Early last year, more than $530 million was wiped from the Waves blockchain network, leaving investors devastated. How that much money was lost, who was involved, and whether it was outright theft, is the subject of debate and speculation. But Waves founder Aleksandr Ivanov has vowed to help them get their money back.

Now, DL News has unearthed information that raises questions about Ivanov’s own role in the debacle.

Interviews with 15 former Waves Labs staff and depositors, along with court documents, on-chain data, and Ivanov’s own tweets, cast light on a mystery that has long confounded the Waves community: What happened to the half-a-billion dollars worth of assets that were lost on Vires Finance, a lending protocol on the Waves blockchain?

Waves situation was a ‘farce’

“What astounds me most about the situation is that it all happened without any headlines, let alone anyone being held accountable,” said Bendt O, a Vires Finance user who claimed to DL News that he lost hundreds of thousands of dollars on the protocol.

Bendt O, who asked to use only an initial for his surname to protect his identity, said he believes the episode was a “farce” that rivals both the collapse of crypto exchange FTX and the crash in the tokens TerraUSD and LUNA last year.

Angry Vires Finance depositors have been scouring blockchain transaction data to get to the bottom of what happened to their assets. Some have placed the blame on Ivanov himself.

NOW READ: Traders brace for Bitcoin ‘fireworks’ as $4b in options set to expire

On-chain data analysed by DL News suggests that Ivanov may be behind the wallets that were involved in the extraction of the funds. Ivanov’s personal wallet sent and received millions of stablecoins to and from another wallet connected to the suspicious transactions, according to the data (Ivanov told onlookers about this personal wallet publicly in a Vires Finance governance proposal).

Ivanov has strongly denied he had any hand in engineering the transactions that led to losses on Vires.

“It’s all allegations and rumours with no proofs,” he told DL News over Telegram.

The Waves fiasco is an object lesson in the complexity and opaqueness of decentralised finance. A series of stablecoin transactions in 2022 are at the heart of the matter. It’s widely accepted, even by Ivanov, that they pumped the value of the Waves blockchain’s native token, WAVES, to a peak of almost $5.5 billion in market value a year ago.

‘What astounds me most about the situation is that it all happened without any headlines, let alone anyone being held accountable.’

— Bendt O

The surge was caused by the repeated borrowing and selling of funds from Vires Finance over a two-month period, which eventually left investors holding hundreds of millions of dollars in bad debt. The WAVES token has plunged some 95% since its record high last year.

Among those pointing a finger at Ivanov: Avraham Eisenberg, better known for the $116 million exploit targeting Solana DeFi protocol Mango Markets. He sued Ivanov in a US federal court last year, accusing him of running a “bait-and-switch scam,” and a “global Ponzi scheme.”

Ivanov has not yet filed a response to Eisenberg’s lawsuit but has repeatedly denied wrongdoing and dismissed Eisenberg and other critics as “trolls.”

Waves in the vanguard

As the crypto bull market picked up steam in early 2021, numerous projects challenged Ethereum for supremacy. There was Solana, Terra, and Avalanche, each offering an array of services and products such as token exchanges, lending platforms, and stablecoins.

In 2021, deposits, or total value locked, in DeFi protocols multiplied 11 times, to $166 billion, according to DefiLlama.

Ivanov wanted Waves in the vanguard. Similar to Do Kwon’s Terra, Ivanov constructed Waves as a DeFi ecosystem complete with an algorithmic stablecoin, USDN, and a lending protocol, Vires Finance. And the blockchain had its own native coin — WAVES.

Crazy profitable

That September, Ivanov touted the Waves ecosystem as “crazy profitable” and urged investors to “jump in before the imminent influx of thousands of new users.”

“Waves wants your liquidity, really thirsty for it,” Ivanov tweeted. “APY’s for stable coins are 30-70% now!”

Like so many lending ventures in DeFi, this was a high-risk, high-return proposition. Yet there were plenty of takers for the offer. By the end of the first quarter in 2022, investors had ploughed more than $1.2 billion worth of crypto into Vires Finance.

