- A KPMG report says Bitcoin is a net positive for ESG goals.

- The report argues that Bitcoin mining can help subsidise the cost of renewable energy.

- KPMG's Canadian arm previously invested in Bitcoin and Ethereum in 2022.

- The report found that Bitcoin uses about the same amount of electricity as tumble dryers globally.

Major accounting firm KPMG has released a report highlighting several ways Bitcoin has a positive impact on environmental, social, and governance criteria.

Often shortened to ESG, these criteria are commonly used by socially conscious investors to judge a company’s ethical and sustainable practices.

The report, co-authored by KPMG principal of technology risk Brian Consolvo and director of ESG Kirk Caron, refutes notions that Bitcoin has a mostly negative environmental and societal impact because of its high energy use and popularity among cybercriminals.

Bitcoin is ‘widely misunderstood’

“Despite Bitcoin’s increased adoption, it continues to often be a misunderstood technology and asset class,” the report said.

“This is a phenomenal endorsement,” Daniel Batten, an ESG analyst and co-founder of CH4 Capital, a fund that specialises in methane mitigation technologies, told DL News. “KPMG has done an outstanding job researching the nuances, because these conclusions, while true, are not obvious at first glance.”

According to report co-authors Consolvo and Caron, Bitcoin mining — the process of using powerful computers to solve the complex equations needed to validate transactions on the network — can help incentivise clean energy production, bolster financial inclusion, and even reduce greenhouse gas emissions from industrial activities.

Still, there’s no denying that Bitcoin uses a lot of energy.

A common comparison is that the top crypto asset uses as much energy as a medium-sized country such as Norway annually, per data from the Cambridge Centre for Alternative Finance.

A different perspective

But Consolvo and Caron see the energy use from a different perspective. Using the same data, they highlight that Bitcoin uses about the same amount of electricity as tumble dryers globally.

“Bitcoin miners can be a useful ally in the transition to more renewable energy sources and reduce emissions, despite its significant energy consumption,” the report said.

