Stargate, a crypto bridge that allows users to move tokens between otherwise incompatible blockchains, is on a tear.

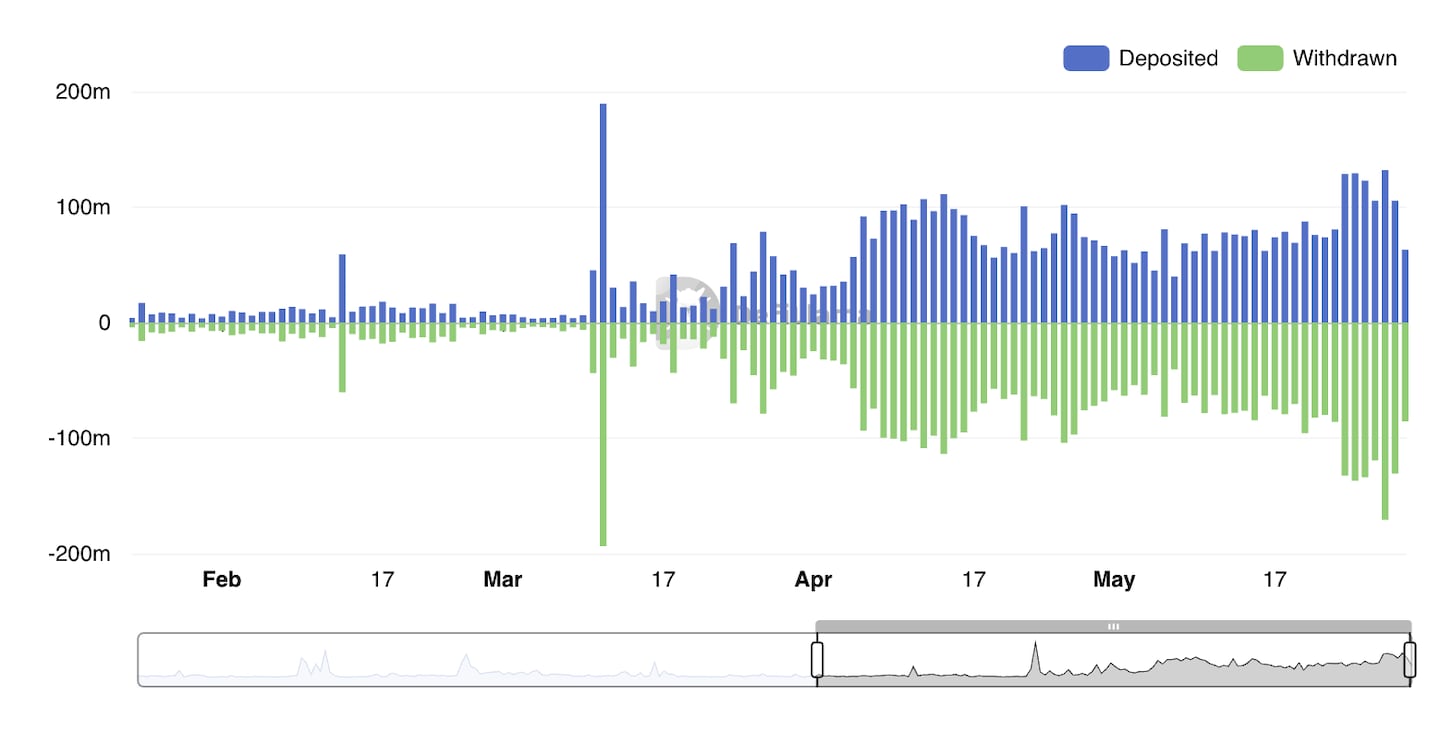

Every day over the past week, the protocol has processed more than a quarter-million transactions worth more than $100 million, surpassing all-time highs it had set little more than a month earlier and dwarfing direct competitors.

But Stargate’s outsized success is also the latest test of a key marketing technique in crypto, according to industry analysts: hinting at an “airdrop,” the distribution of newly minted tokens among a protocol’s early adopters.