NOW READ: Fidelity may beat hiring goal for a 500-strong crypto unit in sign of finance land grab

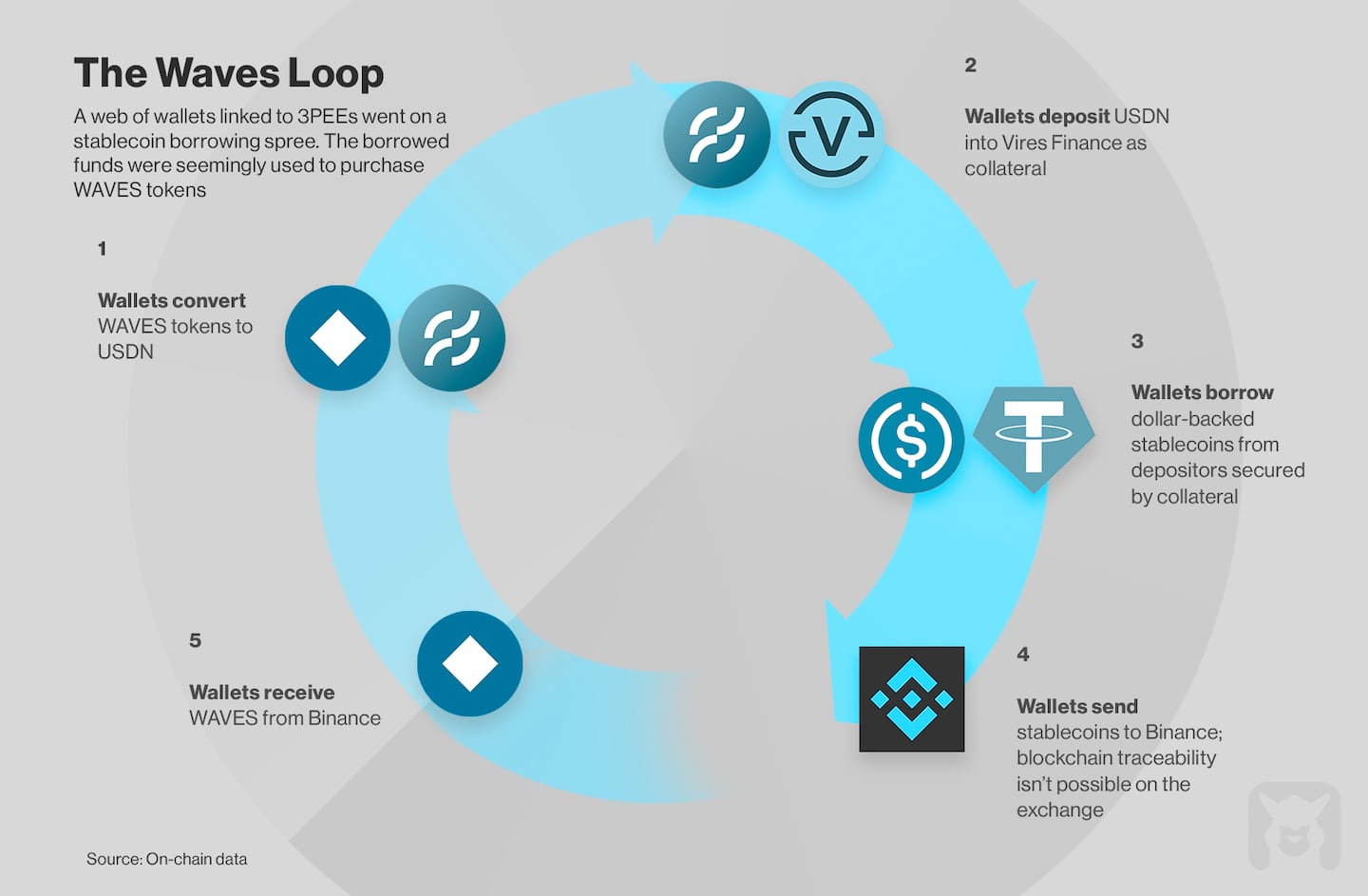

But as user deposits ballooned, a web of wallets started withdrawing those funds. These wallets put up USDN as collateral to borrow widely used stablecoins — user-deposited USDC, which is issued by Circle, and USDT, issued by Tether.