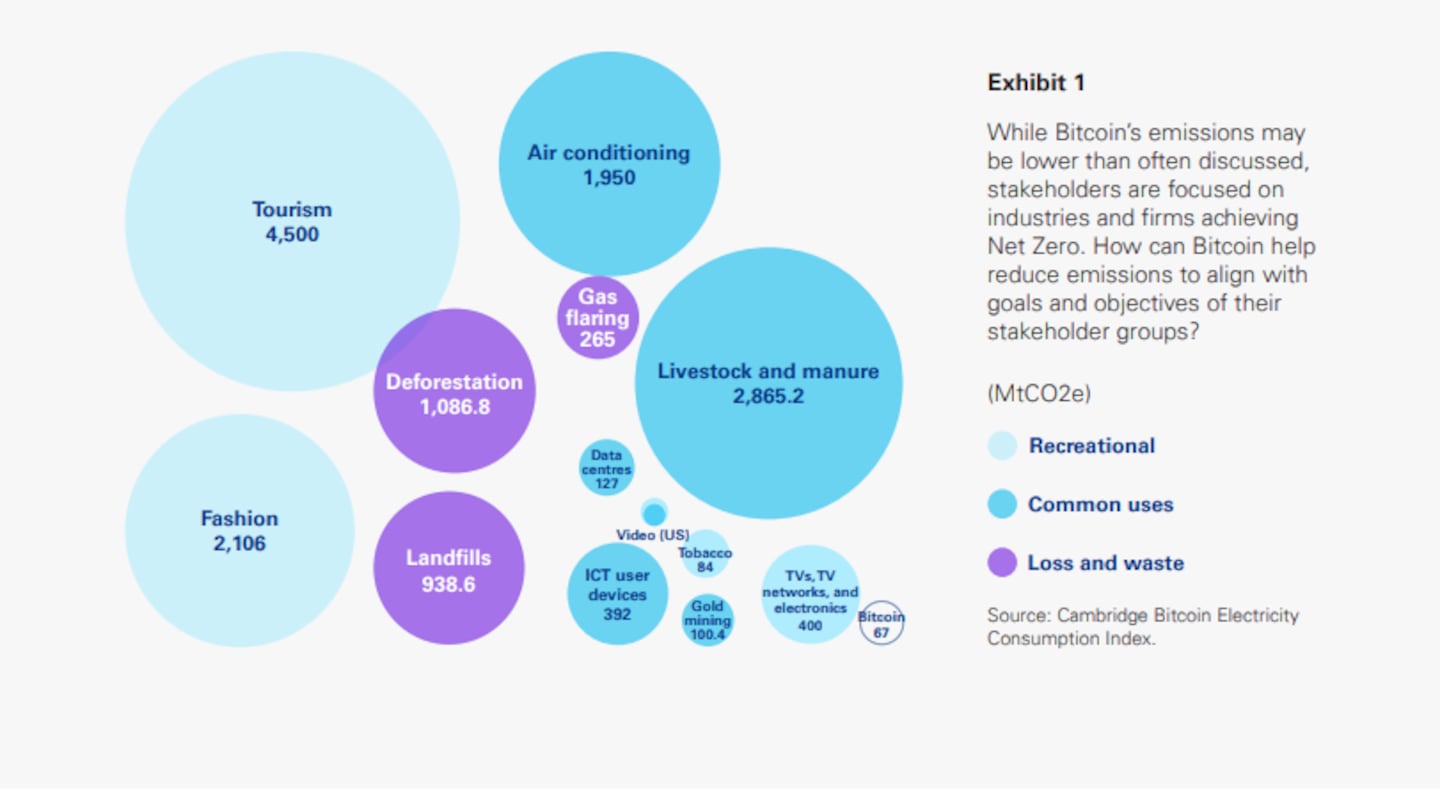

They also say those criticising Bitcoin’s energy use do so under the assumption that all industries should attempt to achieve net zero emissions.

Instead, the report states, “it’s helpful to compare the emissions associated with Bitcoin’s operations with the emissions of a wide range of industries and services.”

The KPMG report focuses on four key areas in which Bitcoin mining can support environmental goals. It argues that mining can help subsidise the cost of renewable energy, balance electricity grids through demand response, heat buildings through recycled heat from mining rigs, and incentivise methane reduction.

Methane in particular is one of the biggest contributors to climate change, and according to the US Environmental Protection Agency, is 25 times more potent as a greenhouse gas than carbon dioxide. It is emitted from many sources, such as coal mining, oil drilling and landfills.

Overstated societal impacts

Flaring — or burning — the gas breaks it down into carbon dioxide and water, and of course, releases energy. The report argues that using this energy to mine Bitcoin incentivises methane flaring and enables various industries to reduce the environmental impact of their operations.

As for social impacts, the report notes the negative impact of Bitcoin’s use in financial crime is overstated, citing a 2022 Chainalysis report which concluded the illegal use of crypto accounted for only 0.24% of all transaction volume in 2022.

Yet the report argues Bitcoin provides many benefits to society, particularly in low-income countries.

It enables low-cost cross-border payments — important for immigrants from developing countries such as Honduras, Haiti, and El Salvador who work abroad and regularly send money back to relatives in their home countries.

In Africa, Bitcoin mining is also helping subsidise electricity grids, helping bring power to millions and reducing costs for consumers.

For governance, the report lauds Bitcoin as a truly decentralised network that removes the need for trusted intermediaries.

KPMG’s investment in Bitcoin

Because Bitcoin is decentralised, no one single entity can exert control over it, making it highly resistant to attack and providing a high degree of confidence in the overall system.

NOW READ: Circle can’t shake SVB hangover as market cap dwindles to two-year low

The report argues that these attributes, coupled with the fact that Bitcoin’s governance and rules are hard coded, results in a system that cannot be abused or misused by those in power or even individuals with ulterior motives.

The Bitcoin-friendly report follows KPMG’s investment in Bitcoin, and the second-biggest cryptocurrency Ethereum, from its Canadian arm in 2022.

At the time, KPMG Canada managing partner Benjie Thomas said the investment reflected the firm’s belief that “institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix.”