XRP swung wildly on Monday after a filing suggested that BlackRock, the world’s largest asset management firm, was seeking government approval for an XRP exchange-traded fund.

But a spokesperson for BlackRock told DL News the information was “false.”

The token, which was trading at $0.65 Monday afternoon, jumped 12% on the news, before falling back to $0.65. XRP is the fifth-largest cryptocurrency by market capitalisation.

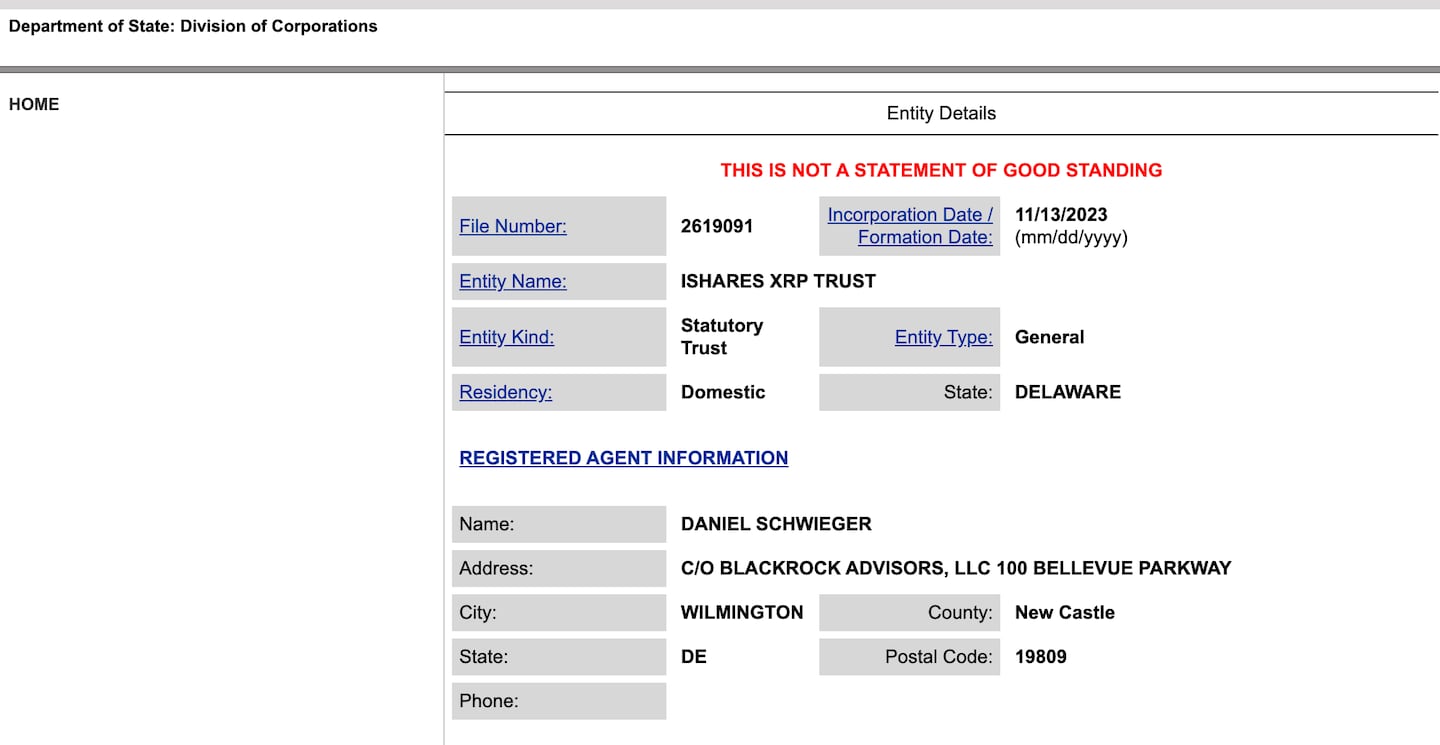

Crypto news outlet The Block had initially reported on the filing, which appeared on the Delaware Department of State, Division of Corporations website.

Listed on the filing was BlackRock employee Daniel Schwieger, who appeared on the company’s filing for an iShares Ethereum Trust just a couple days earlier.

BlackRock did not immediately return a request for comment about how the filing ended up on the Department’s website in the first place.

The Block later wrote on X, formerly Twitter, that the filing was fake.

*DELAWARE FILING FOR ISHARES XRP TRUST ENTITY IS FAKE - THE BLOCK PRO

— The Block Pro Headlines (@theblockupdates) November 13, 2023

It was the latest wild swing in crypto markets set off by inaccurate news about an impending ETF.

Last month, markets jumped on a tweet from crypto website CoinTelegraph that said: “BREAKING: SEC APPROVES ISHARES BITCOIN SPOT ETF.”

A company post-mortem would later reveal that a CoinTelegraph reporter had relied on an unverified screenshot found on X.

Euphoria surrounding a flurry of crypto ETF applications has sent token prices soaring. ETF approval would make the digital assets far more accessible to investors of all stripes in the US.

There are now at least 12 pending applications for a Bitcoin spot ETF, and Bloomberg analyst James Seyffart estimates that there’s a 90% chance the SEC approves one by Jan. 10, 2024.

Last week, BlackRock filed for approval of an Ether ETF, and Ethereum saw its largest inflows since August 2022, “with the last two weeks signifying a real turnaround in sentiment,” CoinShares said in a report.

At some $44 billion, total assets under management in crypto is now the highest since a raft of fund collapses in May 2022, the firm said.

UPDATE: Added additional information on the false Delaware filing and background on crypto ETFs.

CORRECTION: An earlier version of this story said the iShares XRP Trust filing had been removed from the Division of Corporations website. It is still there. An earlier version also used the past tense to imply that the fake filing suggested that BlackRock had sought approval, when the filing suggested the firm would seek approval in the future.