- Venture capitalists poured $500m into French crypto startups in the first quarter in a bullish sign for the burgeoning hub.

- London still beats Paris in funding, but Macron is leading a push for a crypto hub to compete with the UK capital on blockchain innovation.

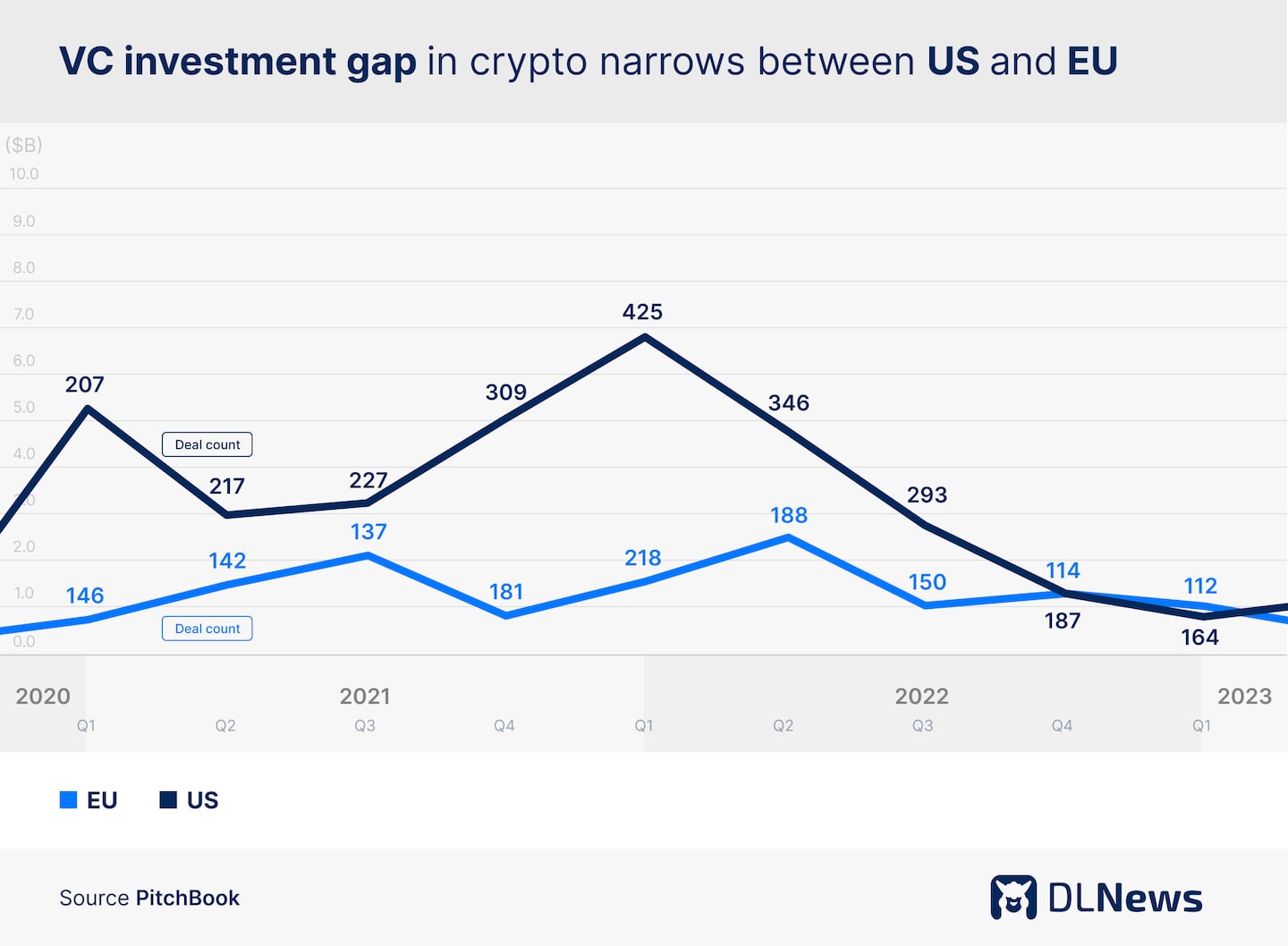

- Europe's clear-eyed approach to regulation is helping the industry compete with the US, but scaling up remains a major challenge.

On a warm July evening, about a hundred crypto aficionados and web3 builders filled the lounge in the Eiffel Tower. Thousands were left on the waiting list, but for the lucky ones, the City of Light stretched out below in summer twilight. On the agenda: cocktails and account abstraction.

That’s crypto-speak for how smart contracts can send transactions from one party to another. Just a few days earlier, it had been the subject of Vitalik Buterin’s talk at EthCC, the Ethereum’s community’s conference in Paris.