The catch was that USDN was an algorithmic stablecoin backed by Waves’ own token, and not the US dollar. By exchanging USDN for the dollar-backed Circle and Tether stablecoins, the wallets were swapping USDN for stronger assets.

Massive transfer

As a result, there was a massive transfer of value from depositors to this web of wallets over February and March 2022. This, in turn, caused the virtual failure of the Vires lending venture when the value of the USDN plummeted and left depositors saddled with over $530 million in bad debt.

In numerous Twitter threads and podcast appearances, Ivanov acknowledged the problem and the bad debt, but he lashed out at critics who suggested he had something to do with it.

“You stupid fuck lol,” he tweeted in reply to one of his challengers in July. “Having trolls like you is like having no trolls at all, all the stuff you post is 100% off the mark.”

‘A lot of manipulation’

Ivanov, who is believed to be living in Dubai, has long said Waves’ $530 million snafu was caused by unidentified players. In a July podcast, he said “somebody” tried to pump the price of WAVES and then others tried to short it. “There was a lot of manipulation but it wasn’t us actually,” he said.

“You think it’s us that pumped waves? If someone made profits, it was not us,” Ivanov told DL News over Telegram in March.

Ivanov declined to answer other questions for this article. “I provided the answers to most of those questions many times publicly,” Ivanov said, without elaborating. DL News could not establish where and when he made those public comments.

‘You think it’s us that pumped Waves? If someone made profits, it was not us.’

— Aleksandr Ivanov

A pseudonymous Twitter user called 0xHamz was among the first to publicly challenge Ivanov, first in a thread in April 2022, and then directly through Twitter Spaces, an online audio forum.

0xHamz claimed Ivanov and other Waves insiders used Vires Finance customer funds to pump the WAVES token price.

On March 31, 0xHamz posted a since-deleted Twitter thread where he accused Waves of being the “biggest Ponzi in crypto” and that Waves insiders had used USDC and USDT deposits on Vires Finance to orchestrate a “massive supply squeeze.”

Borrowed money

“It is being propped up by borrowed money,” 0xHamz said. “There is no organic activity. Just look at the transaction count over time.”

Ivanov called 0xHamz a “troll” and threatened legal action.

But 0xHamz’s accusations spurred a host of anonymous Twitter sleuths to dig further into whether Ivanov was manipulating Waves and Vires Finance.

A Twitter user who goes by the moniker YouAreMyYield said that he had connected Ivanov to a wallet that “siphoned” funds from Vires Finance. Additionally, he pieced together transactions that he believes point to Ivanov being behind wallets that worked together to drain Vires Finance funds. Ivanov denied YouAreMyYield’s allegations.

