- Senior crypto official Elisabeth Noble tells DL News how European Banking Authority will integrate digital assets into financial system.

- EBA to conduct consultations with crypto industry as MiCA is implemented across 27-nation bloc.

- Officials publish consultations on stablecoin issuance in first move to implement legislation.

The European Union is taking its next step in integrating crypto into its financial system. Up first: stablecoin regulation.

On Wednesday, Europe’s financial regulators started the process of drafting the rules that will enable crypto service providers and issuers to do business in compliance with MiCA, the landmark legislation adopted last month.

“We are building a regime from a zero base,” said Elisabeth Noble, senior policy expert at the European Banking Authority, which will supervise crypto issuers under the new rulebook.

“It’s important that we strike the right balance and gain sufficient industry input, especially because we don’t have many international precedents in this area,” she told DL News in the EBA’s 27th-floor office in Paris.

Rulemaking mode

The EBA, which is responsible for stress testing the EU’s banks, is holding consultations to allow industry representatives to provide input on the new rules. On Wednesday, Noble and her team published their first batch of regulatory proposals, and they focus on standards for stablecoin issuers.

Shifting into rulemaking mode is a vital phase in weaving blockchain-based finance into the fabric of the EU’s financial system. Unlike the US, where the Biden Administration is clashing with the crypto industry amid a flurry of enforcement actions, Brussels is taking a more accommodating tack.

NOW READ: EU won’t let Meta or other Big Tech players dominate the €800bn metaverse

The EU’s legislative process may be steeped in complexity, but at least the crypto industry has a seat at the table as the 27-nation bloc labours to provide an approved course for the growth of crypto inside its orders.

MiCA, which stands for the Markets in Crypto-Assets framework, sits at the heart of the project. The law will govern the evolution of the crypto industry in the world’s largest trading bloc and a €14.5 trillion ($16 trillion) economy.

Passing a law is one thing. Implementing and enforcing it is another. To do that, regulators are writing implementation rules and beefing up their supervisory capacity before MiCA goes live by the end of 2024.

‘It’s important that we strike the right balance and gain sufficient industry input, especially because we don’t have many international precedents in this area.’

— Elisabeth Noble

A separate agency, the European Securities and Markets Authority, will focus largely on licensing and supervising crypto service providers; it also published its own consultation papers on Wednesday.

As the point person in this important new chapter, Noble will be drawing on a decade’s worth of crypto experience. Noble, a former senior lawyer at the UK Treasury, started following Bitcoin around 2013. That’s earlier than most in the financial industry can say.

Bitcoin captured Noble’s attention in the wake of the global financial crash in 2008.

“Something emerged into the market that was intended to essentially circumvent the traditional financial system,” Noble said. “It can provoke you to think about the functioning of the traditional financial system and how that can be improved.”

NOW READ: Bitcoin startup Blockstream and wallet firm Ledger lead 2023 raises as VC funding slumps 75%

But if Bitcoin and its fellow digital assets were to scale, she said protections would be needed to protect consumers, and the system, from the same risks that blew up Wall Street and triggered the worst global recession since the 1930s.

Brussels clearly believes integrating crypto into the traditional financial system instead of leaving it outside the perimeter is the wiser course.

No surprise, Noble, who has been the policy guru for fintech at the EBA since 2014, spends almost the entirety of her work these days on crypto and blockchain-based finance.

Plug the gap

The EBA and ESMA have nudged the European Commission to “plug the gap” in the regulatory cracks in which crypto was falling in 2019, Noble pointed out. Their reports on crypto assets eventually led to the EU’s work on MiCA.

According to Noble, the challenge now is twofold. The crypto industry will need to work on bringing their “compliance systems and controls” up to scratch.

And financial watchdogs must help the industry comply with the law. “We too need to think about how to monitor effectively, and how to build our set of supervisory priorities and processes,” she said.

NOW READ: CFTC plots own course on crypto by naming Polygon and Uniswap leaders to key advisory panel

For the EBA, the top priority is overseeing stablecoins rules.

MiCA distinguishes between stablecoins that peg their value to a fiat currency such as the US dollar or the euro, and those which rely on a basket of assets to make up their value.

In the coming weeks, EBA regulators will seek feedback on the details such as how non-banking firms should be allowed to issue these “asset-referenced tokens.” The EBA will also assess who holds the shares, a process it calls “assessment of qualifying holdings.”

Providing input

Toward the end of the year, the EBA will publish a second set of consultations surrounding governance and prudential policy areas. The crypto industry’s representatives will have the opportunity to provide input.

“Prudential mandates relating to the composition of the reserves of assets I think will get quite a bit of attention,” Noble said. “For example, the specification of highly liquid assets for the reserves, and how we define those, will gain some interest.”

Meanwhile, traditional finance has taken a keen interest in crypto assets and their underlying technology. Not only are finance giants like BlackRock filing for Bitcoin ETFs, central banks and governments are starting to experiment with decentralised ledger technology.

“Since around 2008, we’ve seen incremental growth and diversification of the tokens on the market very far away from this original incentive of Bitcoin and increasingly integrated with traditional financial services.”

Noble is optimistic that the regulatory clarity that MiCA brings to Europe will allow the industry to build itself up on a “solid foundation,” also for actors looking to move there.

The UK is now racing forward to catch up. Policymakers are hoping that a MiCA-like framework can be in place by the end of next year and align with Europe.

