- The SEC delayed its decision on the rule change proposal to list a first-of-its-kind physical carbon allowances ETF on Tuesday.

- Spot Bitcoin ETFs are going through the same process and could face similar delays.

The Securities and Exchange Commission deferred making a call on the rule change proposal to list a first-of-its-kind physical carbon allowances ETF on Tuesday.

That could spell bad news for spot Bitcoin ETF hopefuls including Ark Invest, BlackRock, and Fidelity, Bloomberg Intelligence analyst Eric Balchunas said.

That’s because the process for the carbon ETF is the “exact same” as the spot Bitcoin ETFs, he said.

Cathie Wood’s firm is first in line to hear back on its application. The decision is expected by the week of August 13 and could take up to 240 days from the filing date, with a deadline estimated on January 10, 2024, according to estimates based on filing dates from Bloomberg Intelligence.

Now read: Here’s why Cathie Wood’s Ark dumps Coinbase stock just as it’s rising

BlackRock, Fidelity and a litany of asset managers are waiting on responses after Ark. Larry Fink’s firm kickstarted a slew of applications after joining the race for the first-ever spot in Bitcoin ETF in mid-June.

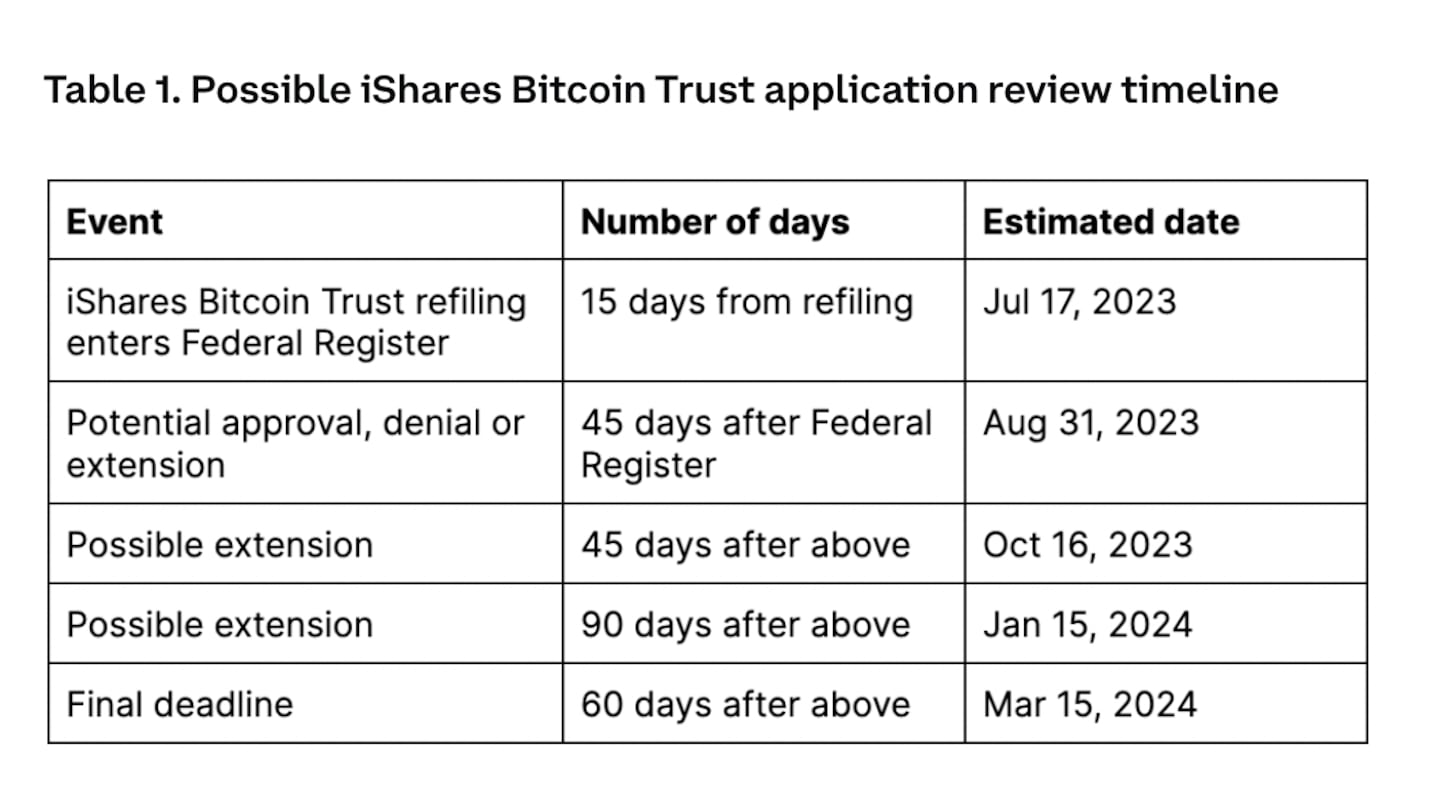

Coinbase institutional research notes the world’s largest asset manager has its first deadline on August 31, which mayc now likely pass without a decision. The SEC is known for punting decisions like this.

The first-ever application for a spot-based Bitcoin ETF was made by the Winklevoss twins over 10 years ago. No application has been successful to date, although futures-based products exist.

The SEC argues futures products gained approval due to the CME being regulated. But proponents of a spot product argue the underlying price the CME uses for its futures product is based on the spot market anyway.

NOW READ: Fidelity races BlackRock to a Bitcoin ETF — but Cathie Wood’s Ark is first in line

The class of 2023 Bitcoin ETF applications from Ark Invest, BlackRock, and Fidelity hinge on surveillance-sharing agreements with Coinbase and Nasdaq to allay the agency’s fears. Analysts suggest this may not be enough.

“It is possible that naming Coinbase as the surveillance partner will not be sufficient for the approval,” Jacob Joseph, a research analyst at CCData, told DL News last month.

Impact of a spot ETF

A spot-based product has been seen as the key to the major adoption of Bitcoin for a long time, although the impact has been contested.

JPMorgan analysts doubt the products would be a game changer since similar ones already exist in Canada and Europe.

Now read: Bonds on the blockchain: B2C2′s CEO on what crypto can learn from TradFi

Coinbase said recently this is “short-sighted,” and pointed out the ETF market in the US is the largest and most developed in the world.

“We may also see institutional investors potentially using an approved bitcoin spot ETF as the underlying for new derivative instruments that could also expand trading volumes,” David Duong, head of institutional research at Coinbase, said.

Nicola White, CEO of market maker B2C2 told DL News that’s an exciting proposition to have a BlackRock Bitcoin ETF.

If investors can access a crypto ETF through their Fidelity or Robinhood account, that lowers the barrier to entry, she said.

Do you have a tip on Ark, BlackRock or another story, reach out to me at adam@dlnews.com.