$5 million purchase

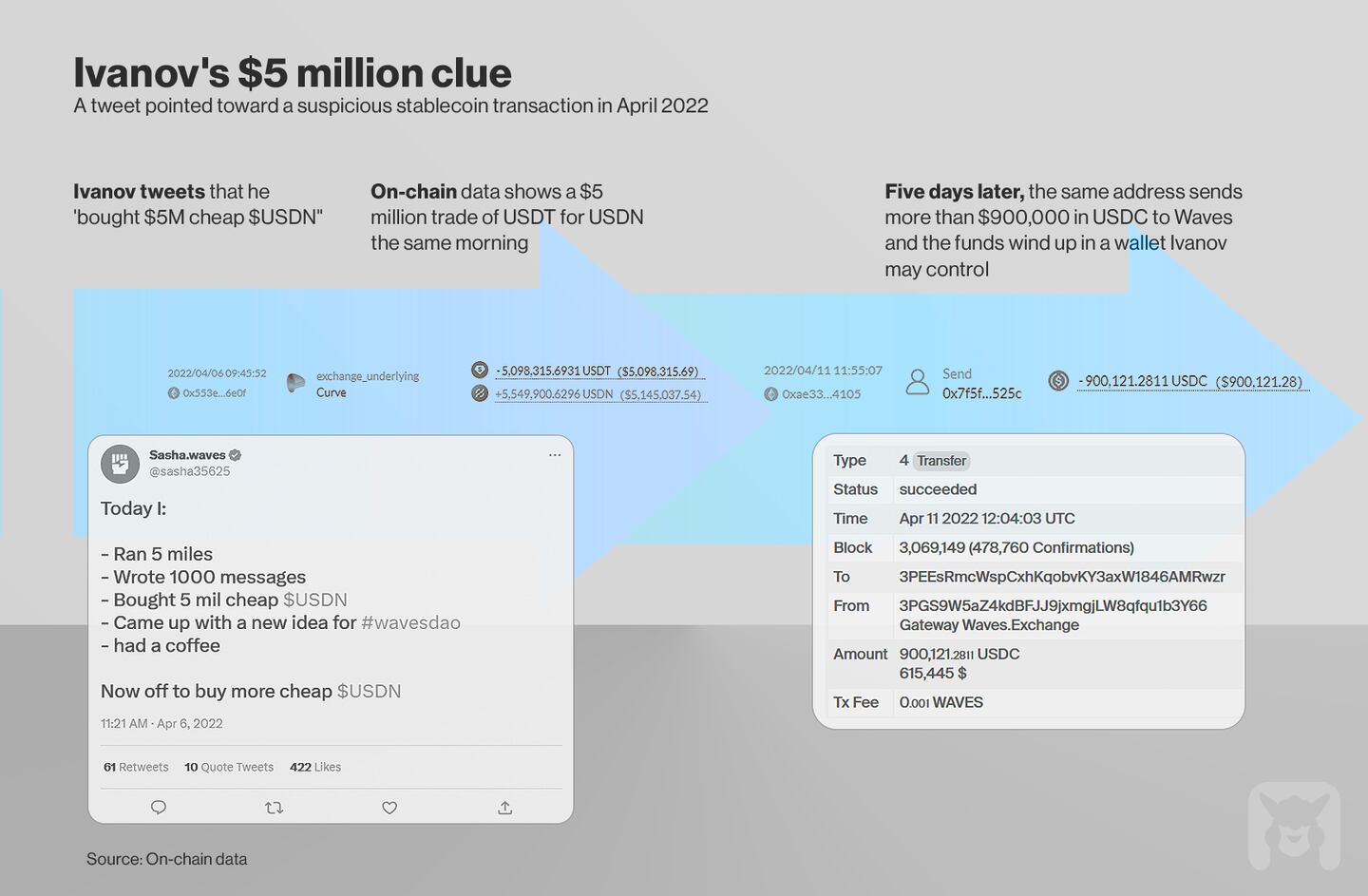

But it was Ivanov himself who provided a clue to developing a fuller picture of what happened on Vires Finance. On April 6, 2022, he tweeted that he had “bought 5 mil cheap $USDN.”

DL News found that virtually the only place to buy such a large quantity of USDN at the time was on Ethereum through the USDN pool on decentralised exchange Curve Finance. There is only one address that made a $5 million purchase of USDN on Curve between April 4 and April 7: an Ethereum wallet with a public key beginning 0x9c0.

Today I:

— Sasha.waves (@sasha35625) April 6, 2022

- Ran 5 miles

- Wrote 1000 messages

- Bought 5 mil cheap $USDN

- Came up with a new idea for #wavesdao

- had a coffee

Now off to buy more cheap $USDN

Then on April 11, the 0x9c0 address sent $900,121.2811 in USDC from Ethereum to Waves using a token bridge, according to on-chain data. Just over an hour later, that exact amount — $900,121.2811 — left the token bridge and entered a Waves wallet with a key combination beginning with 3PEEs.

No other transactions for this specific amount of USDC were sent through the bridge that day. The timing of Ivanov’s tweet about making a $5 million purchase of USDN and the transfers suggests that he may control the 0x9c0 and 3PEEs wallets.

3PEEs is one of several wallets that borrowed huge numbers of stablecoins from Vires Finance and left depositors holding $530 million of bad debt.

