EU’s landmark MiCA legislation clears parliament

European lawmakers voted Thursday to approve the Markets in Crypto-Assets law that will set the stage for unified crypto regulation across the bloc.

The approval marks the largest international effort to regulate crypto to date, and has the potential to set regulatory precedent for nations outside of the EU as well.

MiCA comes into effect in July, but various provisions may take up to two years to begin enforcement.

While US regulators have been busy infighting and refusing to provide the most basic of clarity for the crypto industry, the European Union just approved the MiCA regulation, which provides a comprehensive regulatory framework for crypto in Europe. It's sad to see the US being…

— Tyler Winklevoss (@tyler) April 20, 2023

NOW READ: Why EU is ‘ahead of other jurisdictions’ on crypto as MiCA set to kick in

NFT weekly user and sales stats lowest since 2021

Non-fungible token sales and usage numbers dropped to their lowest levels since 2021 last week.

Unique users across the largest NFT marketplaces totalled 7,805, with noticeable declines in top venues Blur and OpenSea.

Sales were also down with 16,149 sales recorded, despite the release of former US President Donald Trump’s second NFT collection earlier in the week.

While that collection soared, the price of Trump’s first NFT collection has plunged.

NOW READ: Ethereum staking outflows hit $1.3bn one week after Shapella upgrade

Tom Brady is still excited about crypto despite $1bn FTX lawsuit

Retired NFL star Tom Brady told a Miami crowd Thursday that he was still “excited” about crypto despite being sued over his promotion of failed exchange FTX.

Brady spoke at the eMerge Americas 2023 tech conference, and said he runs “a digital asset business that I love to be a part of,” without providing further details.

Brady is currently named in a $1 billion lawsuit alongside other celebrities such as former NBA star Shaquille O’Neal and Seinfeld creator Larry David.

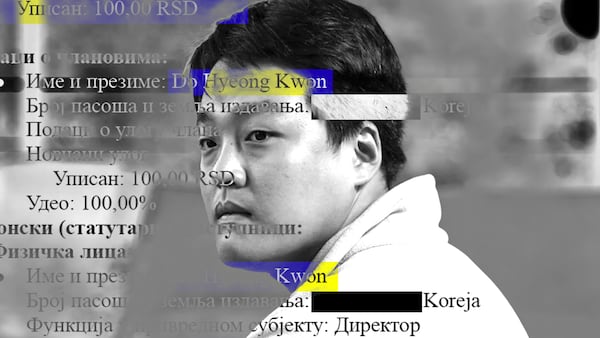

NOW READ: Fallen crypto king Do Kwon slapped with fake passport charge in Montenegro

Societe Generale launches euro-pegged stablecoin

French bank Societe Generale took another step into the world of crypto on Thursday by launching its euro-pegged stablecoin EUR Coinvertible, or EURCV.

SG-Forge, the digital assets-focused subsidiary of Societe Generale that spearheaded the project, championed it as an attempt to “bridge the gap between traditional capital markets and the digital assets ecosystem.”

The EURCV launch marks one of the first examples of a major institution minting its own stablecoin, but some crypto veterans have blasted it for being inefficient and costly to run.

Societe Generale has proven to be a crypto-friendly bank in the past, having previously requested a loan from crypto lending protocol MakerDAO in its native token DAI, launched a security token on the Tezos blockchain, and assisted in issuing a bond on Ethereum.

SEC warns advisors to be careful recommending crypto to clients

The US Securities and Exchange Commission advised investment brokers and advisors on Thursday to tread carefully when making crypto recommendations.

The SEC outlined duties in a bulletin, such as the need to be knowledgeable about security types prior to recommending them to clients, but specifically mentioned crypto assets as a risky asset.

In February, the SEC proposed that advisors must keep clients’ crypto with custodians it deemed as “qualified,” which in many cases would prevent advisors from recommending crypto holdings entirely.

More web3 news from around the web...

Bitcoin’s 70% surge fuels an ETF showdown between bulls and bears — Bloomberg

Crypto effort in House gathers steam, could gain allies in Lummis, Gillibrand — The Block