- New memecoin BALD whipsaws after apparent rugpull.

- Curve Finance severely damaged by exploit, founder sells off governance tokens.

- Ethereum layer 2s continue raking in the cash.

A version of this story appeared in our The Decentralised newsletter. If you want to read this or our other newsletters before your friends do, don’t hesitate to sign up.

Hey everyone, Tim here. Welcome back to The Decentralised, your one-stop shop for all things on-chain in crypto.

This weekend was a rollercoaster of emotions for DeFi degens.

On Saturday evening, an unknown crypto whale launched a new memecoin called BALD on Base, the nascent Coinbase-backed layer 2 chain.

The fact that the chain hasn’t officially launched didn’t stop traders from pouring millions into BALD, helping it rise to a market cap of almost $100 million at its peak.

NOW READ: Coinbase’s Base had 24 hours of meme coin frenzy, rug pulls and $58m in deposits

Some who chucked pocket change into the token on Saturday night, woke up the next day as millionaires. The situation echoed that of the PEPE memecoin, which speculators pumped to dizzying heights back in April.

But there’s a catch — because Base is still in its early test phase, there’s currently no real way to bridge large amounts off the chain back to Ethereum.

There’s also the question of who launched BALD in the first place. Blockchain sleuths were quick to point out that the same wallet had previously built up a highly-leveraged position of cbETH — Coinbase’s Ether liquid staking token — on lending protocol Aave.

The position is so precarious that Gauntlet, an organisation tasked with analysing the safety of Aave positions, highlighted the wallet as a risk to the protocol back in April.

Then, on Monday afternoon, the BALD saga took a darker turn.

The whale who deployed the memecoin and provided liquidity for it on decentralised exchange LeetSwap started pulling tokens off the exchange.

The reduced liquidity caused BALD to flash crash over 90%. After the dust from the rug pull settled, the whale walked away with a net profit of 2,789 ETH, or $5.2 million dollars.

After the apparent rugpull, the crypto community immediately got to work trying to uncover who the BALD deployer is.

Strangely, instead of using a fresh wallet, whoever launched BALD used one with a rich on-chain history, showing them interacting with Alameda Research wallets, voting on early Sushiswap governance proposals, and posting on the dYdX forums.

All these clues (plus several more) have led many to accuse disgraced FTX founder Sam Bankman-Fried of launching BALD while he awaits trial for defrauding FTX customers.

However, despite all the speculation, all evidence to suggest that Bankman-Fried is behind BALD is circumstantial at best — just chatter and guesswork.

Bankman-Fried is currently under house arrest where he has limited access to the internet under the terms and conditions of bail aggreement, while he awaits trial.

And if you’re wondering why DeFi degens were so enamoured with a token called BALD, it’s because of a running joke in DeFi circles started by long-time poster DegenSpartan.

In recent months, they’ve been very vocal about their investment in Coinbase stock. But if you ask them why they’re so bullish the answer might not be quite what you expect.

“The thesis for COIN is simple, Brian Armstrong, [Coinbase’s founder and CEO], is bald,” they recently tweeted.

But mere hours after the initial BALD token euphoria, disaster struck at one of DeFi’s most respected and long-standing protocols — Curve Finance.

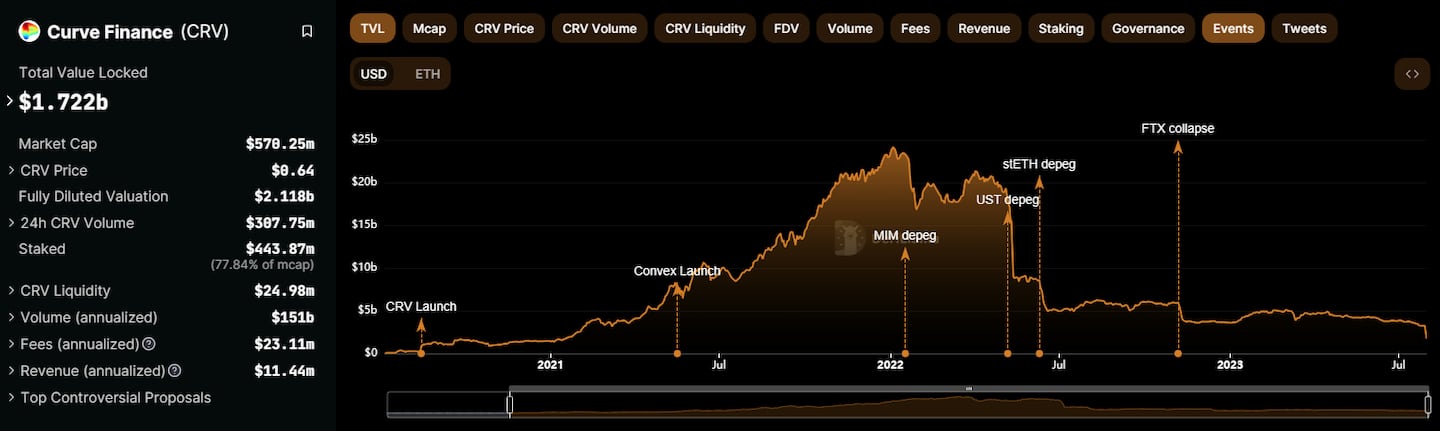

Many of the protocol’s Ether trading pools were drained of a combined $61 million worth of tokens via a bug in outdated an version of code they used. The event crashed the price of Curve’s CRV token, putting Curve founder Michael Egorov’s CRV-backed Aave loan at risk of liquidation — again.

