- Investors put $6.2 billion into crypto projects in 2023, down from $22 billion in 2022.

- While starting off high, investment into the industry ended at a lower level at the end of 2023.

- Analysts don't expect 2024 to be much better, with the year being plagued by so-called 'zombie funds.'

2024 will be a year of zombies.

That’s according to new analysis from financial research firm PitchBook, which covers crypto investment trends.

It found that not even the recent bull run in Bitcoin has done anything to sway venture capitalists to return to their pre-crypto winter capital injection levels.

This year, investors say, “will feature a wave of zombie funds — VCs that are unsuccessful in raising new funds but continue to manage an existing portfolio,” PitchBook analysts wrote.

The analysis comes as investment in crypto declined by 72% to $6.2 billion in 2023, down from about $22 billion in 2022, according to data from DefiLlama.

The number of projects raising money dropped to 717 from 732 during the same period, with funding declining over the course of the year.

The meant 2023 ended 2023 at a lower level than the beginning — albeit with a slight spike in November.

The new data comes at a key moment for the crypto industry. Market watchers expect a crypto bull run fuelled by the approval of US spot Bitcoin exchange-traded funds, new laws, and wide adoption by traditional financial firms.

And the areas in which investors injected capital in 2023 may show where they expect growth in the future.

DefiLlama tracks money invested, who the investors are, the type of funding round, industry and sector, and when the cash injections were made.

The platform collects data from multiple sources. Still, in some cases there is no data on how much money was raised, and descriptions or categories may be missing.

Who was the biggest investor in 2023?

Investment management firm Kingsway Capital injected the most money into the crypto ecosystem last year, according to DefiLlama’s data.

It topped up the coffers of three firms — Blockstream, Blockchain.com and River Financial — to the tune of $270 million in total.

Other notable investors included traditional finance behemoths like Goldman Sachs, BNP Paribas, Credit Suisse, and PayPal Ventures, as well as Binance Labs, the venture capital arm of beleaguered crypto exchange Binance.

Which crypto and DeFi organisation raised the most money in 2023?

Five organisations’ crypto rounds outstripped the rest in 2023.

Interoperability protocol Wormhole secured the biggest round of the year in November when it bagged $225 million from investors Brevan Howard, Coinbase Ventures, Multicoin Capital and others.

Line Next, a subsidiary of the Korean web3 company Line Next Corporation, attracted the second-biggest round in December, when it secured $140 million for development of a global NFT platform from Crescendo Equity Partners.

In January 2023, Kingsway Capital, along with Fulgur Ventures, and Cohen & Company Capital Markets raised $125 million for Blockstream, a blockchain technology company for Bitcoin and blockchain infrastructure.

LayerZero, an omnichain interoperability protocol, got $120 million in April for infrastructure. The lead investor was a16z, along with Christie’s, Sequoia Capital, Samsung Next, Bond, Circle Ventures, and OpenSea Ventures.

Worldcoin, OpenAI founder Sam Altman’s eye-scanning crypto project, bagged the fifth biggest raise of 2023. It secured $115 million from Blockchain Capital in May.

You can explore the available information about the biggest raises from 2023 in DL News’ interactive chart:

Which crypto sector attracted the most investment in 2023?

While 2023 saw investors pour money into a wide range of crypto sectors, some attracted more than others.

The infrastructure category raised the most capital, securing $1.3 billion in total. This category included projects developing blockchain infrastructure, digital asset infrastructure, web3 payments, and AI technology.

Wormhole secured the biggest round of the year in this category and, as pointed out earlier, in general.

“Investors tend to skew toward infrastructure early in the cycle,” Chris Carapola, co-founder of Curvance, a DeFi protocol, told DL News in December. It’s easier for venture firms to identify promising infrastructure providers than specific applications, such as DeFi protocols, he said.

It was also a good year for gaming, despite web3 games still lacking a blockbuster success that might propel blockchain-based gaming into the mainstream.

Gaming recorded $544 million across 66 raises. Believer, a gaming platform, secured the biggest round in March, when Lightspeed Venture Partners injected $55 million into the startup.

Rounds like that have fuelled optimism towards the web3 gaming revolution.

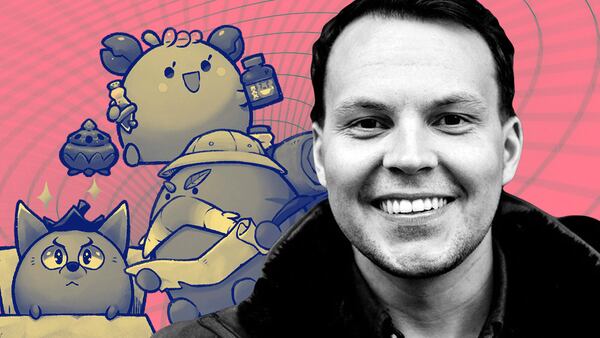

“We expect blockchain gaming and the open metaverse to continue to attract significant investment due to growing user awareness of digital ownership and the other advantages of decentralisation,” Yat Siu, chairman at web3 game and investment company Animoca Brands, told DL News in December.

The third-biggest category was NFTs. This sector attracted more than $392 million across 49 funding rounds.

In comparison with the previous year, the principal categories changed their order. DeFi was a leader in 2022, followed by infrastructure, NFT, and gaming.

Ana Ćurić is DL News’ data correspondent. Have a tip? Contact the author at ana@dlnews.com.