- The price of Bitcoin crashed more than $2,000 in a matter of minutes last night, prompting a sell-off in the broader crypto market.

- Fading hopes of a spot Bitcoin ETF and economic fears prompted the drop, according to CoinShares’ head of research.

Happy Friday!

Crypto markets crashed overnight as Bitcoin shed more than $2,000 from its price in a matter of minutes. Its market cap plunged below $500 million in the process. The move was initially a mystery, but CoinShares’ head of research James Butterfill has offered some insights into what’s going on.

Read on to find out more!

Why did Bitcoin crash?

After weeks of trading in a tight range between $29,000 and $30,000, the price of Bitcoin experienced a sharp drop Thursday.

The move was prompted by the market reassessing its expectations of a spot Bitcoin exchange-traded fund gaining approval in the US, Butterfill said on LinkedIn.

The market is realising that a decision from the Securities and Exchange Commission on whether to approve a spot Bitcoin ETF “isn’t imminent,” he said.

Fears over the economic downturn in China are gathering pace as well, but “could ultimately be supportive for Bitcoin if the financial sector is significantly affected,” he added.

Elsewhere, 30-year rates in the US hit their highest level in 20 years, which produced a sense of foreboding, Butterfill warned, adding: “Bitcoin has often been the first to act in recent years, so this may be preceding a broader crash in other asset classes.”

Other issues weighing on investors included the prospect of higher interest rates in the US.

Volumes have also been slashed, with Bitcoin trading just $2.3 billion per day at present – compared with $11 billion per day at the beginning of the year. As such, markets are “more sensitive” to larger trades.

In essence, there’s less support in markets and it takes less to move prices.

“The broader driver of today’s dip is that crypto assets are not immune to the deepening risk-off selling pressure seen across all asset classes,” Ben Laidler, global markets strategist at eToro, said of the crash.

“Global bond yields have hit a 15-year high, and investors are looking to lock in some of the record-breaking gains many have seen so far this year, driven largely by tech’s revival,” he concluded.

Crypto market movers

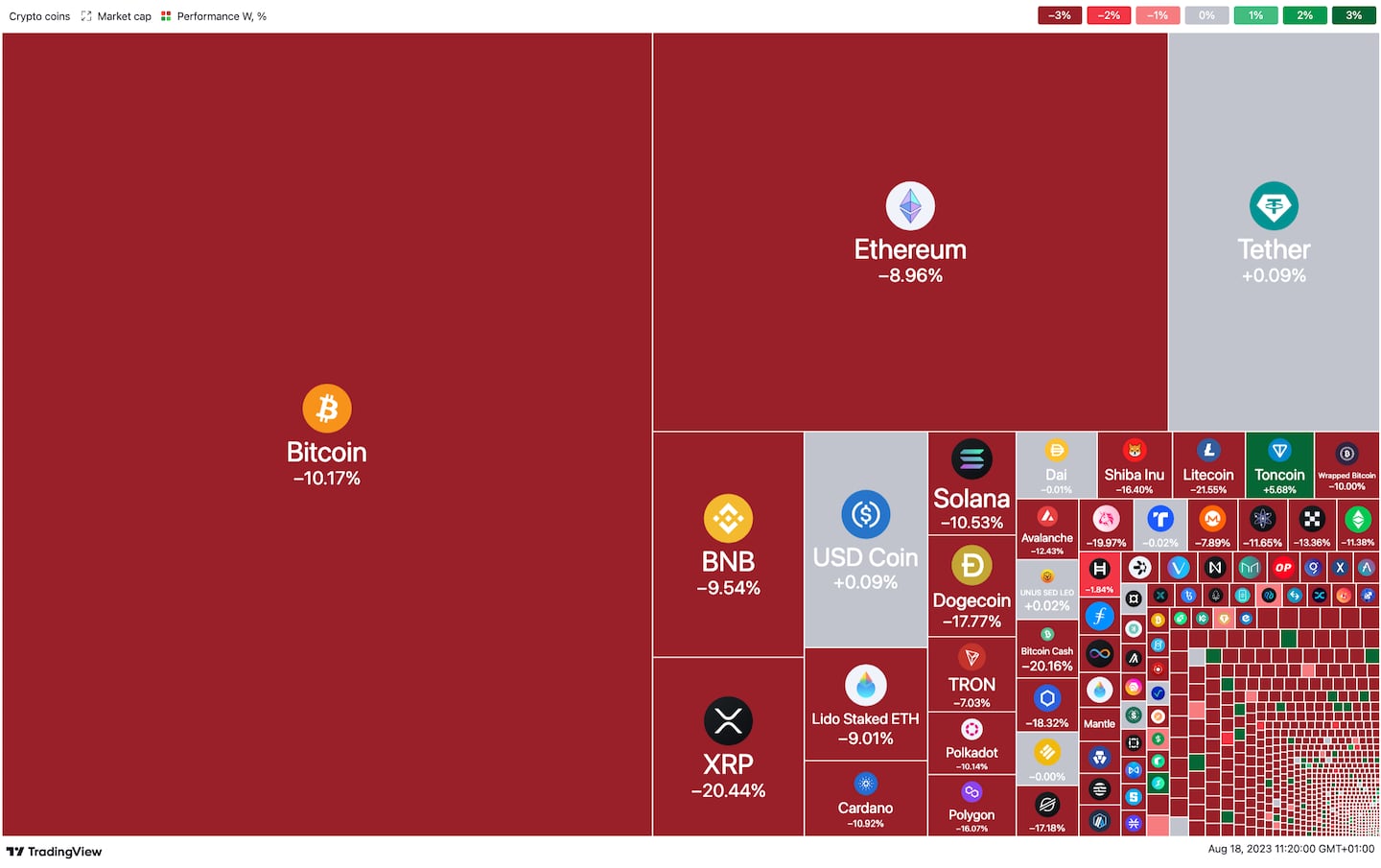

- Bitcoin’s overnight crash left it trading down 7.2% over the past 24 hours, and down 10% over the past week, changing hands for just under $26,500.

- Ethereum fell in line with Bitcoin, despite positive reports suggesting approval of Ethereum Futures ETFs was imminent. The second-biggest digital asset by market cap traded just below $1,700, down 6.6% over the past day. Ethereum is down about 9% since last Friday.

What we’re reading

- Coinbase and Binance crank up lobbying push as Congress prepares to debate crypto bills – DL News

- The Roundup: Coinbase looks to futures and joins Binance in upping lobbying expenditure – DL News