- Marc Cohodes told DL News earlier this year that he saw trouble in Signature Bank and Binance.

- The veteran short seller and investor explains why he is turning his sights onto Tether, the stablecoin issuer.

Marc Cohodes is on a roll.

The opinionated and colourful California short seller told DL News earlier this year that he saw trouble in Signature Bank and Binance, claiming the companies were analogous to issues he had seen at now-defunct bank Silvergate.

His predictions appear prescient.

NOW READ: Silvergate short seller says he’s betting against Signature: ‘Binance is next’

Signature collapsed days after his comments, on March 12, while the US Securities and Exchange Commission sued Binance this month as its banking partners flee.

Now Cohodes, a bearish investor and part-time chicken farmer, says he spots another company that may follow the same path: Tether, the top stablecoin issuer.

‘Last one standing’

“The last one standing is Tether,” Cohodes said by phone from Cotati, about 45 miles outside of San Francisco. “Tether can’t audit anything, can’t prove anything, can’t verify anything. So it’s the same deal.”

Tether is no stranger to doubters — sceptics have wondered whether it has the dollar reserves to back its so-called stablecoins, which are pegged to the US currency. Hindenburg Research, an activist short selling firm, as far back as 2021 questioned the opaque nature of its disclosures. It’s unclear who Tether banks with. The New York Times has called it “the coin that could wreck crypto.”

‘Tether can’t audit anything, can’t prove anything, can’t verify anything.’

— Marc Cohodes

“There is progression,” said Cohodes, who linked the fall of exchange FTX last year with the on and off-ramps of the crypto-friendly banks. He also linked those issues to Binance.

Tether claims its stablecoin is backed one-to-one by the company’s reserves — for every Tether stablecoin there is a dollar, or cash equivalent, held by Tether.

A Tether spokesman told DL News: “Our quarterly reports are available on our website, and there’s full transparency into the number of Tethers in circulation and in our reserves.” He added that he doesn’t “believe it is productive to amplify the opinions of short sellers who make profit by shorting assets.”

Tether at the time called Hindenburg’s criticism “a pathetic bid for attention.”

But why is Cohodes so bearish on Tether?

“Because they sit on top. And they’re unaudited” and haven’t backed up their claims, Cohodes said. “It’s just a matter of going up the chain.”

The SEC alleges that Binance allows clients to sidestep anti-money laundering controls while mishandling customer funds. A separate SEC filing earlier this month revealed that CEO Changpeng Zhao, known as CZ, controlled various companies that had accounts with Silvergate and Signature Bank.

Tether also used Signature, Bloomberg reported in April.

Links between them

Cohodes pointed to those links, explaining why he was sceptical of those crypto-friendly banks and is now voicing concerns about the exchanges and platforms that they worked with.

“Banks used by Tether always had access to several banking channels and counterparties,” Tether told Bloomberg at the time, adding that its risk controls before Signature’s collapse ensured “our entities wouldn’t be affected” by exposure to Signature.

Binance did not respond to a request for comment, but has responded to the SEC on its website: “While we take the SEC’s allegations seriously, they should not be the subject of an SEC enforcement action, let alone on an emergency basis. We intend to defend our platform vigorously.”

The company called the SEC unjustified and its lawsuit part of an “ideological campaign” against the US crypto industry.

‘Connecting the dots’

”I’m just connecting the dots. Binance was a customer of Silvergate, Binance was a customer of SBNY,” Cohodes said, using the stock ticker for Signature. “These guys are all doing the same thing. You start at FTX and you work your way up. Now, you can say clearly: Tether is next.”

A crackdown in the US crypto industry has helped stablecoins, especially Tether’s USDT, as spooked investors yank their funds from more volatile tokens and pile into the relative stability it offers.

NOW READ: Uniswap taps Wormhole for bridge deal in win for Jump Trading and defeat for a16z

