- Grayscale converting its flagship fund to a spot Bitcoin ETF could open up billions of dollars in redemptions.

- FTX and Genesis creditors are eager to get paid, and with a combined $1.1 billion locked in GBTC, it might be key to easing demands.

Crypto investors battered by a brutal year for the industry have pinned their hopes on spot Bitcoin exchange-traded funds.

BlackRock is gunning for one, as are Fidelity and Ark Invest.

Grayscale’s recent win over the US Securities and Exchange Commission in court led experts and analysts to say a Bitcoin ETF is closer than ever.

Yet while the giants await an SEC nod, bankruptcies and delinquent loans pose an existential threat to crypto’s biggest fund — the Grayscale Bitcoin Trust.

GBTC has around $16 billion in assets under management and some investors are demanding their money back.

Outflows and unwinds could see funds move away from this behemoth, negating the positive news of a spot Bitcoin ETF being approved in the short-run.

If GBTC experienced redemptions of up to 20% of its assets under management following approval, then north of $1.5 billion worth of Bitcoin would hit the market — or be reallocated to other asset managers like Cathie Wood’s Ark Invest.

Wood’s fund has invested more than $100 million in GBTC shares as well as another $88 million through its Ark Next Generation ETF.

Potential payday for creditors

Grayscale’s proposal to convert its GBTC trust into a spot ETF would pose a substantial benefit to creditors of high-profile bankruptcies like FTX and Genesis.

Many GBTC investors appear desperate to cash in on their shares. Between FTX creditors and Digital Currency Group, Grayscale’s parent company, there are about $1.1 billion worth of shares that could be used to pay creditors and delinquent loans.

