Dalvir Mandara and Bilal Hafeez are financial analysts who advise hedge funds at research firm Macro Hive.

After a torrid 2022, crypto markets have started 2023 with a bang. Yet key debates rage on, such as whether centralisation or decentralisation will drive future crypto adoption.

Decentralised finance stands at the vanguard of this argument, and proponents argue that without DeFi, the crypto dream will end. So, what is the current state of DeFi? And what should we track to determine its health? Using DefiLlama data, we identify three key trends.

DEXs vs CEXs

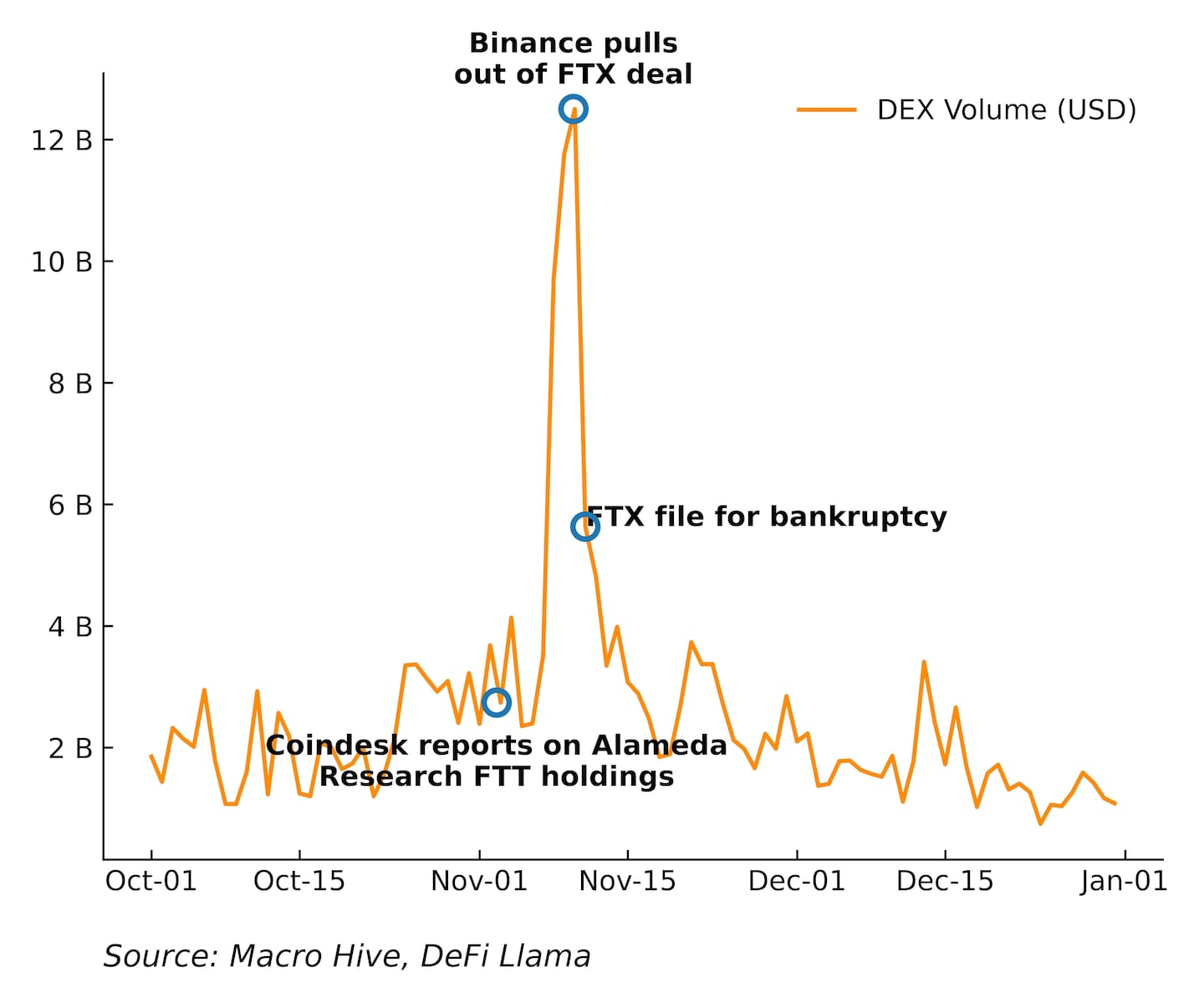

The collapse of the centralised exchange FTX was an important test for DeFi. Would investors switch to decentralised exchanges, dubbed DEX, or abandon crypto altogether? The answer was clear – DEX trading volumes surged as the FTX debacle unfolded in November 2022. Daily trading volume hit highs of $12.5 billion on 10 November, and total trading volume for November was around $114 billion compared with $66 billion for October.

Chart 1: DEX Trading Volume Spikes Around FTX Implosion

Much of these flows likely came from investors fleeing centralised exchanges. Many centralised exchanges saw record outflows during the same period – including Binance, the largest cryptocurrency exchange by trading volume. This may have led traders to seek out alternative trading platforms that are less prone to centralised failures, such as DEXs.

Additionally, risk management dynamics likely kicked in. There was increased need for liquidity as FTX halted withdrawals, which may have led traders to seek out liquidity elsewhere such as in DEXs. There was also increased on-chain trading activity due to increased volatility. During the Terra collapse earlier in 2022, DEX trading volumes also spiked. Finally, traders may have shifted trading activity to DEXs to reduce their exposure to a single centralised exchange.

