- Ark Invest bet on Grayscale after its court appearance in March.

- The Grayscale discount has narrowed significantly since then, to the benefit of Cathie Wood's firm.

- Investors like Ark Invest are reliant on GBTC converting to a Bitcoin ETF to truly realise their gains.

Happy Friday!

Investors in the Grayscale Bitcoin Trust are anxiously waiting for news of the company’s spot Bitcoin exchange-traded fund approval.

G-arbitrage

That’s because if and when a regulatory nod hits, they’ll be able to exit their positions in GBTC, Grayscale’s digital currency investment product. As retail interest has dropped over the past year or so, investors have been stuck.

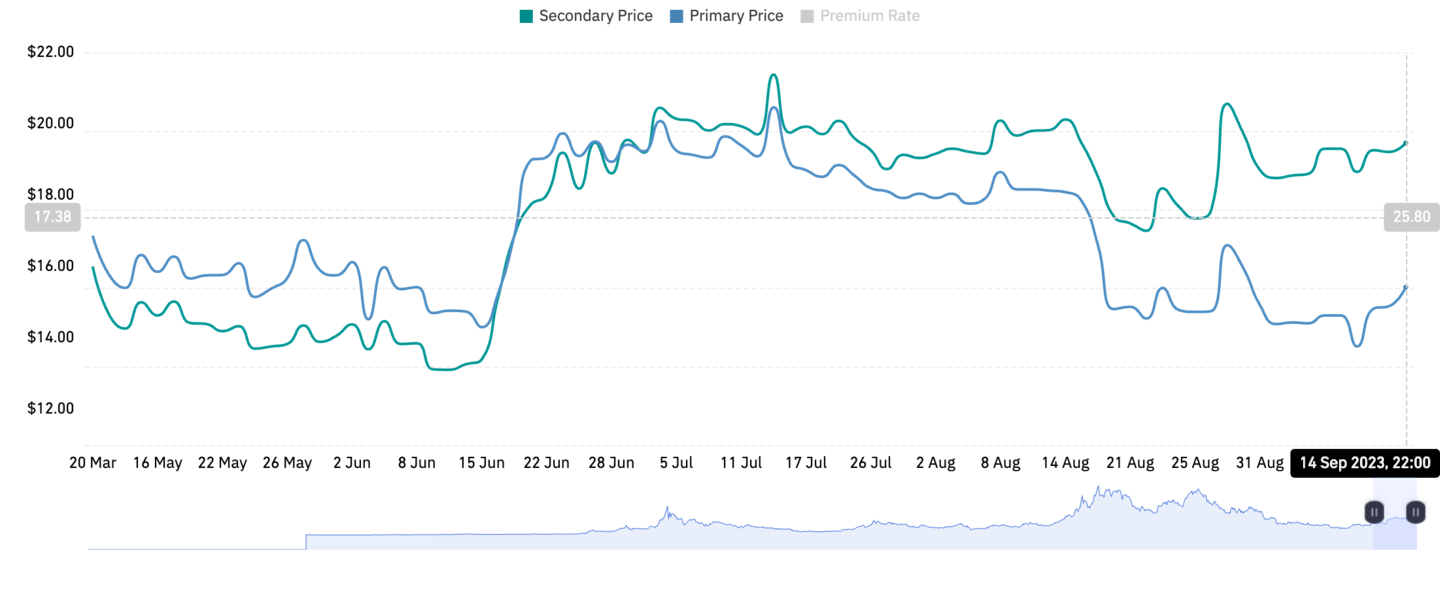

The trust tracks the price of the Bitcoin it holds, but doesn’t currently offer users the option to redeem shares. As a result, there is a disparity between its share price and the spot price of Bitcoin. The shares now trade at a discount to the value of the underlying Bitcoin.

It’s a discount that Ark Invest’s Cathie Wood says she is exploiting.

Wood said her firm analysed the judge’s comments following Grayscale’s oral arguments in March and bet the asset manager would win.

Based on GBTC’s current discount, the odd of approval are near 80%, according to Coinbase’s head of institutional research, David Duong. If the discount disappears and shares trade in line with net asset value, Coinbase says this implies a 100% probability of one or more spot bitcoin ETF approvals.

“This assumes that the current GBTC discount reflects its lack of liquidity and redeemability for its shareholders,” Duong said. If it traded in line with its net asset value this would imply a 100% probability.

