A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here.

Here’s what caught my DeFi-eye recently:

- Excitement over Jupiter’s token launch is reaching a fever pitch

- Euler Labs CEO finds his lost governance tokens

- Circle deploys USDC on another Ethereum layer 2

Jupiter dev whets appetites with WEN

After a more than two-month wait, Jupiter is making the final preparations ahead of its token airdrop scheduled for January 31.

As the biggest decentralised exchange aggregator, not just on Solana, but in all of DeFi, the expectations for Jupiter’s airdrop are high.

Jupiter dev Ming Ng took the excitement to another level late last week when he and the Ovols team launched WEN — a so-called memecoin created using Solana’s new token extensions and launched through Jupiter’s LFG launchpad

WEN was airdropped to over a million wallets — including active Jupiter users, several top NFT collection holders, and genesis Saga phone holders. The one trillion WEN tokens near-instantly rose to over a $100 million in total value.

On the surface, creating and airdropping WEN might seem like little more than another way to hype up Jupiter ahead of its token launch.

But under the hood, WEN acts as a proof of concept for the WEN New Standard — or WNS — a new, lightweight token standard for NFTs on Solana created by LFG. WEN is a WNS NFT fractionalised into one trillion fungible tokens.

The WEN launch also acted as a stress test for Jupiter’s infrastructure, its bot mitigation measures, and the Solana network as a whole.

While WNS is the first Solana NFT standard built using the 13 new token extensions the blockchain deployed last week, it almost certainly won’t be the last.

Watch out for other Solana projects using the token standards to build new and innovative stuff in the future.

Euler CEO recovers lost governance tokens

Euler Labs CEO Michael Bentley told DL News that he has recovered the $3.8 million worth of governance tokens he said he had lost at the start of the month.

On January 10, DL News managing editor Ekin Genç reported that Bentley had lost access to his EUL tokens after a losing the private key to the wallet where they were stored.

Bentley’s approximately 1.2 million EUL tokens were lost, representing 4.4% of the total token supply.

In September 2022, when the token’s price peaked at $12.78, his holdings would have been worth about $15 million.

After the Euler protocol suffered a $200 million hack in March, many assumed it would wind down, even after it was able to recover the stolen funds.

But Bentley and Euler Labs have carried on. In January, they announced a new DeFi primitive called the Ethereum Vault Connector, which lets lending protocol smart contracts communicate with each other.The promise of future Euler launches has helped EUL rally over 159% from its 2023 lows.

Celo gets native USDC

Ethereum layer 2 Celo has just become the latest blockchain to get a native USDC deployment. It’s the 16th blockchain Circle has launched USDC on.

🗞️ Welcome @Circle to the Celo ecosystem! 🤝

— Celo.eth 🦇 🌳 (@Celo) January 30, 2024

Native USDC is deploying on Celo to further everyday adoption of digital currencies & assets

What does this mean? 🧵👇 pic.twitter.com/aVP6vyBXvQ

Native deployment means that Circle, the company behind USDC, has built the infrastructure for users to mint and redeem USDC directly on a specific blockchain. The benefit is that Circle now directly guarantees native USDC trading on Celo.

Not all USDC trading on blockchains is deployed natively. Some blockchains use bridged versions of USDC. These work by letting users lock up native USDC on a different blockchain, then issuing a placeholder token on a destination chain.

While such bridges are convenient — it’s often faster to build bridges instead of waiting for Circle to go through the process of deploying natively — they are much less secure.

Because these kind of token bridges hold user’s USDC deposits, often in multi-signature wallets, they are susceptible to hacks and exploits.

Previous hacks at the Ronin bridge, Muiltichain, and several others highlight the risks of such bridges.

As Circle deploys USDC natively on more chains it will boost interoperability in DeFi and make blockchain ecosystems more secure.

But for Circle, which is planning to IPO in the US later this year, it needs to make sure it doesn’t fall foul of regulations doing so.