The evolution of TVL

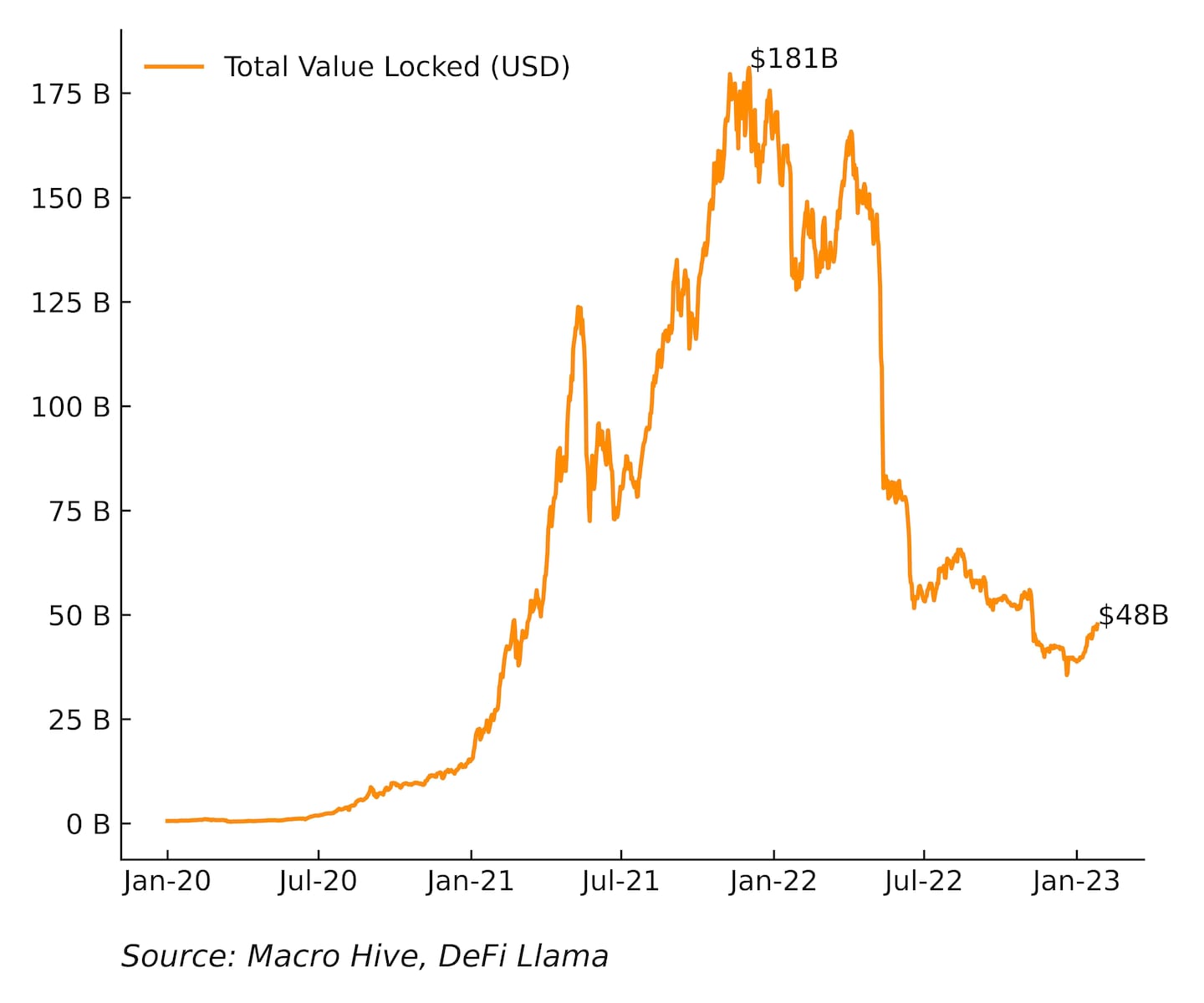

The second trend is the evolution of the total value locked, or TVL, in DeFi. TVL is the total amount of assets deposited into various protocols and platforms comprising the DeFi ecosystem. The assets include cryptocurrencies, stablecoins, and other digital assets used to participate in lending, borrowing, and trading activities on these platforms. It serves as a measure of the scale and liquidity of the DeFi ecosystem and is a key indicator of its growth and maturity.

In 2021, TVL hit an all-time high of $181 billion, according to DeFi Lama data (Chart2). The bull run in crypto – when Bitcoin and Ethereum reached record highs – helped. Last year saw a major reversal in TVL thanks to Fed rate hikes and the collapse of Terra (LUNA) and FTX. But 2023 has started well, with TVL increasing by 20% to reach $46 billion. It remains clearly below the previous highs but appears to be stabilising.

