A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Ethereum layer 2 activity is surging. But are the rollups ready for it?

- Projects pick Celestia stakers for token airdrops

- DeFi security may not be ready for another bull run

How decentralised are layer 2s?

DeFi users are piling into layer 2 blockchains, pushing several metrics to new highs.

Arbitrum, the biggest layer 2 by total value locked, surpassed the Ethereum mainnet in decentralised exchange transaction volume. At the same time, the combined TVL of all layer 2s registered a fresh all-time high of over $20 billion.

Even smaller layer 2s like Metis are benefitting from the excitement surrounding Ethereum’s scaling options.

Ethereum’s faithful cheer the increased adoption of layer 2s, which are faster and cheaper than the main Ethereum network they rely on to finalise transactions.

But there’s an elephant in the room: most layer 2s are still nowhere near as decentralised as they would like to be.

Users must trust that transactions are verified correctly by a centralised entity — usually the company building the layer 2 — instead of through a decentralised consensus like the Ethereum mainnet.

This is a problem because it goes against DeFi’s founding principle of not having to rely on or trust any single entity to transact.

For the average DeFi degen, whether or not a specific layer 2 is decentralised probably doesn’t matter that much.

But for more sophisticated investors — such as institutions — having to trust the companies behind layer 2s will make some think twice before committing serious cash to them.

The first layer 2 to fully decentralise its transaction processing should benefit greatly — and I expect at least one to make it happen in 2024.

A new airdrop trend emerges

Celestia stakers had a great start to 2024: two projects have promised them airdrops of valuable tokens, with another strongly hinting at the prospect.

So why are these projects being so generous?

In a nutshell, because they rely on the Celestia blockchain for their transaction validation, and those who stake their Celestia tokens are pivotal to that.

If the projects running on Celestia can incentivise more people to stake Celestia tokens, the more secure they are.

It’s likely this new trend of airdropping tokens to Celestia stakers is only just beginning. More projects building on Celestia — such as Berachain, Monad, and Kinto — are also set to launch later this year.

CertiK calls out DeFi security — then gets hacked itself

Crypto security firm CertiK warns the brewing bull run will be a key test for the DeFi sector in a new report.

CertiK said the DeFi industry needs to decrease the correlation between the money deposited into it and the total amount lost in hacks and scams, if it wants to be taken seriously.

While CertiK makes a valid point, a security breach in its own house dampened its effect.

Just two days after publishing the report, CertiK’s X account was compromised following an employee’s interaction with a scammer posing as a representative from a media organisation.

The breached CertiK account disseminated a message to the security firm’s 343,000 followers, claiming a vulnerability in the decentralised exchange Uniswap’s router contract and linking to a phishing site.

After a year of mishaps for CertiK, where the firm signed off on multiple projects that went on to get hacked or rug pull depositors, 2024 isn’t off to a great start.

