest data on market depth shows. Market depth has fallen to around 5,000 Bitcoin from over 10,000 Bitcoin at the beginning of the year. Kaiko views depth as one of the most important gauges of liquidity.

Market depth measures the number of orders within a price range waiting to be filled. Kaiko sums bids and asks within 2% of the mid-price to assess the depth of the Bitcoin market.

Debt ceiling drama

Liquidity in crypto markets receded heading into Memorial Day weekend in the US – which typically signals the beginning of the summer holidays for these market participants.

Market conditions have likely been exacerbated by the debt ceiling debate, according to David Duong, head of institutional research at Coinbase. Duong noted the ongoing credit crunch has also impacted conditions, albeit to a lesser extent.

NOW READ: MakerDAO members set to approve controversial ‘whistleblower bounty’ to enforce anonymity

“Keep in mind that we believe the latter issue [credit crunch] is more worrying, but the approaching deadline surrounding the US debt ceiling likely makes the former seem more pressing for investors,” Duong wrote on Friday, adding “Both factors are contributing to relatively low conviction views.”

A potential default can be avoided if President Joe Biden and House Speaker Kevin McCarthy agree to increase the debt ceiling on June 1, however, a deal remains elusive.

No quick fixes

Improved regulatory conditions in Asia aren’t necessarily a remedy for market liquidity, the exchange noted.

Hong Kong’s Securities and Futures Commission paved the way last week for retail crypto trading. From June 1 virtual asset trading platforms are open to apply for a licence. Retail traders won’t be able to trade stablecoins for now and products offering yields, lending and borrowing aren’t permitted.

“Tokens to be listed on regulated exchanges must have a track record of at least 12 months and should be included in two acceptable indices,” Duong added.

The approval of retail trading in Hong Kong is significant considering China initiated a nationwide ban in 2021, Duong said, but it’s unlikely to result in large Asia inflows immediately. The regulator is set to begin accepting applications from June 1 according to its announcement.