Boats on the Seine

DeFi and web3 rendezvous have been popping up across Paris this year. There have been conferences in the halls of the Louvre and receptions on the rooftops overlooking the Palais Bourbon and drinks on the bateaux-mouches floating on the Seine.

The scene is buzzing as French President Emmanuel Macron leans into making Paris the go-to web3 hub of Europe. It’s a plan long in the works. In recent years, French officials have laboured to clarify the rules around crypto, cut taxes on profits from digital assets, and support education for software engineers keen on developing blockchain ventures.

But there is one big problem: money.

NOW READ: French regulators race to get a jump on MiCA and make Paris Europe’s web3 hub

When it comes to crypto development, what France lacks most is funds from venture capitalists and other investors, according to Paul Midy, a centrist member of the National Assembly.

“Today, France is the leading ecosystem in continental Europe, but a significant gap remains with China, the United States and the United Kingdom,” according to a report Midy published in June, which was commissioned by the French government.

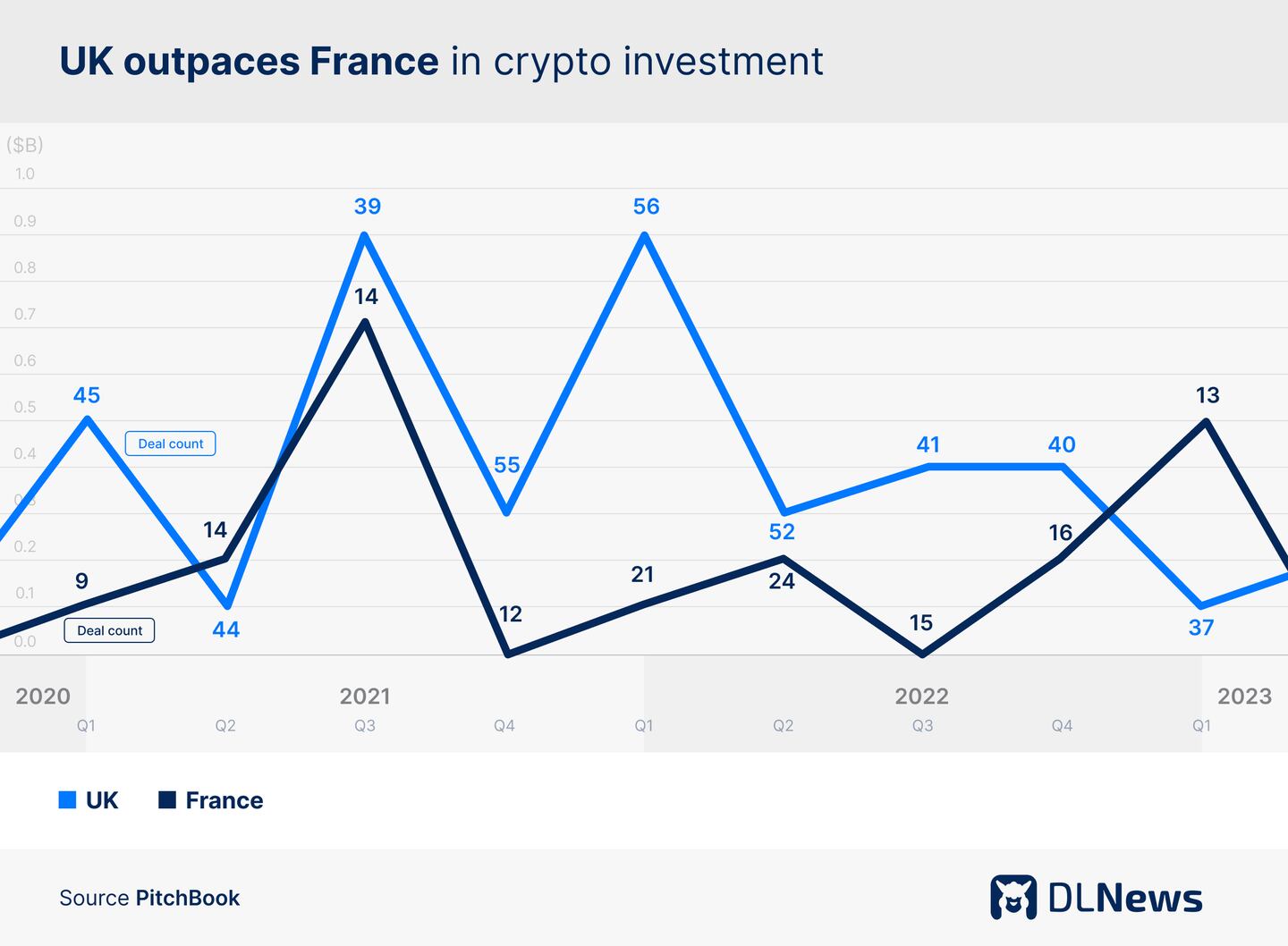

In 2022, investors ploughed more than $500 million into French crypto ventures, which was only a quarter of the inflow to UK blockchain startups, according to data from PitchBook.