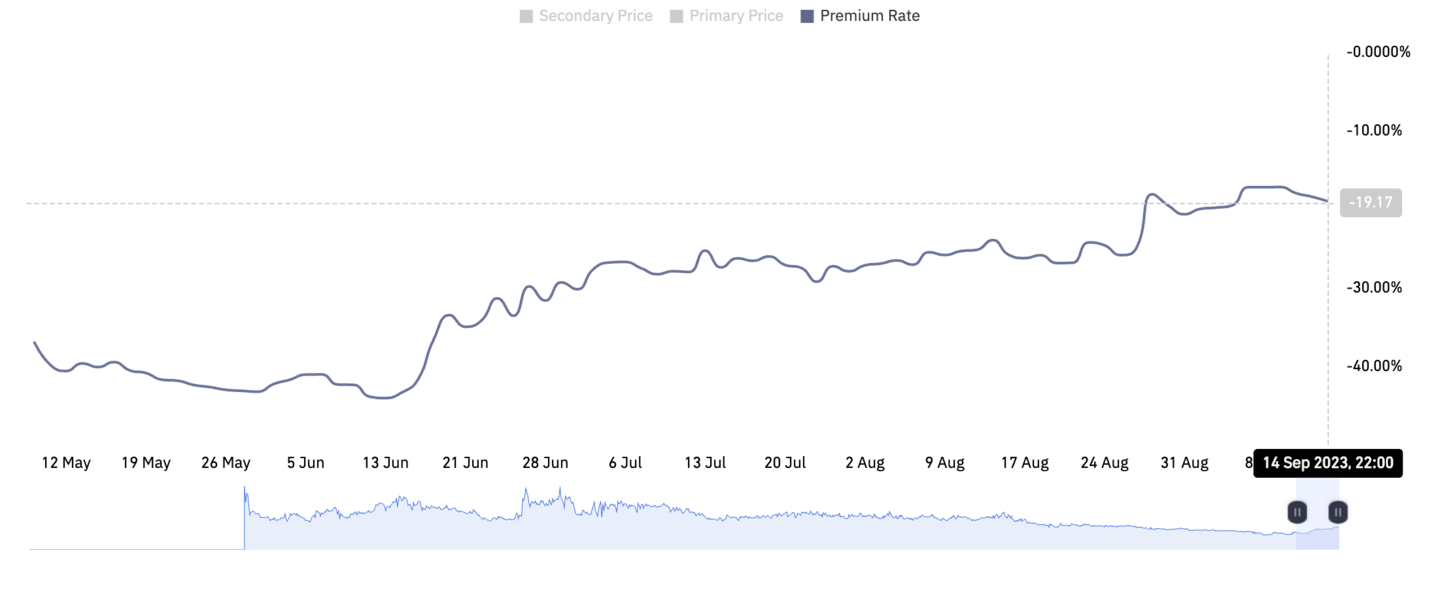

That discount widened to about 19% over the past few days. It had narrowed to around 17% following Grayscale’s legal victory over the US Securities and Exchange Commission at the end of August.

Despite widening this week, the discount is considerably tighter than it was at the beginning of the year, when shares were about 50% cheaper than the value of the Bitcoin it held.

The narrowing discount indicated optimism that a spot Bitcoin ETF would gain approval, Nate Geraci, president of financial advisory firm the ETF Store, said last week.

Investors appear to see approval for GBTC to convert to a spot Bitcoin ETF as the best way out.

GBTC was known for its “slam dunk” arbitrage back in its heyday between 2020 and 2021, when it traded at a premium to its net asset value.

Arbitrage traders would borrow Bitcoin — often from Digital Currency Group’s now bankrupt crypto lending platform Genesis — and then deposit it with Grayscale to get GBTC shares.

Traders could offload these shares at higher prices on the secondary market to retail investors after a six-month lock-up period.

That off-ramp for arbitrageurs no longer exists.

GBTC shares trade at around $19.50 on the secondary market, versus $24 on the primary market. Without demand from retail investors, there’s no exit opportunity for traders.

That’s why converting GBTC to a spot Bitcoin ETF is so important for investors. This would allow investors to create and redeem shares. Until now its been a one way street, where new shares are created but never destroyed, which results in the current discount to net asset value. The discount would effectively disappear after conversion.

Really, there is no arbitrage while its still a trust, so funds like Ark are sitting on paper profits and run the risk of the discount widening again as the spot Bitcoin ETF drama persists.

Crypto market movers

- Bitcoin is flat over the last day as it continues to trade around $26,500.

- Ethereum fell slightly to $1,620, down just around 0.1%

What we’re reading

- North Korea’s stolen crypto haul reaches $3.4bn — 16 years of Lazarus heists and hacks — DL News

- Binance’s US unit just lost two more execs as exchange reels from CEO departure — DL News

- The Merge one year on: Ethereum no longer a ‘wanton environmental polluter’ but centralisation issues remain — DL News

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.