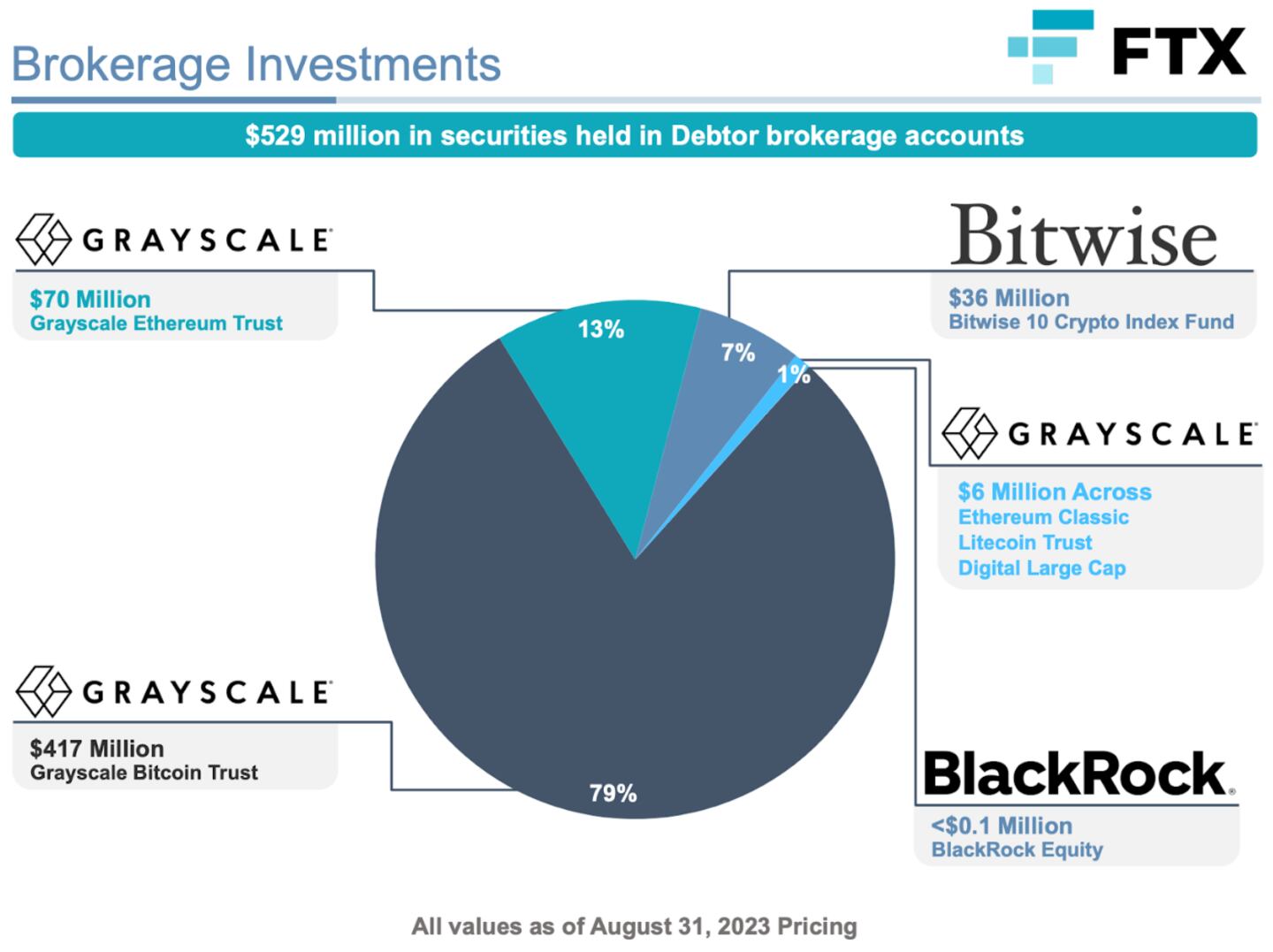

The FTX creditors committee brought a lawsuit against the asset manager in an effort to claw back its funds locked in the trust. FTX’s investment totaled $417 million as of Aug. 31, according to court filings.

DCG has almost $700 million tied up in GBTC shares. Last week, DCG was sued by its subsidiary, Genesis, over $620 million in unpaid loans.

While DCG is in the process of offloading its media arm, CoinDesk, the sale appears to be valued at a little more than $100 million, meaning the GBTC shares it holds still offer the best opportunity for creditors looking to get paid.

Tender offer

Hedge fund Fir Tree Capital dropped part of its case in July, but not its fears over redemptions. Its proposal could benefit DCG as well.

“Grayscale has repeatedly rejected Fir Tree’s suggestion that it permit redemptions of outstanding GBTC shares so that shareholders may recover some portion of their investment,” the firm said, adding this would be the “easiest solution for shareholders to recoup the billions in value in GBTC that DCG and its affiliates have managed to wipe out.”

Fir Tree suggested Grayscale conduct a tender offer to “unlock value for investors.”

The hedge fund said its proposal would provide a mechanism for Grayscale to address investor concerns and potentially reduce the discrepancy between the market price of GBTC shares and their net asset value.

Shares in GBTC trade at a discount to the value of the underlying Bitcoin it holds, since the fund cannot create or destroy shares, and there is a lack of demand for shares on the secondary market, where they trade at about $19 versus $23 on the primary market.

Tender offers can be a way for investment trusts like GBTC to manage their share prices and provide liquidity to shareholders who want to exit their positions.

Fir Tree said its proposed tender offer schedule could result in $3.6 billion in immediate value for GBTC shareholders who participate and $230 million in immediate value for DCG — which it said could be used to help repay its obligations to Genesis.

Approval of an ETF could negate the need for such a tender offer and could open up even more value for GBTC investors with debts to pay. The hedge fund appears bullish on approval, taking recent trade activity into account.

Fir Tree bet $60 million on Grayscale in the fourth quarter of 2022, buying GBTC and betting the discount to net asset value would narrow. The hedge fund booked a 40% profit on the trade, sources told Bloomberg. This suggests the firm sees significant upside for Grayscale’s fund to convert to a spot product, which would allow it to properly exit its position.