A version of this story appeared in our The Decentralised newsletter on March 12. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Lower Ethereum transaction fees are almost here.

- MakerDAO ups borrowing rates to over 15%.

- Jito takes steps to stop Solana MEV bots.

Dencun to lower Ethereum layer 2 fees

It’s about to get a lot cheaper to transact on Ethereum thanks to a new upgrade set to go live this week.

Cancun-Deneb, or “Dencun” for short, contains nine different EIPs, or Ethereum Improvement Proposals.

Among them, EIP-4844 is the most highly anticipated. It promises to dramatically cut the costs of interacting on layer 2 blockchains like Arbitrum and Optimism.

Layer 2 fees will drop by a factor of 10 after the upgrade. That means swapping tokens on decentralised exchanges, which currently costs $1-2, should fall to around 20 cents, and could even go as low as a single cent on some layer 2 networks like Base.

EIP-4844 will not, however, lower transaction costs on the Ethereum mainnet.

By reducing transaction fees, Dencun may also unlock new use cases, such as onchain gaming, generative art, and artificial intelligence, which were previously not practical due to high transaction costs.

EIP-4844 ushers in Ethereum’s “Surge” phase, as Ethereum co-founder Vitalik Buterin specified in his updated network roadmap in December.

The end goal during this phase is to hit 100,000 transactions per second.

After Dencun, Ethereum developers can start looking towards other improvements, such as letting users run Ethereum nodes on mobile phones.

MakerDAO almost runs out of USDC

Crypto cooperative MakerDAO is making urgent changes to its borrowing rates after the protocol’s peg-stability mechanism, or PSM, almost ran out of funds last week.

The PSM lets holders of MakerDAO’s DAI stablecoin redeem it for $1 worth of other stablecoins, most prominently Circle’s USDC. The PSM’s main function is helping to keep DAI pegged to a dollar.

Because Maker offered low borrowing rates compared to the market, DeFi users locked up assets like Ether and Wrapped Bitcoin to borrow DAI. But due to Maker locking the yield on DAI at 5%, borrowers exchanged it for USDC through the PSM, which they could use to earn much higher yields in other protocols.

In response, MakerDAO pushed through a proposal to increase lending and borrowing rates for DAI to bring them inline with the broader market.

In ~2 hours, @MakerDAO will implement some unprecedented rates moves. There’s been some confusion about the cause, reasoning behind, and likely effect of these changes. Let’s go through them (in that order) 1/n pic.twitter.com/FdNvbNCJ4P

— PaperImperium (@ImperiumPaper) March 10, 2024

According to PaperImperium, a MakerDAO community member and governance liaison for GFX Labs, the higher rates will encourage borrowers to repay their loans, preferably by swapping USDC to get the DAI for repayment.

Higher yields on DAI should also encourage DeFi users to move funds into DAI, hopefully using the PSM.

Jito suspends mempool after MEV bots fleece memecoin traders

Jito Labs, a company creating Solana staking and MEV software, has just suspended its mempool — a waiting room for transactions before they are added to a blockchain.

Jito Labs has decided to suspend the mempool offered through the Jito Block Engine due to negative externalities impacting users on Solana.

— Jito Labs (@jito_labs) March 8, 2024

The decision has been made after deliberate conversations with the Jito Labs team and key Solana ecosystem stakeholders.

Jito Labs said in an X post that it had made the decision due to “negative externalities” impacting users on Solana.

The move makes it more difficult for those running MEV bots to hit unsuspecting traders with sandwich attacks — placing transactions before and after a trade in order to extract value from price movements.

Sandwich attacks cost traders millions every year. They make it so traders get worse prices on their trades than they otherwise would. The effect of sandwich attacks is much more prominent in assets with low liquidity, such as memecoins.

Memecoin trading volume on Solana soared last week, hitting $2 billion in 24 hours.

