- EigenLayer airdrop speculators are turning to Pendle to cash in on speculation of a potential airdrop.

- Over $129 million of eETH, a liquid restaking token, is now deposited in Pendle.

- With a boost in revenue, the Pendle token continues to break all-time highs.

One protocol is a secret winner in the EigenLayer airdrop frenzy. Pendle, a yield trading protocol, has seen the price of its native token surge 74% in the last month.

Since January 10, deposits into Pendle in one type of token — another protocol Ether.Fi’s liquid staking token called eETH — have soared from around $1 million to over $129 million.

Traders are betting on a strategy that gives them a form of leveraged exposure to the upcoming EigenLayer airdrop.

EigenLayer, an Ethereum native protocol that introduces restaking, awards points to depositors. Points systems are a relatively new trend in DeFi that have stirred speculation among traders about future airdrops.

Such excitement around the protocol has helped the value of Pendle’s governance token. In the last month, the value of the eponymous token has nearly doubled to $2.00.

It’s up by 2,076% over the past year.

Any EigenLayer airdrop — giveaway of a protocol’s tokens that could be worth thousands of dollars on the market — has yet to be officially announced. Still, Pendle is in a position to continue to profit from the speculative frenzy.

The trader frenzy is evidenced by the market-set implied Annual Percentage Yield for eETH, which is 27.5% — significantly higher than what is offered by staking Ether on its own, around a 4% Annual Percentage Yield.

How Pendle works

Pendle lets users deposit eETH, a liquid restaking token issued by another protocol called Ether.Fi, and splits the token into a principal token, or PT, and a yield token, or YT.

The PT-eETH token represents the principal portion of one eET.

The YT-eETH token represents the yield component, EigenLayer points and Ether.Fi points generated by one eETH.

The value of PT-eETH and YT-eETH tokens are designed to be inversely correlated: as demand for YT-eETH increases with traders betting on the points system, the token’s price increases, simultaneously leading to a decrease in the price of PT-eETH.

When a user deposits one eETH into Pendle, they are issued one PT-eETH token valued at $1,988.77 and one YT-eETH token priced at $214.81 determined by the rate set by the market.

Both tokens can be actively traded on Pendle until their expiration date, set for June 26.

With the price of one YT-eETH token at $214.81, a trader exchanging one Ether can receive approximately 10.3 YT-eETH tokens.

This exchange effectively offers them an exposure that is roughly 10 times leveraged to the points of both EigenLayer and Ether.Fi.

Pendle metrics surge

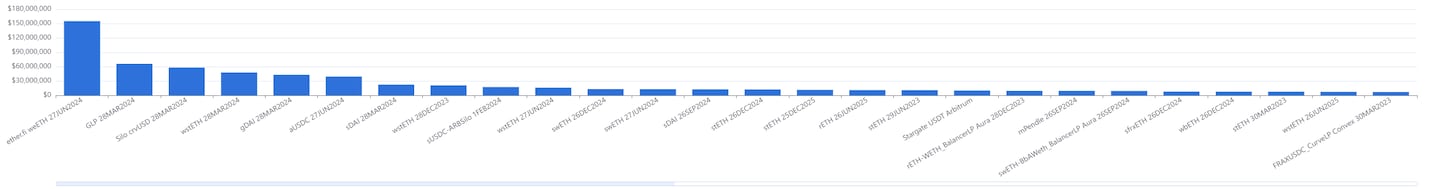

The eETH market is the most actively traded on Pendle, accounting for over $155 million in cumulative volume, over double the amount of the next highest traded product.

The increase in deposits has helped to boost revenue, as 3% of all yield accrued by yield tokens are distributed to Pendle stakers.

The protocol does not take a percentage of revenues for itself, instead, all revenues are passed on to stakers.

Around 30% of the total circulating supply of the PENDLE token is staked, and a total of $235,000 has been distributed to these stakers from the revenues generated.

Risks

But the strategy involves a lot of risks.

EigenLayer has not formally announced an airdrop, and the value of the points at the expiration date might not be sufficient to justify the costs associated with the strategy.

Smart contracts — lines of code — on which these protocols operate always have security risks too.

Even so, traders are speculating that this strategy may be worth it.

Ryan Celaj is DL News’ New York-based Data Correspondent. Reach out with tips at ryan@dlnews.com.