- A judge ruled that Ripple’s sale of XRP tokens did not constitute an investment contract.

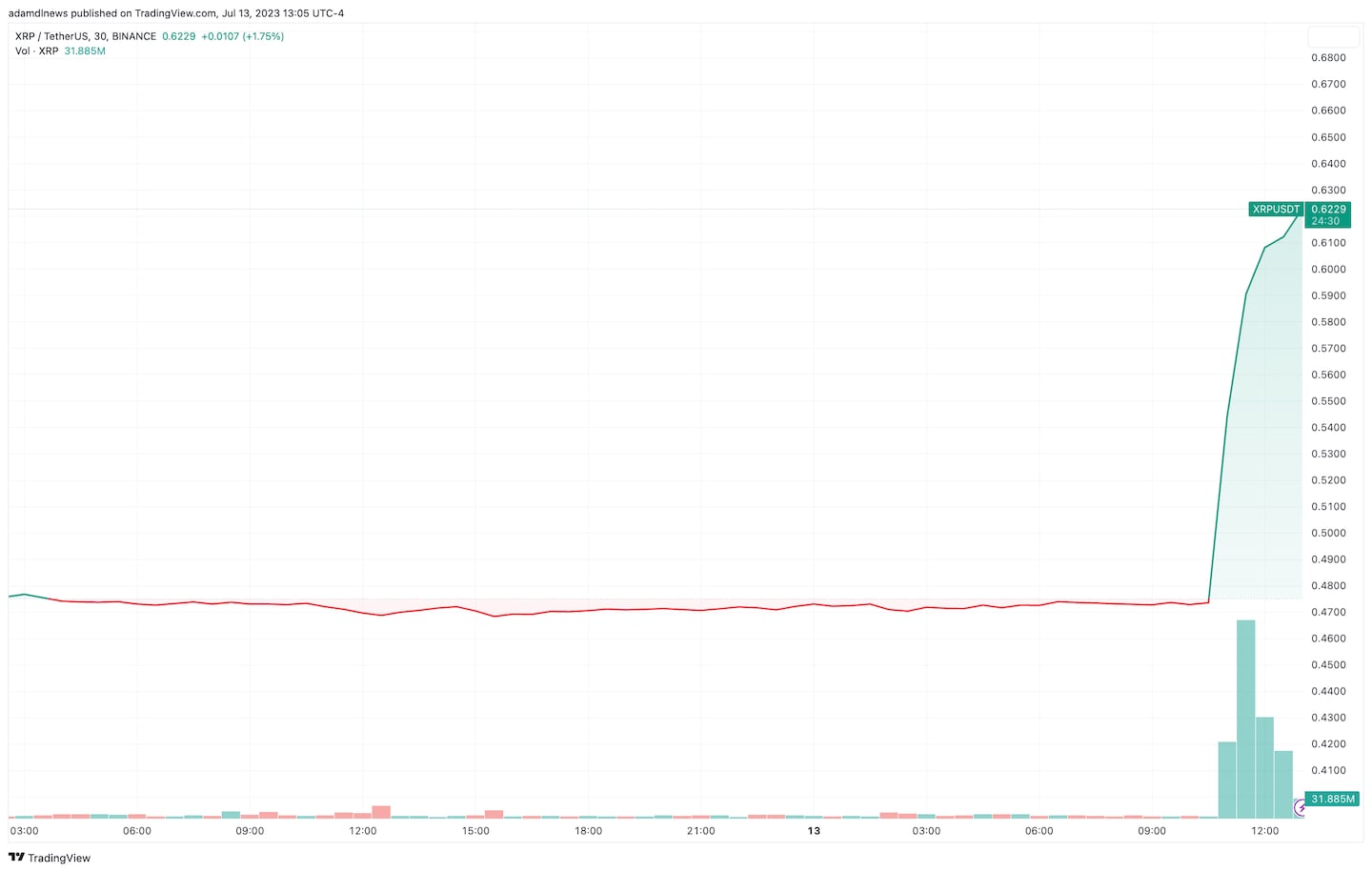

- The token price soared following the news, up around 30%.

- Investors saw the judge’s ruling as a sign that crypto may not fall under traditional financial regulations.

Nearly three years from the onset there’s an answer in the Securities and Exchange Commission’s case against Ripple.

The judge’s summary judgement said that Ripple’s sales of XRP do not constitute investment contracts.

Joshua de Vos, research lead at digital asset research firm CCData, told DL News the ruling is a “huge milestone for the industry, given that it may provide a strong precedent for other tokens to be deemed non-securities.”

Ripple’s token, XRP, soared as much as 30% as investors saw the judge’s ruling as a sign that crypto may not fall under traditional regulations like those that rule trading in stocks and bonds.

Regulatory oversight of traditional finance is seen by crypto investors as overly onerous.

NOW READ: Coinbase ‘welcomes’ legal battle with SEC amid signs of widening crypto crackdown

Stephen Palley, a partner at Brown Rudnick’s Digital Commerce group, welcomed the news on Twitter.

“Definitely more of a win than I was expecting for the defendants, and maybe trending helpfully in the direction that secondary sales are not securities transactions.”

The ruling wasn’t an all-out win for Ripple, and a trial will follow.

For example, institutional sales were securities transactions, while programmatic sales and distributions to employees were not, Palley said.

That may eventually affect banks’ sales of crypto products, including derivatives. The court “punts” on whether secondary market sales are securities transactions, he added.

NOW READ: Elizabeth Warren’s anti-crypto crusade may bolster Wall Street’s land grab in Bitcoin market

“We said in December 2020 that we were on the right side of the law, and will be on the right side of history.,” Brad Garlinghouse, Ripple CEO, tweeted after the ruling.

“Thankful to everyone who helped us get to today’s decision – one that is for all crypto innovation in the US. More to come.”

Ripple’s XRP jumped around 30% to around $0.60 shortly after noon New York time, according to CoinGecko data.

A trial date and pre-trial deadlines will follow in due course, the court said.

To share tips or information about Ripple or another story, please contact me at adam@dlnews.com.