- Coinbase is a big partner to finance giants hoping to offer Bitcoin ETFs.

- But the exchange faces threats as well to its business model with the new launches.

- Low fee Bitcoin ETFs put Coinbase’s high-fee retail model under pressure.

- And custody revenue is unlikely to be material for the crypto exchange.

Coinbase is tied to most spot Bitcoin exchange-traded fund applications, and its stock has ridden the euphoria surrounding their approval.

BlackRock named the exchange in its surveillance sharing agreement in June, and later named Coinbase as its custodian, as did seven other issuers.

Coinbase will also buy and sell Bitcoin for BlackRock and other issuers.

But the impact from this new business will be modest, according to investment bank KBW, while material impacts are “indirect.”

For instance, the Bitcoin ETF hype has helped push the price of the digital asset higher.

Bitcoin has gained over 66% in the past three months. This lifted the crypto market and, in turn, benefited Coinbase as retail trading volumes rose again.

“If this price surge continues, we could see retail begin to re-engage more meaningfully, as retail engagement has been surprisingly lacklustre through the extreme price move in Bitcoin in 2023,” KBW said.

ETF implications

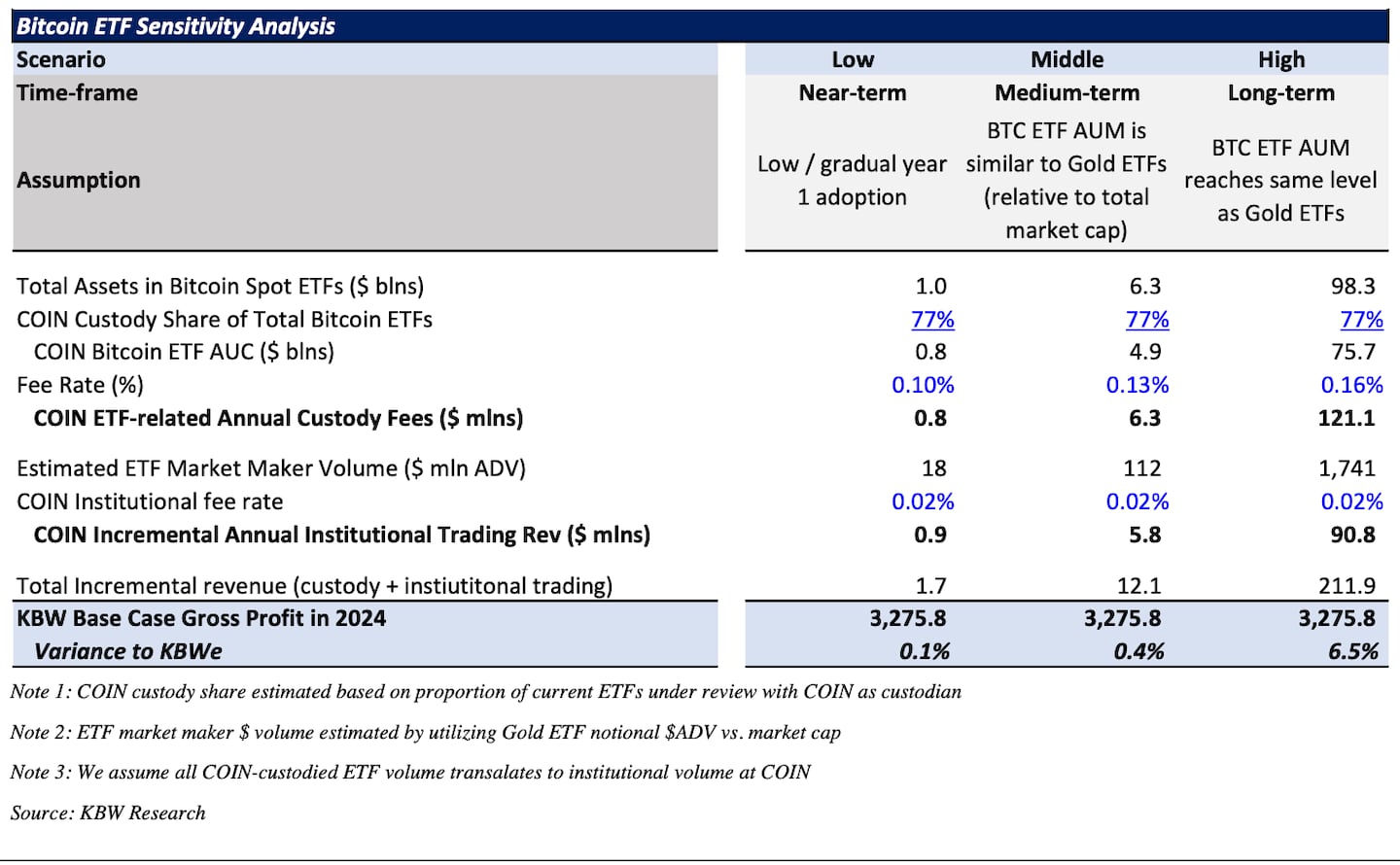

KBW estimated the custody fee rates on January 4, before filings revealed issuers fees. The investment bank assumed ETF fees would range between 0.4% and 0.6%, meaning custody fees would fall around 0.1% and 0.16%.

Trading fees for ETF market-making are close to 0.02%, the investment bank estimates.

Based on these fees, Coinbase’s gross profit would increase by 0.4% after Bitcoin ETF approval, KBW analysts led by Kyle Voigt said.

This scenario assumes the total assets under management in spot Bitcoin ETFs to be around $6.3 billion — about 0.7% of Bitcoin’s total market capitalisation.

In the longer term, gross profit could grow by over 6.5%. But there’s a big if: Bitcoin ETFs must match those of gold — some $98 billion in assets under management.

This is “not realistic near term,” KBW said.

This scenario requires Bitcoin’s total market capitalisation to increase significantly and for Bitcoin ETFs assets under management to reach $98 billion.

While not accounted for in its current research, KBW did note that a “price war,” could compress custody fees over the medium term.

“Coinbase does not disclose fees with our institutional clients,” a spokesperson told DL News in response to a request for comment on fees.

“We provide a range of services to ETF issuers which generate revenue for us including custody, agency trading, matching and settlement and financing,” the spokesperson added.

Simple users

Another factor that KBW noted: Over 90% of Coinbase’s total retail transaction revenue in the third quarter was linked to “simple users,” KBW estimates.

That’s around 45% of gross profits.

Simple users are less sophisticated retail users that invest in one or more cryptocurrencies, the bank said.

In the future, these users could utilise spot Bitcoin ETFs to gain exposure to crypto, rather than holding investments in a separate account on Coinbase.

“We do not expect a migration of users/assets off of the COIN platform as a result of the introduction of a crypto spot ETFs; however, these ETFs may negatively impact COIN medium-term user growth specifically for ‘simple’ users,” KBW said.

If these users gradually move away from the platform this could lead to fee compression for Coinbase.

The crypto exchange currently charges over 2.5% on average for retail transactions, based on revenues and retail trading volumes from the third quarter of 2023.

Coinbase would no longer earn these high fees if potential new users are swayed by spot Bitcoin ETFs. Instead the exchange would earn custody and trading fees from the ETF issuers.

Adam Morgan McCarthy is a markets correspondent for DL News. Have a tip? Contact the author at adam@dlnews.com.