- Spot Bitcoin ETFs are outperforming nearly every other ETF launched in 2023.

- Europe and Canada-based funds saw the largest decrease in Bitcoin holdings since US ETFs were approved.

One week after gaining approval from the US Securities and Exchange Commission, spot Bitcoin ETFs have been a big hit with investors.

The newly launched products clocked up $10 billion in volume in the first three days of trading, according to Bloomberg data. The volumes were branded as “insane” by Bloomberg Intelligence ETF analyst Eric Balchunas in a tweet on Tuesday.

BlackRock’s spot Bitcoin ETF is seeing more volume than all of the ETFs launched in 2023.

By comparison, he said: “There were 500 ETFs launched in 2023. Today, they did a combined $450 million in volume.” Balchunas added that the most successful of those ETF saw $45 million in volume.

The US tightened its stranglehold on the global Bitcoin funds market as a result. The US accounts for 80% of the total market share of all Bitcoin held in ETFs or similar products, according to analysis by K33 Research.

Post approval, similar Bitcoin products in Europe and Canada saw a decrease of over roughly $380 million, in the first two days of trading. Markets across Hong Kong, Australia and Brazil were little changed.

Following the approval of spot ETFs, Bitcoin is down nearly 9% over seven days to around $42,300.

It’s worth noting daily analysis of inflows and outflows may not fully capture actual movements due to the inherent delay in traditional finance settlements. Therefore, early data on fund flows should be approached with caution.

In any case, roughly 4.5% of the circulating supply of Bitcoin is estimated to be held globally in such instruments, a number expected to increase throughout this year, K33 said.

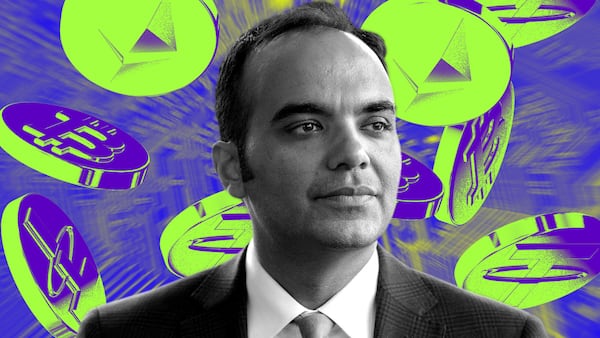

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.