Because wallet owners are anonymous, it isn’t possible to verify who controlled them. Ivanov declined to tell DL News whether he owned the wallets.

Non-payment

A Ukrainian who moved to Russia when he was 17, Ivanov studied physics at Lomonosov Moscow State University before earning a masters degree in Leipzig, Germany. In 2013, Ivanov, who uses the nickname Sasha, launched a crypto exchange called Coinomat.com. The company was registered as Intelligence Unitrade Ltd in the British Virgin Islands in 2010, and was struck off five years later for “non-payment of annual fees,” according to official records.

The firm popped up in London a couple of years later with a new name — Elite Way Development, which was held by two shell companies registered in the Seychelles, records show. The company was removed from the UK Register at Companies House in 2019.

NOW READ: We compared the ‘unbridgeable chasm’ between Europe and US crypto laws

By 2016, Ivanov had started Waves, which aimed to be an alternative to Ethereum. Ivanov had also spun up a private enterprise blockchain called Vostok, and in 2019 raised $120 million from investors, bestowing the startup with a $1.2 billion valuation.

In July 2019, Ivanov sold the Vostok brand for an undisclosed sum to GHP Financial Group, a wealth management firm led by Mark Garber, a financier in the Russian investment community.

“The priority was and remains the international development of the Waves Platform to create the next generation of the internet with smart, decentralised services running on the blockchain,” Ivanov said in a statement at the time.

A lucrative loop

In a July podcast with London Real, Ivanov explained how a complex looping mechanism drained Vires investor’s funds. After swapping WAVES tokens for the algorithmic dollar-pegged USDN, wallets deposited the stablecoins into Vires Finance as collateral to support borrowing other stablecoins deposited by investors, such as USDC and USDT.

Next, 3PEEs and other wallets sent the stablecoins to Binance, an exchange where customers can buy and sell crypto and also off-ramp funds to bank accounts via fiat currencies.

Although sending the funds to a centralised exchange breaks the chain of traceability, on-chain records show large sums of WAVES moving from Binance to 3PEEs and several other connected wallets, suggesting the transactions were likely part of the same cycle. Some of those wallets were later identified by Ivanov himself in a Vires Finance governance proposal as participating in the scheme.

Then, it was rinse and repeat: The wallets that received WAVES from Binance executed the same process again and converted WAVES to USDN and used the tokens as collateral to borrow even more user deposits and sell them for WAVES.

Binance, which has not been accused of wrongdoing in the Waves transactions, declined to comment for this article. Binance’s lack of scrutiny toward client transactions is at the heart of a lawsuit that US regulators filed earlier this month.

A ‘Ponzi scheme’

The 3PEEs wallet is connected to at least four other wallets: 3P87z, 3PPuz, 3PJPB, and 3PNWj. They, too, engaged in this lucrative loop and sent each other funds primarily in February and March 2022, according to on-chain data. During this period, the repeated WAVES buying pushed the token’s price up sixfold and it hit a record $61.30 on March 31, 2022.

Using the stablecoin loop to pump the value of WAVES lay at the heart of the alleged scheme, the Eisenberg lawsuit says, alleging that by manipulating the tokenomics, Ivanov was able to make a killing in WAVES.

“Defendants had been running their business as a Ponzi scheme and using investors’ assets to buy up the underlying commodity so they could sell it all at an inflated price,” said Eisenberg’s lawsuit.

‘Defendants had been running their business as a Ponzi scheme and using investors’ assets to buy up the underlying commodity so they could sell it all at an inflated price.’

— Eisenberg lawsuit

According to on-chain data, wallets connected to the 3PEEs web of wallets sent more than 22.3 million WAVES tokens to Binance between April and November 2022 after the looping activity stopped. Going by the WAVES price at the time of each transaction, the tokens sent to Binance during this period were worth almost $223 million.

Ivanov declined to comment on the million of dollars worth of WAVES sent to Binance and on the apparent link he has to those wallets.