Egorov has since sold off almost 40 million CRV tokens to various parties and used the proceeds reduce his risk of liquidation, but the damage to Curve is severe.

The protocol’s total value locked has dropped over 46% as depositors withdrew $1.5 billion worth of tokens over fears that other Curve trading pools might also be at risk.

Among those caught in the crossfire was JPEG’d, a lending protocol that allows users to obtain loans using NFTs as collateral. Its pETH-ETH Curve trading pool was one of the worst affected with an $11.4 million loss. The protocol’s JPEG governance token dropped over 20% in the aftermath.

While the fallout from this weekend’s events is still reverberating across the DeFi space, let’s not forget some of the big stories the DL News team explored last week.

Last Monday, Callan Quinn investigated Uniswap Asia, an extravagant Ponzi scheme which operated in China using the top decentralised exchange’s name.

After going all out to dupe unwitting investors, Uniswap Asia pulled the plug on its operations on July 12 after it claimed it was “hacked.” Check out Callan’s story here to find out what happened next.

Also last week, I published my first dispatch from EthCC. I talked to Eleftherios Diakomichalis about why crypto’s open-source culture is so important and how his project Drips is helping open-source software developers get paid. Check out the full story here.

Wrapping up last week’s stories, Osato Avan-Nomayo wrote about the “rage quit” of developers at Alameda-backed Parrot Protocol.

The Parrot team have enraged the Solana DeFi community by proposing to pay themselves huge bonuses after failing to deliver on any of the project’s roadmap.

Find out how much the Parrot team stand to gain by reading the full story here.

Data of the week

The rise and fall of Curve Finance: After reaching an all-time high TVL of $24 billion, deposits to the decentralised exchange are now back to where they were in January 2021. The UST depeg, the FTX collapse, and this weekend’s contract exploits have all taken their toll on the once-dominant protocol.

This week in DeFi governance

PROPOSAL: Cosmos to add Fee Abstraction Module

If approved, the Fee Abstraction Module will allow transaction fees on any Cosmos chain to be paid with any token by first swapping that token for ATOM on Osmosis.

VOTE: Should CoW DAO use protocol profits to generate extra revenue?

CoW Swap’s DAO is currently voting on if it should send protocol profits to its Treasury Core unit to be allocated across DeFi to generate revenue. If approved, the proposal suggests revenues could be reinvested into protocol development, funding projects, providing grants, or executing $COW token buybacks.

PROPOSAL: MakerDAO to fast-track Enhanced Dai Savings Rate

The proposal from MakerDAO co-founder Rune Christensen aims to increase use of the protocol’s Dai stablecoin by bumping up the interest rate paid to sDAI holders. If approved, the Enhanced Dai Savings Rate would make Dai one of the safest, and highest yielding stable assets in DeFi.

Tweet of the week

get in loser we're farming orb coin pic.twitter.com/2W8szQ2Abs

— murat 🍥 (@mayfer) July 28, 2023

Last week, Sam Altman’s Worldcoin officially launched, opening up locations across the globe where members of the public can scan their eyeballs in exchange for some WLD tokens.

We’re not sure if cats are eligible to sign up, or if they are allowed, what they would use their new, biometrically-guaranteed crypto wallets for.

If any of your pets have had success joining Worldcoin, tell us in a tweet @DLNewsInfo!

What we’re watching for next week

Binance users -> BNB chain

— Seraphim (@MacroMate8) July 30, 2023

Coinbase users -> Base L2

Bybit users -> Mantle L2

Metamask users -> Linea L2

There is a recurring theme of weaponising your CeFi user base to increase revenues via sequencer fees

Convincing your users that they need to be paying gas for the same…

There’s a growing trend of crypto companies launching their own Ethereum layer 2 chains. But what many don’t realise is how profitable such ventures are.

By arbitraging the difference between transaction fees on layer 2 and the cost to send transaction batches to Ethereum, layer 2 operators are raking in the cash.

According to data from @niftytable on Dune, Arbitrum, the biggest layer 2 chain, regularly makes over $1 million a month from this arbitrage.

Do you have a tip-off, a question or an opinion about DeFi? Email me: tim@dlnews.com.