- Interest in Gnosis Chain grows on upcoming payments network.

- Uniswap's new fee splits token holder opinions.

- Polygon's proposed Protocol Council could help it decentralise.

A version of this story appeared in our The Decentralised newsletter. Sign up here.

Hey everyone, Tim here.

Remember Gnosis Chain? This lesser-known, Ethereum-compatible blockchain has boosted its total value locked by 200% since August, quickly surpassing newer, buzzier blockchains like zkSync and Aptos.

Some of this interest has transferred over to GNO, the native token of the Gnosis ecosystem. It’s rallied more than 10% from its October lows.

But what’s its secret? Osato Avan-Nomayo investigated Gnosis’ recent rise. According to Gnosis co-founder Martin Köppelmann, it all boils down to the anticipated rollout of Gnosis Pay.

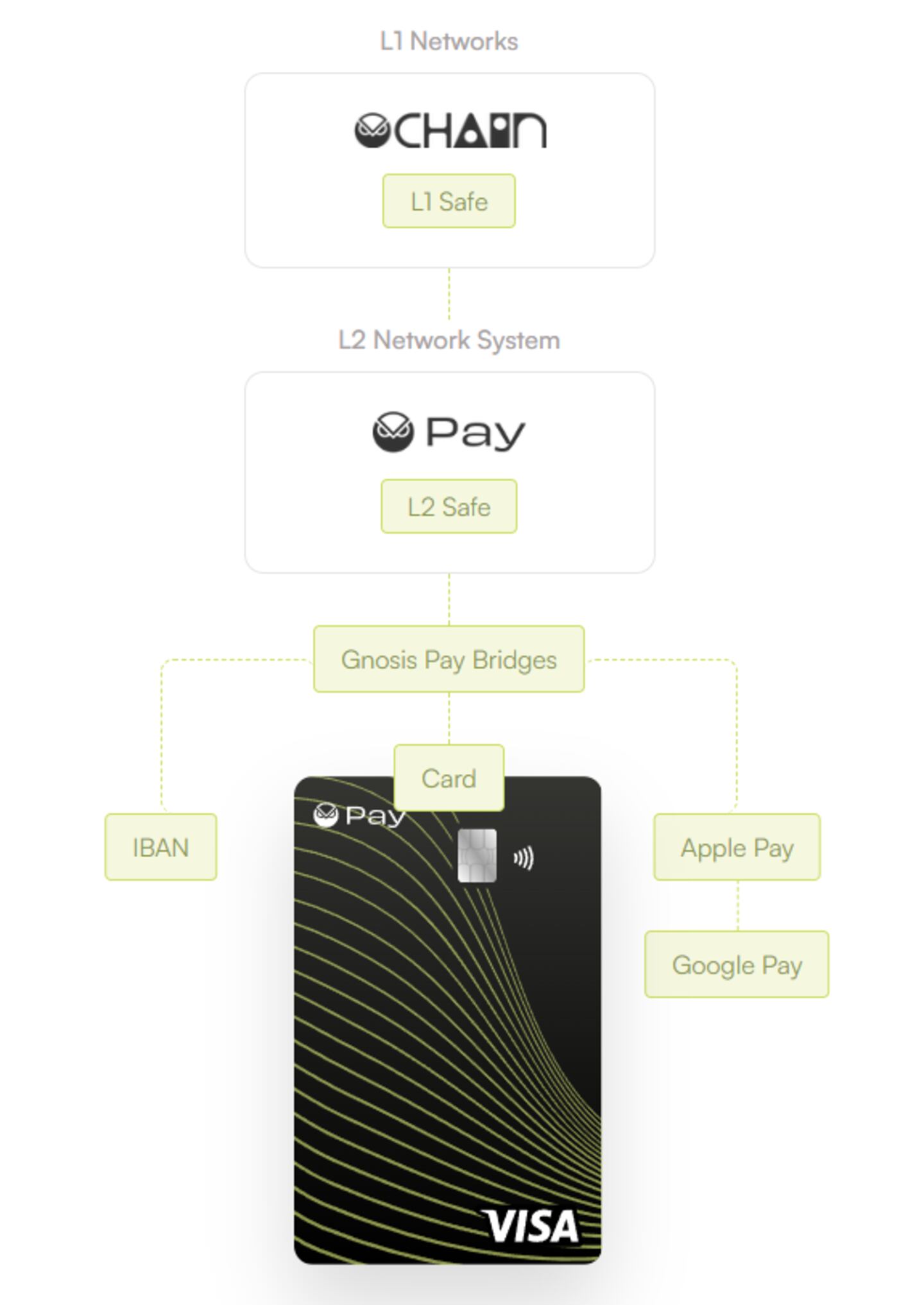

Gnosis Pay promises to deliver something DeFi’s faithful have envisioned for years: a decentralised, crypto-based payments network.