Data of the week

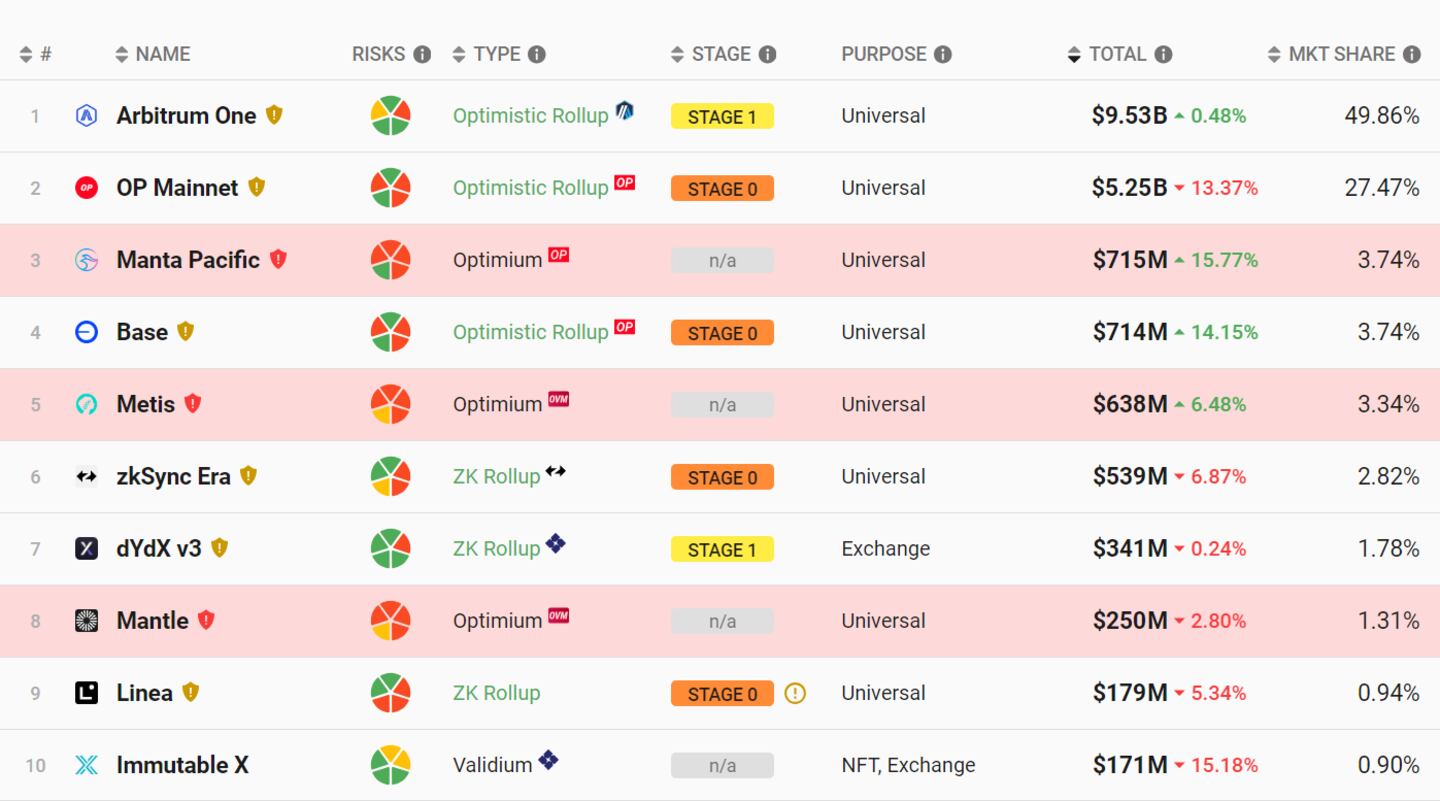

L2Beat provides a nifty dashboard that keeps track of how decentralised each Ethereum layer 2 is.

When it comes to general-purpose layer 2s, Arbitrum is the furthest along, but it has yet to make validation permissionless.

This week in DeFi governance

VOTE: Establish the Arbitrum DAO procurement committee

TEMP CHECK VOTE: Add PayPal’s PYUSD to the Aave v3 Ethereum market

PROPOSAL: Make Celestia liquid staking safer and more aligned with the blockchain

Post of the week

We couldn’t pass up on the opportunity to highlight some rare praise for DefiLlama from one of crypto’s most notorious pseudonymous voices: Gwart.

While Gwart’s posts are usually heavily sarcastic, we’re hoping this one is sincere!

I will say something nice here: the most useful thing in DeFi is DefiLlama

— Gwart (@GwartyGwart) January 8, 2024

What we’re watching

And now $3,000,000,000 of leveraged stETH on Aave that was "very liquid" is relying on $300mn of Curve liquidity; there is still virtually no off-chain liquidity.

— Riyad Carey (@riyad_carey) January 5, 2024

Especially with volatility from ETF news, if any large stETH holder gets impatient and sells, things could get ugly https://t.co/jgNhjesvc5 pic.twitter.com/AFL4Di6NBQ

Celsius’ move to unstake its Ether holdings has clogged the validator exit queue.

Several analysts, including Kaiko’s Riyad Carey, have pointed out that such a situation could put liquidity for Lido’s stETH token in a potentially perilous position.

Have you joined our Telegram channel yet? Check out our news feed for the latest breaking stories, community polls, and of course — the memes.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.