NOW READ: Meet the Montenegro prosecutor set to take the first crack at Do Kwon in court

But the most impactful result of the loop was the creation of bad debt. Every time the loop rotated, the borrowed portion of the assets in the 3PEEs wallets’ positions increased. With USDN far less stable than USDT and USDC, this created enormous pressure on investors. Every time USDN slipped its dollar peg, it threw the value of collateral and debt out of whack.

On April 5, for example, USDN briefly fell to 78 cents and left Vires’ USDC and USDT depositors holding millions in bad debt. USDN-backed lending positions became under-collateralised, and there was no mechanism forcing 3PEEs and other wallets to pay their debts.

Full responsibility

With their USDC and USDT deposits already transferred away to Binance, there was nothing Vires depositors could do to retrieve their assets.

Depositors were outraged. Ivanov said he would “assume full responsibility” by creating a community proposal to move the debt and remaining collateral of 3PEEs and five other wallets to his own wallet, beginning 3P84e.

“EAT THE RICH whales are slaughtered,” Ivanov tweeted after the vote passed on May 31.

On-chain records suggest there were no whales — Ivanov was taking control of what many investors suspected were his own wallets to harvest goodwill from the shaken Waves community.

‘I offer you a challenge. Please trace what I cashed out. If you find any USDT USDC BTC, cash in banks etc., you’re welcome to have it.’

— Aleksandr Ivanov

Ivanov’s own wallet, 3P84e, is also linked to the web of wallets used to pump the WAVES price. On-chain data shows it sent and received millions of USDC, USDT, and USDN stablecoins to and from a 3PEEs-linked wallet, called 3P87z, central to the looping scheme. Ivanov declined to comment on the link.

Over the next few months the situation was frozen. Vires depositors could not access their funds and those with balances under $250,000 were eventually forced to convert the USDC and USDT owed to them into USDN.

Eventually, USDN depegged from the dollar, shattering Vires depositors’ hopes of recovering their funds. In November 2022, USDN started to fall in value, and by the end of the year, it had sunk to 41 cents.

‘Complete and utter crap’

Following USDN’s de-peg, Korea’s Digital Asset eXchange Association issued an investment warning against the WAVES token, citing a “risk of unexpected investors’ loss due to WAVES value volatility.”

Suspicions mounted that Ivanov had used depositors’ USDT and USDC to inflate the value of WAVES and cash out via Binance. On December 8, YouAreMyYield confronted him on Twitter about the wallets “that I think belong to you.”

“Complete and utter crap,” Ivanov responded. “I offer you a challenge. Please trace what I cashed out. If you find any USDT USDC BTC, cash in banks etc., you’re welcome to have it.”

A history of accusations

Throughout the episode, Ivanov has repeatedly denied that he controlled the wallets involved in the Vires Finance looping scheme. Last spring, Ivanov posted an 11-part tweet thread offering his own theory as to who was behind the WAVES token manipulation: Alameda Research.

Ivanov accused Alameda, founded by FTX’s Sam Bankman-Fried, of taking a short position in WAVES and spreading “FUD” — or fear, uncertainty and doubt — to hurt the price.

Alameda hit back at the claims, while Bankman-Fried called Ivanov’s accusations a “bullshit conspiracy theory.”

Eisenberg sues

In July, Eisenberg slapped Ivanov and Numeris, the company behind Vires Finance, with a lawsuit in Puerto Rico, seeking the return of around $12 million, plus interest and punitive damages.

Echoing the arguments of 0xHamz and the army of Twitter sleuths, Eisenberg claimed Waves lured deposits to Vires Finance, only to later change the rules that governed the protocol.

Eisenberg is pursuing his suit even as he is detained in New York pending a federal trial for “orchestrating an attack” on Solana DeFi protocol Mango Markets. Eisenberg denies any wrongdoing.

Just days before he was arrested in Puerto Rico in December, Eisenberg accused Ivanov of “straight theft” in a Twitter exchange.

“So you have no intention to file a response with the court?” Eisenberg asked.

“Explain what you mean, for starters, ‘Stole’ and such,” Ivanov replied. “I am a very public person, let’s meet, bring your lawyers. I’ll come alone :)”