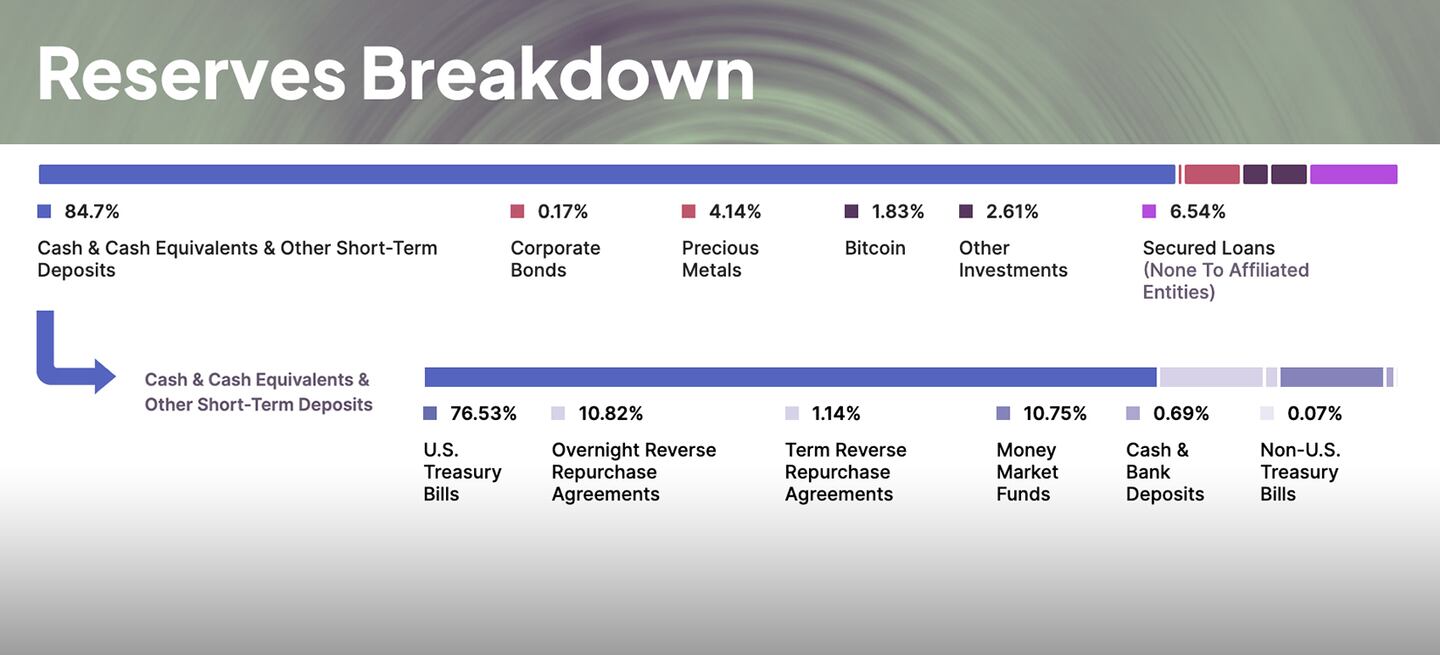

In a bid for transparency, Tether released a quarterly so-called attestation report. Tether says on its website that it has yet to fail to redeem its stablecoin for dollars.

But despite being carried out by an audit firm, an attestation is quite different from an audit, which involves uncovering data, risks, or compliance issues.

They are “useless” as a form of due diligence, John Reed Stark, the former head of the SEC’s Internet Enforcement Office, tweeted in May about it. He said attestations only “evaluate whether the data being examined by the ‘attestator’ is accurate at that precise moment in time.”

NOW READ: Short seller Jim Chanos says Coinbase ‘will still lose money’ even as crypto prices soar

Trillions have been laundered through this overall system, Cohodes said.

“And it’s now coming out. It has nothing to do with crypto,” he said. “It has everything to do with money laundering and theft of people’s money. You can buy crypto and you can do whatever you want with crypto. Be wary of the exchanges and be wary of what goes on, because these guys are enabling money laundering and criminal entities.”

”People aren’t interested,” in fraud in crypto, he said, referring to general investors in the broader financial industry, “because you can’t make money,” from bearish bets. “But I think the entire ecosystem” is open to criminality, he said.

‘Just doing the world a service’

”I do not have money on any of these exchanges. You can lose all your money,” he said. “The main point of this is that what I’ve said is true. And what I’ve said has happened.”

Unlike Silvergate and Signature, Binance and Tether are privately run, with no shares to short.

However, investors have bet via derivatives on the quality of Tether’s reserves. As far back as March of last year, hedge fund Fir Tree Capital Management said it is betting against Tether, citing at the time the coin’s $24 billion in high-yield commercial paper, which it said it believes is tied to Chinese real estate developers.

Tether started removing commercial paper from reserves early last year, then said it completely removed almost all commercial paper in September.

It has opted instead to increase its exposure to US Treasuries — and more recently it revealed plans to divert profits into Bitcoin. Bitcoin, which has fallen this week, is up about 45% this year.

Tether may be on the verge of disclosing financial reports in response to a freedom of information request in New York by CoinDesk, the company tweeted on Thursday.

Despite Tether’s criticism of short sellers, Cohodes said he is not short Tether: “I’m just doing the world a service.”

This story has been updated on June 16 to include Tether’s response to DL News.