- Grayscale won its case against the SEC as spot Bitcoin ETF approval begins to look more likely.

- The D.C. court ruled in favour of Grayscale, and said the proposed conversion of GBTC to spot Bitcoin ETF is similar enough to Bitcoin futures ETFs to receive the same regulatory treatment.

- GBTC is not automatically converting to an ETF.

In a decision that could pave the way for a spot Bitcoin exchange-traded fund, a US appeals court ruled Tuesday that the US Securities and Exchange Commission erred by denying Grayscale’s application for such an offering.

The appellate court overturned a decision by a lower court that had found the SEC was right to reject the application for a Bitcoin ETF from Grayscale, a firm that has long managed publicly traded trusts for Bitcoin, Ether and other cryptocurrencies.

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products,” Judge Neomi Rao wrote in the decision. “We therefore grant Grayscale’s petition and vacate the order.”

“This is a monumental step forward for American investors, the Bitcoin ecosystem, and all those who have been advocating for Bitcoin exposure through the added protections of the ETF wrapper,” a Grayscale spokeswoman told DL News. The asset manager and its legal advisors are “actively reviewing the details outlined in the Court’s opinion and will be pursuing next steps with the SEC. We will share more information as soon as practicable.”

Futures contracts

At the heart of the case was Grayscale’s contention that an ETF based on the spot price of Bitcoin was similar enough to a Bitcoin ETF based on futures contracts. The SEC has long approved the latter because they are tailored for sophisticated institutional investors instead of retail traders.

The ruling immediately made an impact in the crypto investment community. Bitcoin soared more than 5% on the news.

“There it is, Grayscale wins their lawsuit against the SEC,” said Bloomberg Intelligence analyst James Seyffart. “DC Circuit court of appeals is vacating the SEC’s denial of GBTC’s conversion into an ETF.”

This does not mean the Grayscale Bitcoin Trust — a listed instrument with more than $16 billion in assets undermanagement — will be automatically convert to a spot Bitcoin ETF, Seyffart added.

NOW READ: The Decentralised: Tornado Cash storm, Solana’s signs of life

The decision is a pivotal development in the push by crypto firms to provide investors with the same type of accessible investment offerings as traditional players.

Grayscale, which is part of the crypto conglomerate Digital Currency Group, sued the SEC in June 2022 after the agency rejected its application to convert its publicly traded spot Bitcoin trust into an exchange-traded fund.

ETFs tend to be far cheaper for investors to trade than trusts, which are unwieldy and expensive instruments to manage.

In rejecting the application, the SEC said Grayscale failed to address how the fund would prevent fraud and market manipulation.

NOW READ: Ark Invest files for crypto ETFs, Grayscale discount narrows, and SEC-linked coins pop

Grayscale countered that the SEC had approved Bitcoin futures exchange-traded products and was treating its application unfairly by applying a double standard. Futures are derivative contracts that let investors bet on the anticipated price moves of securities and commodities.

Wall Street has long eyed Bitcoin and Ethereum ETFs as a potent means of capitalising on the growth of cryptocurrencies as an asset class.

TradFi giants

The ruling comes as established TradFi giants elbow their way into the Bitcoin ETF race. On June 16, BlackRock surprised the market with its application for a spot Bitcoin ETF. WisdomTree and Valkyrie followed suit.

Ever since it hit the market in 2013, Grayscale’s Bitcoin trust, which goes by the ticker GBTC, has been a go-to product for institutional investors despite its pricey 2% fee. With $19 billion in assets, it has returned a staggering 19,421% to investors in the last decade thanks to Bitcoin’s consistent appreciation, according to Grayscale data.

NOW READ: Base frenzy fuels Coinbase revenue outlook amid rising fees and shrinking market share

Grayscale now distributes 17 crypto-based trusts that track underlying crypto indices. They range from Bitcoin to Ethereum to Solana and even Decentraland, the metaverse player. The venture raked in $210 million in fees from GBTC, according to estimates from UBS. Grayscale garnered another $100 million in revenue from ETHE, its Ethereum offering.