Data of the week

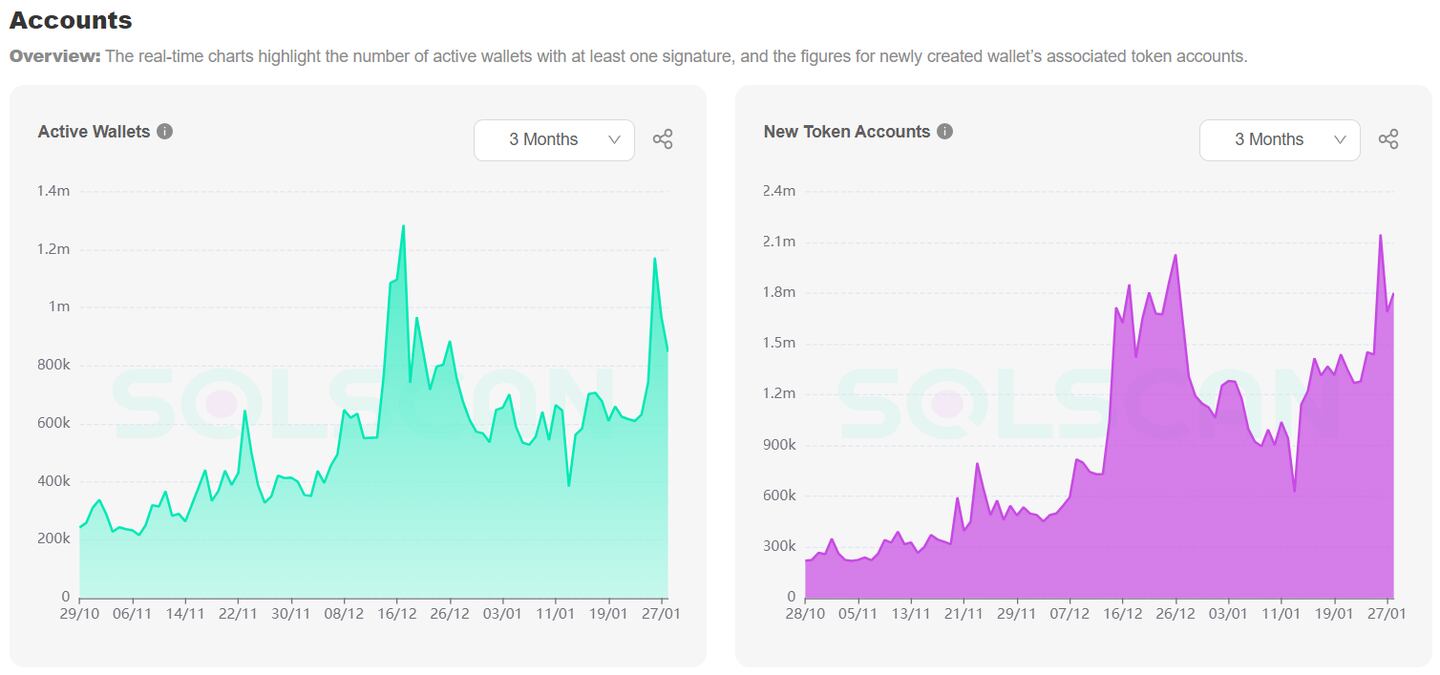

Solana activity is rising again in the lead-up to Jupiter’s token launch.

Active wallets and new token deployments saw the most prominent spikes, but other metrics, such as transaction count and network fees, have also increased over the past week.

While new tokens deployments have surpassed their December high, active wallets have yet to do so.

This week in DeFi governance

VOTE: Arbitrum votes on changes to its constitution and Security Council election process

VOTE: Euler requests more funding for the Euler Foundation

Post of the week

Uniswap founder Hayden Adams adds to the piling criticism of the points epidemic sweeping crypto.

can't believe the current industry meta is tokens but we removed the transfer function and track them in an offchain database

— Hayden Adams 🦄 (@haydenzadams) January 27, 2024

What we’re watching

Decided to look at the chain.

— CherryWorm (@CarryWorm) January 26, 2024

There has been a total of ~$120B of USDC transfers over the last week. >90% of that is by 9 accounts. Literally every single one of them are Phoenix market makers. Phoenix does not have a volume of $120B, this number is heavily inflated by creating… https://t.co/16CI6EXa6N

CherryWorm and several others have noticed that the stablecoin transfer volumes on Solana have skyrocketed in recent weeks.

Solana-based decentralised exchange Phoenix confirmed to DL News that the increase in transfers is due to how trades are processed on the exchange.

When market makers create and cancel orders on Phoenix, as they routinely do thousands of times a day, those unfulfilled trades technically count as transfers.

The situation has caused a lot of confusion among analysts, who interpreted the increased transfer volume as actual trading volume.

Got a tip about DeFi? Reach out at tim@dlnews.com.