- Bitcoin has soared around 160% since FTX collapsed and Bitcoin ETF approvals have improved sentiment.

- Despite the bullish outlook, market makers have yet to return to most exchanges due to rising liquidity concerns, according to Kaiko.

Investors have found it increasingly easier to buy and sell Bitcoin over the past month, but markets are still less efficient and riskier than before the FTX collapse.

That means sophisticated trading firms are worried about rocky markets ahead.

Market movers

Low liquidity could be behind recent price declines in Bitcoin, according to crypto data analytics firm Kaiko.

Liquidity refers to the ability to sell an asset for cash. Less liquidity poses a risk for investors as they could find it hard to convert Bitcoin into cash close to the prevailing market price.

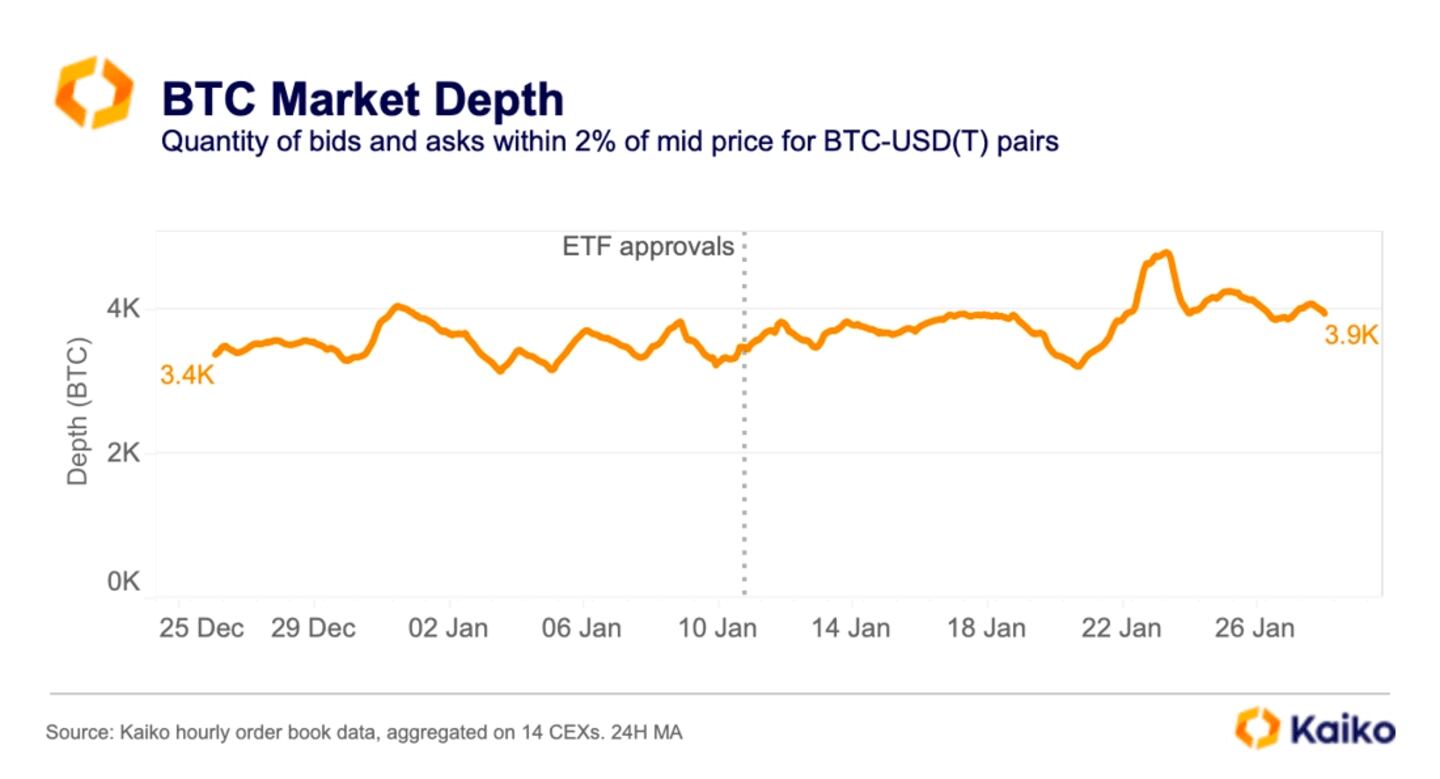

Bitcoin’s so-called market depth increased since the end of December, but is still below pre-FTX collapse levels. This “could also explain the strong price move” in January, Kaiko said Monday.

Kaiko uses market depth as its main liquidity gauge. Market depth is determined by measuring the number of orders within a price range waiting to be filled.

This allows Kaiko to assess how well the market can sustain relatively large orders without impacting the price.

“Bitcoin’s 2% market depth for BTC-USD and BTC-USDT trading pairs aggregated on 14 exchanges has not yet recovered to its pre-FTX levels of more than 10,000 Bitcoin, suggesting that market makers have not returned in full force,” the firm said.

Kaiko’s report said market depth approached 4,000 Bitcoin for the first time in over a month in January.

Liquidity has been an issue across crypto exchanges since the collapse of FTX in November 2022. The high profile bankruptcy brought increased scrutiny from regulators and acted as a deterrent to established firms.

Market makers Jane Street and Jump both scaled back their operations last May, and it seems many of their peers have yet to return to crypto markets.

Crypto market movers

- Bitcoin slipped by 2.3% since Tuesday to $42,600.

- Ethereum fell 0.9% to trade below $2,300 shortly after midday in the UK.

What we’re reading

- Bettors put millions on Michelle Obama winning presidential election — DL News

- Germany Seizes Over 50,000 Bitcoin (BTC) In Copyright Case — Milk Road

- Spot Ethereum ETFs Likely to Be Approved on May 23: Standard Chartered Bank — Unchained

- Vitalik Buterin Outlines Potential Crypto + AI Use Cases And Risks — Milk Road

- Jupiter dev’s WEN airdrop introduces new Solana NFT standard — DL News

Tyler Pearson is a junior markets correspondent at DL News. Got a hot tip? Reach out to him at ty@dlnews.com. Adam is a markets correspondent for DL News. Have a tip? Contact him at adam@dlnews.com