Airdrops are meant to reward early adopters, testers, and liquidity providers of new projects. But they’re also free money, and can attract “low-quality” users and activity that vanishes the moment the airdrop — or the hint of one — passes, according to Patrick Scott, an advisor to DeFi projects.

“Clearly they’re attracting a lot of users,” he told DL News. “Now the question is, will those people be sticky?”

NOW READ: LayerZero faces backlash over monetising ‘no value’ Ethereum sandbox tokens

Stargate is built by LayerZero Labs, which was valued at $3 billion during a Series B fundraise last month. The protocol is meant to solve a primary problem with bridges, one that has made them particularly vulnerable to hacks.

When a user bridges an asset from one blockchain to another, the tokens on the destination chain are typically derivatives — “wrapped” tokens, in crypto speak — redeemable for the “real” tokens held in escrow on the bridge. Where possible, however, Stargate issues “native” tokens on destination blockchains, rather than “wrapped” tokens.

Popular target

The benefit of this approach became clear last year. With the massive amount of crypto that bridge protocols hold on users’ behalf and their relative complexity, they became a popular target for hackers in 2022. When protocols were drained, wrapped tokens on destination chains became worthless.

Just last week, reported technical issues at Multichain, a competing bridge, led to a sell-off of the protocol’s token and a jump in activity across all bridges.

NOW READ: Rookie DeFi traders bear the brunt of bot attacks: ‘Even small trades are at risk’

As such, bridge protocols had a busy week, processing more transactions than at any point since September 2022, according to DeFi Llama data. But the vast majority of transactions and volume at Stargate likely come from airdrop “hunters,” according to Messari analyst Chase Devens.

“LayerZero is arguably the next largest potential airdrop target after Arbitrum, so farmers shifting activities makes sense,” Devens told DL News.

Code from parent company LayerZero stored in a Github repository mentions an yet-to-be announced “ZRO token.” LayerZero and CEO Bryan Pellegrino did not immediately respond to requests for comment.

NOW READ: DeFi users pile into Ethereum zero-knowledge chains in hope of airdrop riches

Metrics for Stargate and other protocols rumoured to be preparing for an airdrop began to take off in March, just after Arbitrum announced the launch of its long-rumoured ARB token.

Bridges also make for relatively risk-free airdrop farming targets.

“It’s just easy to ‘use’ the app without taking on additional capital risk unlike if someone was farming a perps protocol, they’d probably want to run some trades through it but that forces them to go long or short an asset,” Devens said.

Stargate processed more than 530,000 transactions over the past 24 hours, according to DeFiLlama data. Celer’s cBridge came in a distant second, with fewer than 7,000 transactions.

Stargate is also crushing its competition in terms of transaction volume. Over the past seven days, it has processed more than $850 million in transactions, to Multichain’s $180 million.

“The volume is elevated, but the average transaction size [on Stargate] is much smaller,” Scott said. “They’re just bridging back and forth many times a day, hoping that it increases their ability to get the LayerZero airdrop.”

Users could also be “sybil attacking” Stargate — creating and using several sock puppet wallets in order to increase the payout from a potential airdrop.

Free money

“I’ve heard of people having as much as thousands of wallets, where they’re just doing things over and over again to try to qualify for the airdrop,” Scott said.

If most of its users are trying to game the system in order to get free money, Stargate’s challenge now will be to ensure they stick around.

NOW READ: LayerZero demands anonymous devs reveal identities to work on new bug bounty effort

Examples of that challenge abound. Monthly trading volume on Paraswap, a decentralised exchange aggregator, peaked in November 2021, when the protocol’s PSP token was airdropped to early users. About a year later, trade volume was down 75%. It has yet to revisit its former highs.

But there have been success stories. The value of all crypto locked in Arbitrum hit an all time high on May 6, more than a month after the airdrop of its ARB token.

“An airdrop is a way to get free eyeballs on your product,” Scott said. “If you have a good product, you’re probably going to stay. If you don’t have a good product, they’re probably not going to stay.”