Chart 2: Total Value Locked (TVL) in DeFi

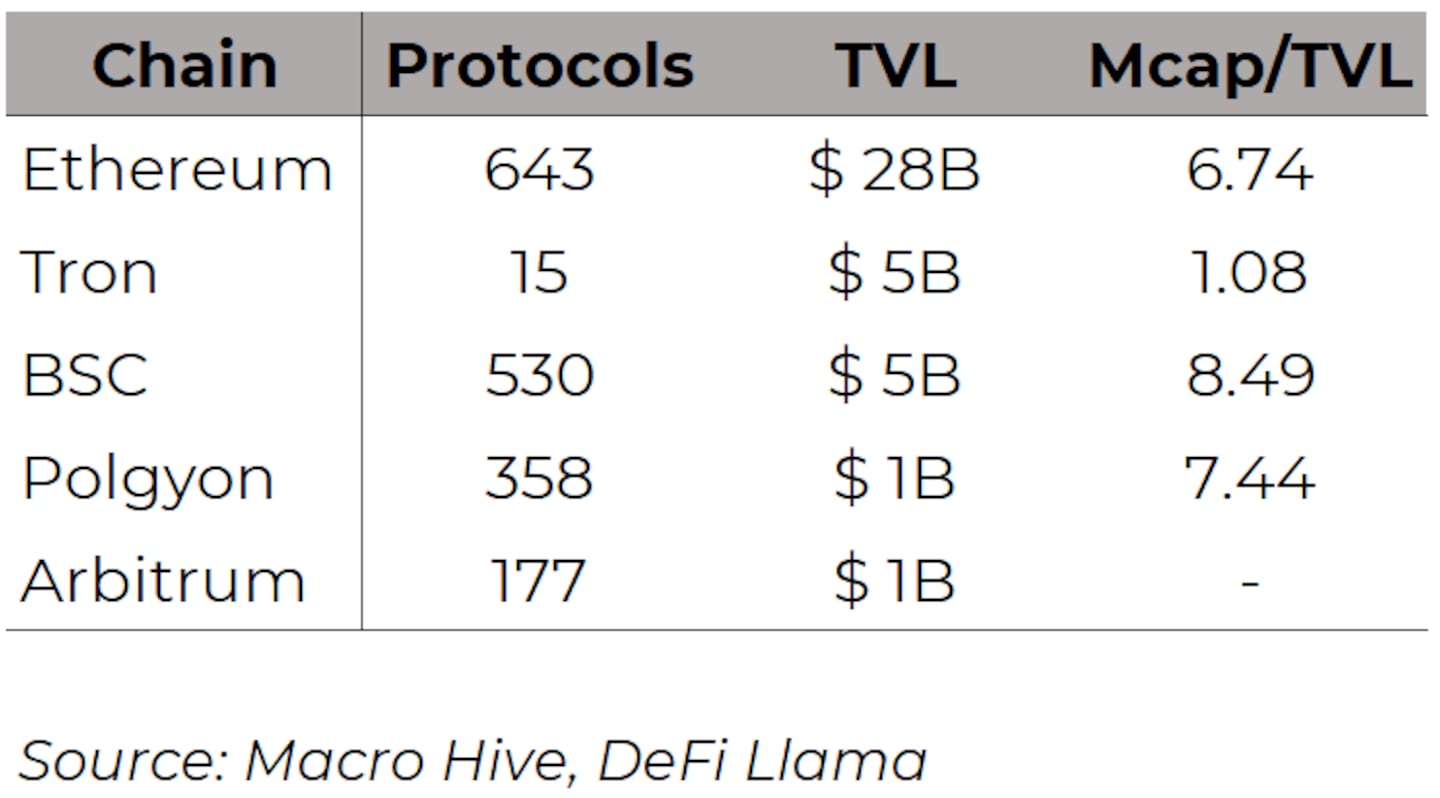

The chain attracting the most TVL remains Ethereum. It is the second-largest cryptocurrency by market cap, has a TVL of around $28 billion, and has over 640 DeFi protocols built on top of it, according to data from DeFi Llama (Table 1). Yet the number of protocols is not always linked to TVL. DeFi Llama data reveals that Tron has just 15 protocols and a TVL of around $5 billion, while the Binance Smart Chain, or BSC, has 530 protocols and the same TVL.

We can also determine the valuation of chains by calculating the ratio of market cap to TVL (market cap divided by TVL, Mcap/TVL; Table 1). This is akin to the price-to-book ratio for stocks. Note that Arbitrum does not yet have a native token, so this metric is not applicable to it. The latest Mcap/TVL values suggest that all chains in the top five by TVL are overvalued except Tron, which has an Mcap/TVL near 1 (i.e., fair value).

Table 1: Top 5 Chains By TVL

How will interest rates impact DeFi?