Grayscale arbitrage

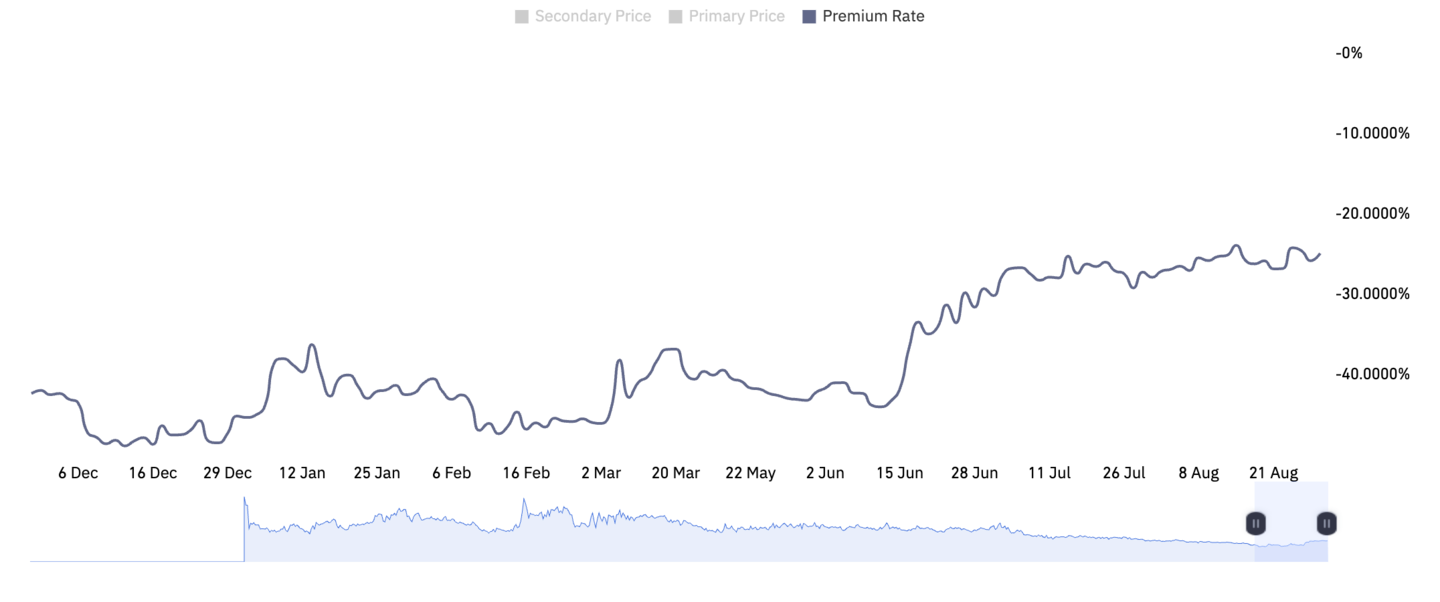

One of the main draws for savvy traders has been the tendency of shares in the trust to trade at a premium or discount to the net asset value (NAV).

Because the trust tracks the price of the Bitcoin it holds rather than offering users the option to redeem shares for it, there is a disparity between its share price and the spot price of Bitcoin. This gap provides traders with an opportunity to profit from the spread in what’s known as arbitrage.

Savvy traders would borrow Bitcoin, deposit it with Grayscale and get GBTC shares in return. Traders could then offload GBTC shares at a higher price to retail investors six months later – at the end of the lock up period.

GBTC’s premium to Bitcoin flipped to a discount — shares in the trust are worth less than the Bitcoin it holds — around two years ago. GBTC’s discount to NAV narrowed by over 20% since the June applications, according to CoinGlass data.

Discount to NAV

As the market downturn intensified over the past year shares in the trust traded lower, widening the discount to almost 50%. It’s all about supply and demand, said Rayhaneh Sharif-Askary, Grayscale’s head of investor relations: “If there’s more shares out there than there’s demand for, you might have a discount and if there’s a scarcity you might have a premium.”

So, there’s no exit opportunity for people trading the arbitrage if demand falls. The arbitrage that funds once thought was a “slam dunk,” was no more.

If a redemption program was put in place the discount would narrow to zero. The holders would be able to redeem shares to take advantage of the arbitrage opportunity and narrow the discount, or over supply of shares.

Double standards

In its lawsuit, Grayscale argued that basic norms should govern the actions of the SEC. The agency must “conduct themselves in a manner that is not arbitrary and capricious, and they’ve got to engage in reasoned decision-making,” Don Verrilli, a former U.S. Solicitor General during the Obama administration, argued for Grayscale in March.

The Commission’s decision to approve Bitcoin futures ETFs and not approve spot market ETFs demonstrated is a major problem, Verrilli said.

“They just contradict each other, and that’s the essence of our case,” he said.

NOW READ: Tornado Cash founders agonised over KYC almost a year before sanctions, prosecutors say

The SEC argued that futures products are harder to manipulate as the market is smaller and based on futures prices from the CME, which is CFTC-regulated. The mechanism by which spot products are priced has always been a bug bearer for the Commission.

TradFi takeover?

BlackRock, the world’s largest asset manager, caused fervour with its application in June. Experts, including Bloomberg Intelligence’s Eric Balchunas, even suggested the firm might have an inside track on Grayscale’s application.

Cathie Wood’s Ark Invest saw its latest application, a partnership with crypto asset manager 21Shares, delayed for comment last Friday. The deadline for Ark’s application is early 2024.

Grayscale recently filed for an Ethereum Futures ETF.