Data of the week

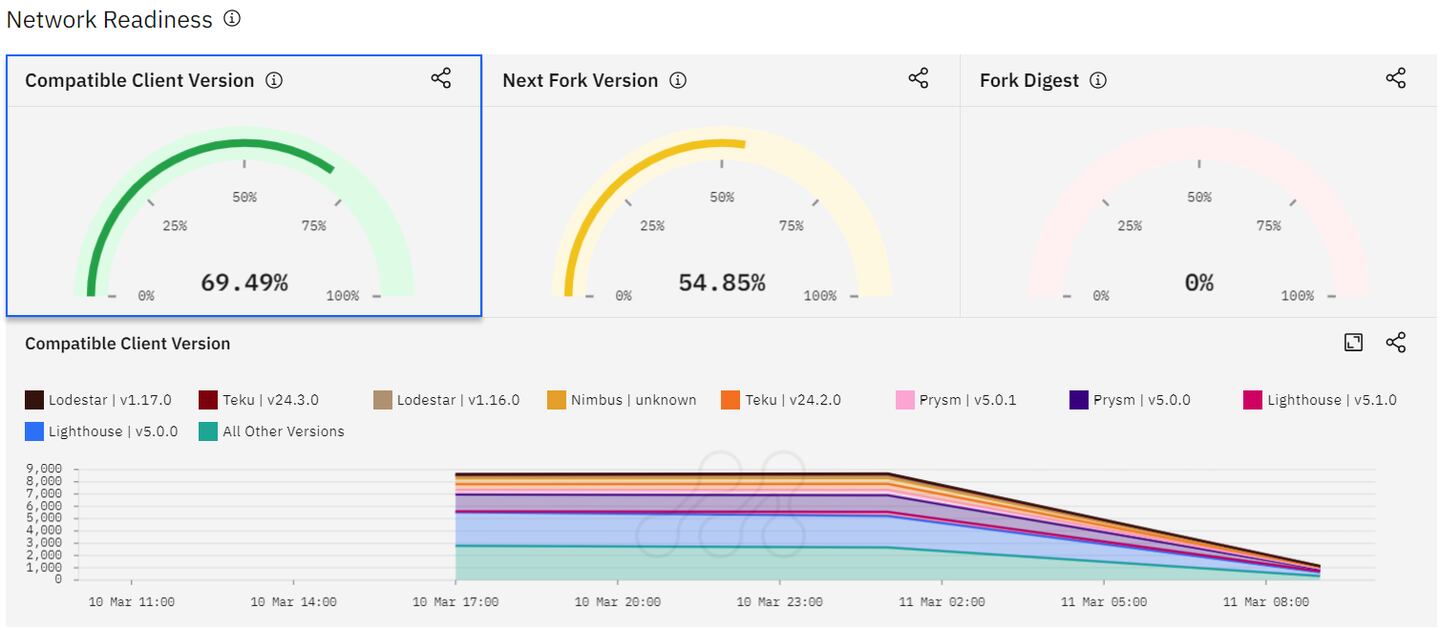

Blockchain data platform Metrika has created a dashboard to track Ethereum’s Dencun upgrade.

It allows users to monitor the upgrade as validators switch over to the new version of the network. It also provides an estimate of the time until the upgrade is set to take place.

This week in DeFi governance

VOTE: Aave to add GMX’s gmETH to its Arbitrum liquidity pool

VOTE: Jupiter DAO concludes vote on LFG launchpad candidates

VOTE: Arbitrum votes on new $4 million grants programme

Post of the week

Ethereum co-founder Vitalik Buterin slaps back at an X user complaining about high transaction fees.

The big hard fork that will help a lot with that is coming in three days. pic.twitter.com/u00MsaeI6W

— vitalik.eth (@VitalikButerin) March 10, 2024

What we’re watching

USDC market on Compound v3 is 99.82% utilized and only has $5M in liquidity, and offers 30% APR

— Mustafa Al-Bassam (@musalbas) March 11, 2024

Will we see failed withdrawals soon? pic.twitter.com/jUTF8uxYRA

Demand for US dollar leverage in DeFi is surging.

Lending protocol Compound’s $478 million USDC pool is over 99% utilized — meaning borrowers have taken out USDC loans close to the total amount available.

Got a tip about DeFi? Reach out at tim@dlnews.com.