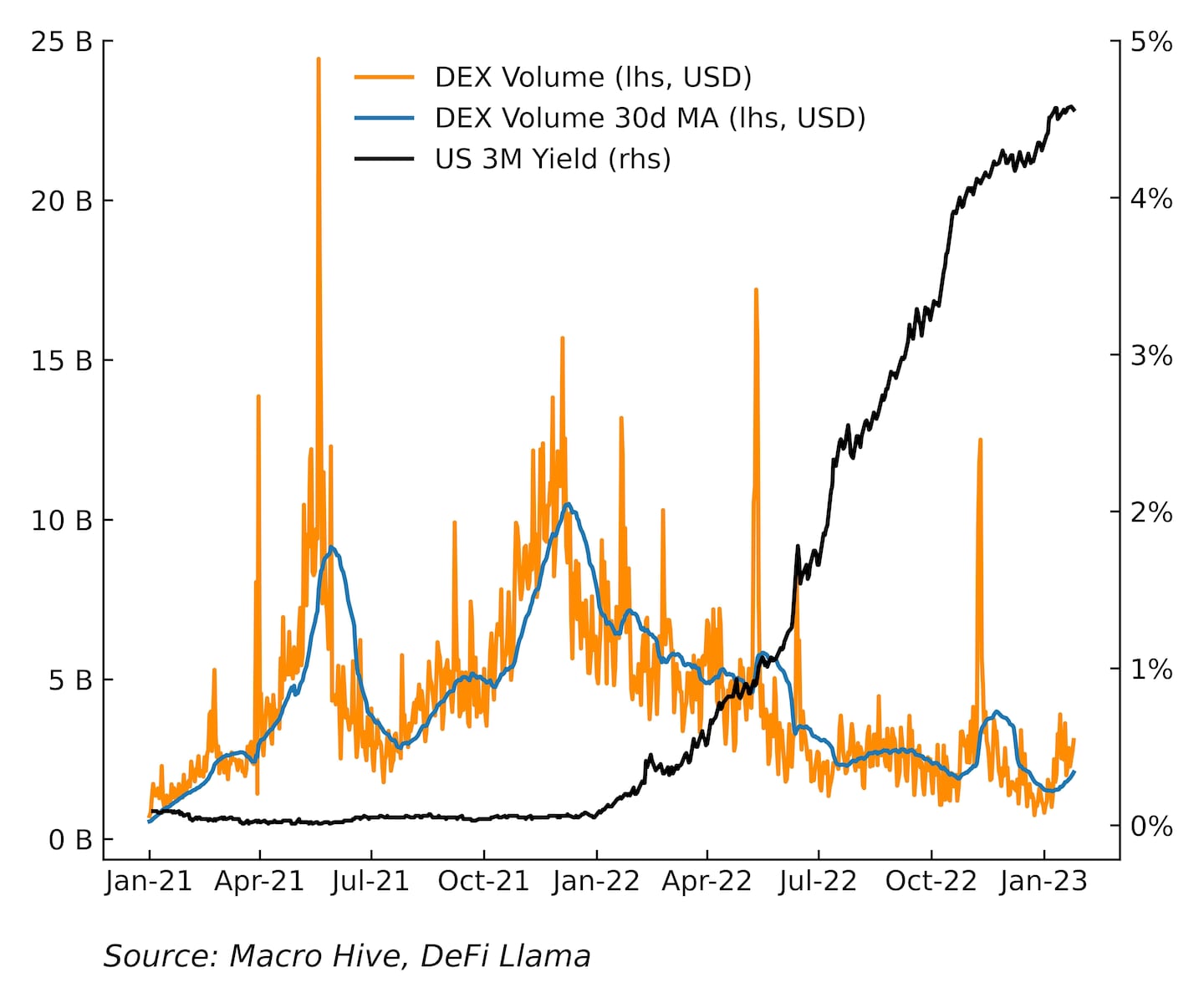

The third and most dominant trend to watch is how interest rates will impact DeFi. After all, DEX volumes plummeted in 2022 just as the Fed started to hike rates (Chart 3). There are several reasons why a high interest rate environment presents challenges for the DeFi ecosystem.

1. Demand for DeFi lending and borrowing falls. Higher TradFi interest rates make DeFi protocols for lending and borrowing less attractive for investors as they can secure higher yields through less risky investment vehicles (e.g., government bonds) that offer higher returns.

2. Liquidity starts to fall. As investors withdraw funds from DEXs to take advantage of higher returns in TradFi, the liquidity of DEXs decreases. This has a knock-on effect on trading volumes. The 30-day moving average of daily DEX trading volume is currently down 73% from the start of 2022.

3. Volatility increases. Rising interest rates increase uncertainty in the markets as investors speculate over the path of future rate hikes and their impact on the economy and financial markets. More uncertainty leads to more caution, and this may reduce DEX trading volumes.

Chart 3: DEX Volume Plummets as Federal Reserve Hikes Rates

Which trend matters most?

Two of these three trends are positive for DeFi: uncertainty around CEXs, and TVL in DeFi protocols. Uncertainty around CEXs should lead to more flows into DEXs. Meanwhile, TVL in DeFi protocols appears to be stabilising, though valuations on some look stretched. But the trend that could matter the most – further Fed rate hikes – remains a risk. Currently, markets expect the Fed to end its hiking cycle soon, then start to cut rates. That should support DeFi if it happens. If the Fed cannot tame inflation and must hike rates further, DeFi could face challenges again.