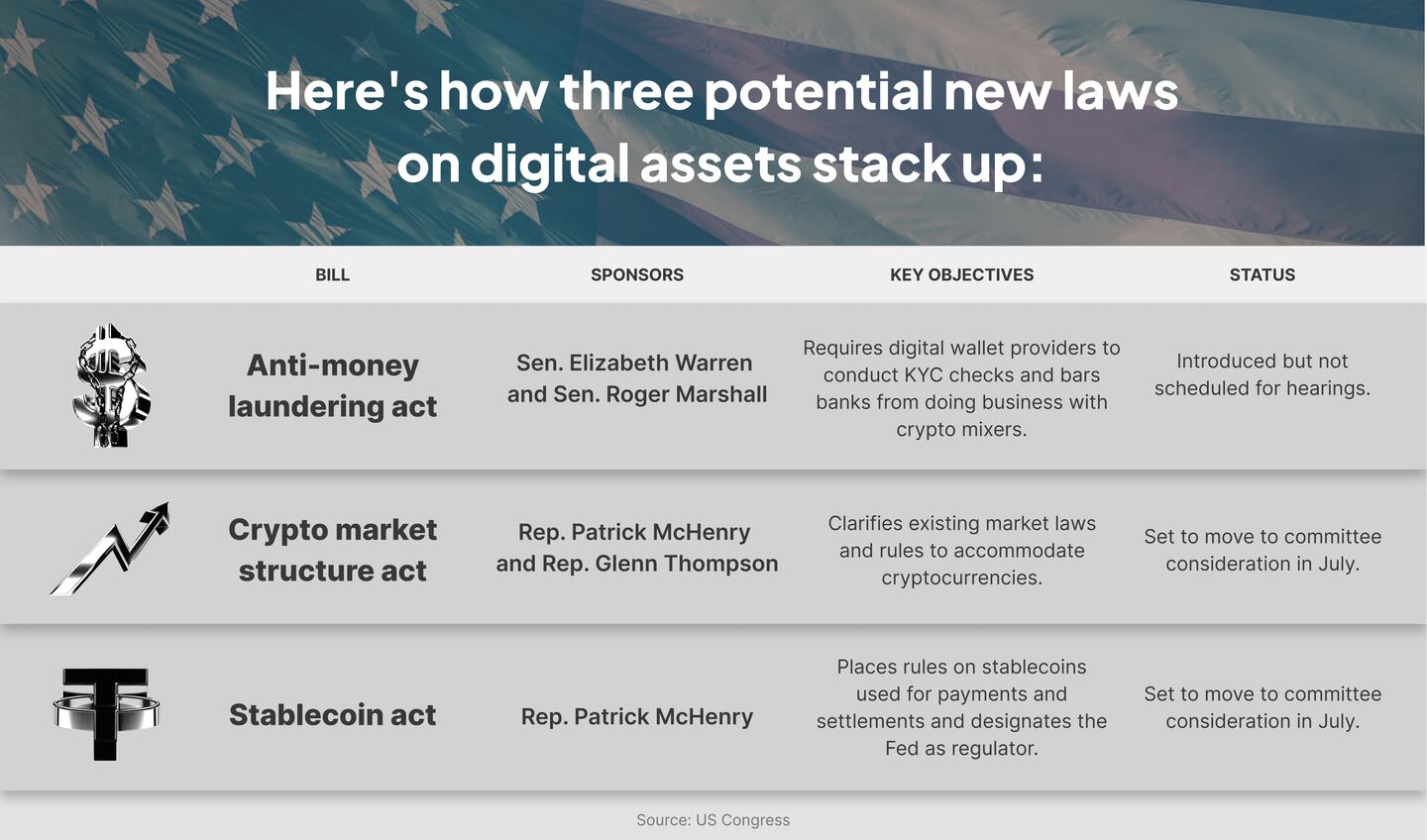

In the meantime, a US crypto solution is further on the horizon. A recent Republican bill was presented to Congress, but will need bipartisan support to pass, which will be a challenge.

Noble said Europe’s high regulatory standards will strengthen crypto firms. “If you can thrive in that environment then hopefully that means that you can grow a business that also is capable of thriving in other jurisdictions,” she said.

NOW READ: Elizabeth Warren’s anti-crypto crusade may bolster Wall Street’s land grab in Bitcoin market

Even though American crypto supporters may look at MiCA’s clarity with envy, the law does require firms to hew to many of the same rules as their TradFi counterparts. Those offering crypto services or issuing tokens to EU residents need to comply with anti-money laundering rules, electronic money directives, cybersecurity laws, data protections and others in a web of regulations.

“There has to be a culture of mitigation of conflicts of interest, there has to be a culture of fair conduct towards consumers in terms of disclosures in white papers, the marketing materials and so on,” Noble said. “It’s getting that culture right, as well as complying with the letter of the new rules.”

DeFi up next

Now DeFi is getting a lot of attention, Noble said.

Entities or protocols without a centralised authority were left out of MiCA’s scope. “When you look at what’s currently in the market, most DeFi still involve intermediary functions that are capable of being regulated and supervised under MiCA,” she said.

Indeed, policymakers, as well as European Central Bank topdogs, have called for a MiCA 2.0 to address decentralised finance and its activities like crypto staking and lending.

The EBA is still closely monitoring its evolution, as it has done with crypto for many years. When sufficient data to support material risk appears, the EBA would be the first to let EU lawmakers know.

But, according to Noble, there is also a need to let the new sector develop: “We need to be aware of the potential for the technology to evolve and for the use cases to evolve.”

Have a tip about crypto regulation? Contact the author at inbar@dlnews.com.