Something to build on

While British lawmakers have significantly picked up the pace to implement a legal framework for crypto that competes with MiCA, there have been mixed signs. In May, lawmakers proposed regulating the industry like casinos.

Banks have restricted their clients’ spending on crypto and rejected industry players’ applications for accounts. The UK’s financial watchdog has approved only a quarter of the crypto firms applying to register for operating licences.

Still, the French have something to build on. According to PitchBook, VCs invested $500 million in crypto startups in Europe’s second-biggest economy in the first quarter, which trounced the $100 million placed with UK firms.

Maybe that’s a one-off rather than the start of a long term trend. But there’s little doubt the European Union has stolen a march on the UK and especially the US when it comes to clarifying the rules of the road for crypto.

Thanks to passage of the EU’s landmark MiCA law the continent is winning a fresh look from investors who feel burned by the crackdown in the US and the UK’s mixed messages.

And French officials are even racing ahead and implementing MiCA-like rules ahead of the rest of member states in the trading bloc.

Industry giants

France has already attracted industry giants. Binance and Crypto.com have named Paris their regional footholds, while OKX and Circle announced earlier this year they are applying for the national market regulators’ highest blessing.

Paris is also home to two web3 unicorns: Hardware wallet Ledger, which secured $100 million in funding in March, and fantasy gaming platform Sorare.

NOW READ: European Union launches institution to build blockchain infrastructure across continent

But attracting VC funding is hard, especially in a bear market. And it doesn’t help that artificial intelligence ventures have caught the eye of VCs at the expense of crypto outfits.

Midy hopes that incentives like a 30% to 50% reduction on income tax for investments in innovative start-ups will help things pick up.

‘Crypto funding is in the worst place at the moment.’

— Guilhem Chaumont, Flowdesk CEO

“Crypto funding is in the worst place at the moment,” said Guilhem Chaumont, CEO and co-founder of crypto market maker Flowdesk, based in Paris.

Major crypto VCs have turned away from web3. California-based venture capital giant Sequoia has downsized its crypto fund to $200 million from $585 million, The Wall Street Journal reported at the end of July. The slash is due to changes in the market, the report said.

London vs Paris

As longtime rivals when it comes to finance, Paris has been keen on stealing London’s “mojo and momentum,” Xavier Rolet, former CEO of the London Stock Exchange, told DL News earlier this year. With Brexit clouding the growth prospects of London, Paris is pursuing the chance to be Europe’s finance capital.

France may be perceived to be a difficult place to do business, and many VCs may still need convincing. Andreessen Horowitz, the mammoth Silicon Valley VC firm that has amassed $7 billion to invest in crypto worldwide, opted to build its European headquarters in London, the firm said this year.

When it comes to crypto, Paris is trying to change perceptions. Financial giants such as Société Générale have been at the forefront of hooking TradFi up with DeFi.

“Paris has a concentrated banking sector, and is active in terms of European policy,” said Ivan de Lastours, blockchain and crypto lead at public investment bank bpifrance, a key stakeholder in the industry. “There is also a dynamic web3 ecosystem. This is a good and balanced cocktail.”

NOW READ: London loses crypto ‘mojo and momentum’ as Revolut hints at Paris move

Bpifrance has a total €85 million exposure to the industry through grants, loans and direct investment in crypto firms and venture capitalists, the public investment bank says.

“When there is a bull market, there is more direct investment and funding,” de Lastours told DL News. “When it’s a bear market we try to do the same. We try to be there at each phase of the cycle to sustain the web3 ecosystem in the best way possible.”

Investors also want to see a way for startups to go global and scale. While the US has the Nasdaq and deep-pocketed institutional investors and a vibrant deal-making culture to spur confidence that companies can grow, France, and the rest of Europe, are still struggling to match these strengths.

Building blocks

“When you become bigger, you cannot only stay in France, you need to be more global. You need to go to Asia, to the US and so on,” said Chaumont. He pointed out that 80% of Flowdesk’s revenue comes from outside Europe.

France has the building blocks. Bootstrapping a startup in Paris is “extremely capital efficient,” he said. Engineers and software developers are more affordable, taxes have been reformed, and regulators clearly understand what needs to be done to make Paris attractive to VCs.

Incubators like Station F, a onetime train station that has been converted into a startup and fintech factory on Paris’s Left Bank are attempting to create the sort of hothouse culture that exists in London’s Shoreditch neighbourhood and in Silicon Valley.

Chaumont is optimistic that Paris will reach new heights, with the “maturity of the bigger firms” like Ledger and Sorare leading the way.

“This shows that yes, we have the possibility and we have the ambition to create world-class crypto startups,” he said.

Brussels-based correspondent Inbar Preiss covers EU crypto regulation for DL News. If you have a tip contact her at inbar@dlnews.com.