On the surface, Gnosis Pay aims to function no differently than the Visa-based debit cards millions use for everyday purchases. But under the hood, it uses blockchain tech instead of banks and the Swift system to facilitate payments.

But why use Gnosis Pay when banks are paying customers decade-high interest rates?

Well, Gnosis has an answer to that, too. On October 10, Gnosis Chain began supporting sDAI — an interest-bearing form of DAI, MakerDAO’s widely-held US dollar-pegged stablecoin. Currently, sDAI earns holder 5% interest derived from MakerDAO’s short-term US Treasuries.

But there’s a catch. While Gnosis Pay’s plans to launch in Europe are running smoothly, whether it can breach other markets — particularly the US — remains to be seen.

Based on the rush of capital into Gnosis Chain, this uncertainty hasn’t put a damper on the project. We’ll be watching closely to see if Gnosis’ growth continues.

Uniswap ruffles feathers

Elsewhere, Uniswap’s decision to introduce a new 0.15% fee for trades placed through its website and wallet app has ruffled feathers in the DeFi community.

The reason? The new fee will be directed to Uniswap Labs, the company that builds and maintains the Uniswap protocol. UNI holders, who govern the protocol, won’t benefit from it — at least not directly.

I can understand some UNI token holders’ frustrations. The option to split some of the protocol’s fees with UNI holders has been hard-coded into every version of Uniswap released. But there’s never been enough support to get a vote on the issue passed.

I agree with the view of Wintermute’s DeFi envoy, Callen Van Den Elst, that the 0.15% fee will generate more support for a protocol level fee switch after token holders see how much revenue it generates.

As Uniswap is by far the dominant place to swap tokens onchain, it’s unlikely a competitor can take advantage of the fee switch situation. It makes sense that many UNI token holders are being extra careful over such an important decision.

Polygon’s new council

Lastly, Polygon’s proposal to create a new Protocol Council looks to be a positive step to increasing security and decentralisation for the blockchain.

If successful, the proposal would establish a 13-person council to execute upgrades to the Polygon blockchain. There are some big names among the 13, such as Ethereum Foundation researcher Justin Drake and Coinbase’s protocol specialist Viktor Bunin.

Polygon has previously been criticised over its centralisation. The blockchain’s smart contract admin key is controlled by a five out of eight multi-signature contract, with half of the key holders being the founders of Polygon Labs, the company that develops the Polygon blockchain.

This means that only one of the other keyholders needs to conspire with the founders for Polygon Labs to take full control over the blockchain.

Under the new Protocol Council, a consensus of seven of 13 members would be needed to make changes with a 10-day timelock, or 10 out of 13 without a timelock.

Data of the week

Gnosis Chain total value locked soars to over $156 million. According to Gnosis co-founder Martin Köppelmann, much of the new capital comprises MakerDAO’s DAI stablecoin.

This week in DeFi governance

PROPOSAL: Blur community mulls fee switch and token buybacks

PROPOSAL: Onboarding Ekubo as a Uniswap Protocol core developer

VOTE: Radiant to launch incentives using ARB token grant

Post of the week

Vitalik , Hayden, and Justin Drake were walking one day when they noticed a $100 bill on the sidewalk. Vitalik picked it up and said, “we should use this to build public goods and core infrastructure.” Hayden nodded his head, “agreed, we can put this money to good use.”

— Gwart (@GwartyGwart) October 18, 2023

Pseudonymous crypto personality Gwart explores the implications of Ethereum’s economic model in a dark yet hilarious parable.

Be sure to check out the full story — this is only the first part.

Even if you’re a staunch Ethereum believer it’s important to be able to laugh at your own beliefs once in a while.

What we’re watching

Apparently Nethermind and Besu stopped storing historical #Ethereum data and they want to standardise it so instead of a protocol violation it becomes *the* way to do it?!

— Péter Szilágyi (karalabe.eth) (@peter_szilagyi) October 22, 2023

This is an insanely irresponsible idea. 1/4https://t.co/ObULzHaZd5

Ethereum developer Péter Szilágyi raises the issue of Ethereum clients Nethermind and Besu ceasing to store historical data.

Have you joined our Telegram channel yet? Check out our News Feed for the latest breaking stories, community polls, and of course — the memes. https://t.me/dlnewsinfo

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out to him with tips at tim@dlnews.com.