- Binance pleaded guilty to criminal charges on Tuesday.

- Now EU lawmakers demand more checks and scrutiny of Binance’s operations in Europe.

- A legal expert question whether the firm will be able to remain in Europe when new, tougher rules kick in.

Will Binance be able to keep operating in Europe after its US guilty plea?

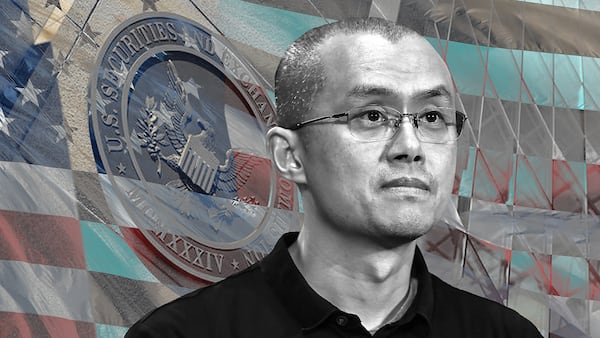

That’s the question European Union lawmakers are asking after the world’s biggest crypto exchange and its founder, Changpeng Zhao, pleaded guilty to skirting money-laundering laws and sanctions.

Two lawmakers from the European Parliament’s Socialists and Democrats group expressed their concerns about Binance to the European Commission, the EU’s executive branch, on Thursday.

“How will the [European Commission] ensure the charges the company was found guilty of in the USA will not take place in the EU?” wrote Finnish and French lawmakers, Eero Heinäluoma and Aurore Lalucq, respectively.

Earlier this week, Binance pleaded guilty to felony charges and agreed to pay US authorities $4.3 billion in fines and restitution to settle the charges.

Heinäluoma requested more checks and scrutiny of Binance’s operations in Europe, the parliamentarian’s office told DL News.

“What happened in the US has certainly an important impact worldwide and also in the EU,” said Francesco Paolo Patti, an attorney and associate professor of private law at Bocconi University in Milan. “There will be enhanced scrutiny and attention on Binance.”

A Binance spokesperson told DL News that over the past two years, the exchange has cleaned up its act with new compliance systems and leadership experienced in compliance. The new CEO, Richard Teng, has helped with that.

“When Binance first launched, it did not have compliance controls adequate for the company that it was quickly becoming, and it should have,” the spokesperson said. The exchange grew at a fast pace within a young industry.

“Binance made misguided decisions along the way,” they said. “Binance takes responsibility for this past chapter.”

Binance was already under scrutiny by European regulators before the US settlement.

This year, the company failed to register in the Netherlands, withdrew its application from Germany, and is under investigation in France.

Binance is still registered in six European countries under different subsidiaries, which should mean compliance with anti-money laundering rules.

Patti told DL News: “It may be questionable whether the AML and counter terrorism funding compliance controls were conducted properly by these national authorities.”

Still, that doesn’t mean Binance will be unable to obtain EU authorisation, Patti added.

It does mean that in the next two years, the firm will need to adhere to higher standards if it wants to continue operating in Europe.

By the start of 2025, the bloc’s landmark crypto rules will become effective.

The new rules, known as Markets in Crypto-Assets regulation, or MiCA, set tough provisions for firms offering crypto services in Europe regarding consumer protection and market integrity, on top of existing anti-money laundering rules.

“Binance is now aware that it is facing an existential threat and it seems to have the means to face it,” Patti said.

Updated to add comment from a Binance spokespersn.

Inbar Preiss is a Brussels-based correspondent who covers crypto regulatory policy in the European Union. Have a tip? Contact the author at inbar@dlnews.com.