- Teng broke a long silence on the situation in Nigeria in a blog post Tuesday.

- He provided details on what went wrong for compliance manager Tigran Gambaryan.

- Nigerian officials are pursuing a wide-ranging investigation of crypto.

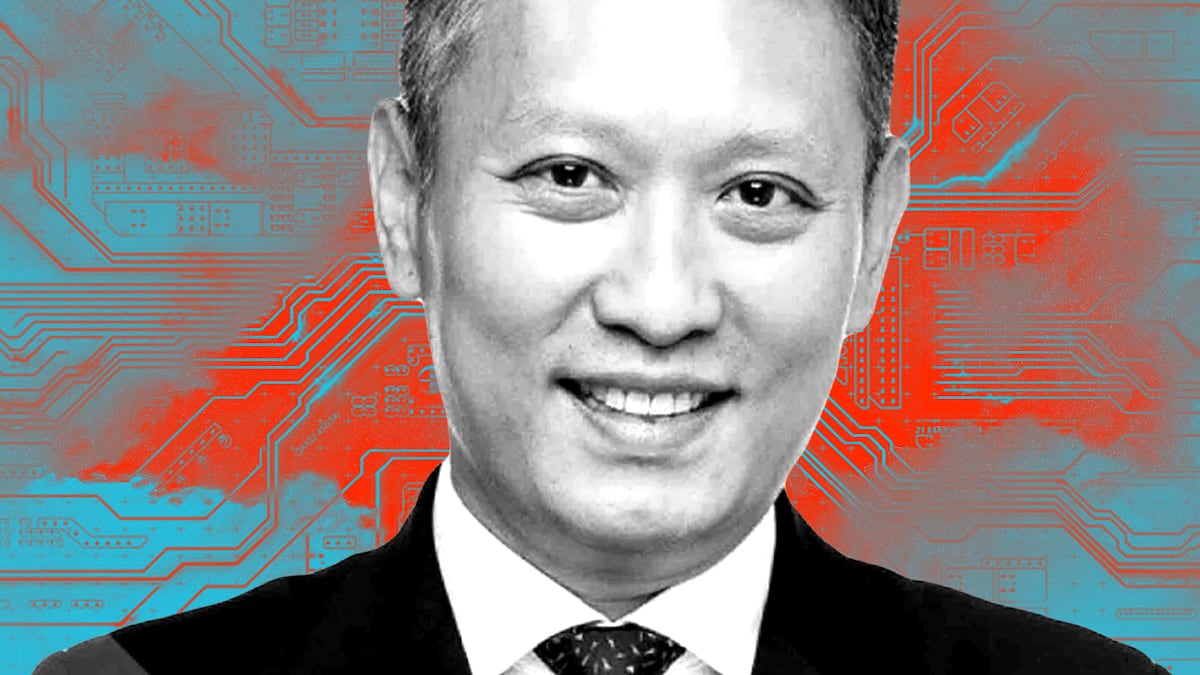

Breaking 10 weeks of silence on Binance’s ongoing crisis in Nigeria, CEO Richard Teng posted a lengthy blog on the exchange’s website Tuesday decrying the arrest and imprisonment of executive Tigran Gambaryan.

Teng also provided important new details about how Gambaryan and his colleague, Nadeem Anjarwalla, were arrested in February, and why.

“The ordeal has been deeply distressing for Tigran, his family and friends, as well as the entire Binance community,” Teng wrote.

The CEO also countered the Nigerian government’s allegations that Binance was facilitating money laundering and currency market manipulation in Africa’s most populous nation.

He clarified that Binance shut down its peer-to-peer trading platform in Nigeria itself, and not at the behest of the government.

“To remove any doubt about suggestions that we had played a role in the country’s currency crisis and as a good faith gesture, I made the difficult decision earlier this month to turn off our P2P product on the Binance platform for NIgeria,” he wrote.

The blog post marked the first time Teng has commented in detail about the situation in Nigeria. His decision comes 10 days before Gambaryan, who is being held in a prison, is scheduled to be tried in a criminal court in NIgeria.

Enforcement actions

For almost three months, Nigerian anti-corruption officials have slammed Binance, the world’s top crypto exchange and one of the industry’s most influential companies, with enforcement actions.

They have accused the company of facilitating $35 million in money laundering transactions for criminals and aiding market manipulators who are destroying the value of the nation’s fiat currency, the naira. They have also charged the company with tax evasion.

In March, Nigeria’s Economic and Financial Crimes Commission, or EFCC, charged two Binance and two of its executives: Gambaryan, Binance’s head of financial crimes compliance and a former special agent with the US Internal Revenue Service, and Anjarwalla, a UK lawyer and Binance’s regional head based in Kenya.

Binance and the two executives have denied the allegations.

‘Gambaryan and Anjarwalla received assurances that they would be granted safe passage for their meetings.’

— Richard Teng, CEO BInance

In his post on Tuesday, Teng said Gambaryan, who is based in the US, and Anjarwalla arrived in the Abuja, the Nigerian capital, on February 26. Their mission: talks with the National Security Adviser and the deputy governor of the Central Bank of Nigeria.

“Despite the clear risks, Tigran Gambaryan and Nadeem Anjarwalla received multiple assurances that they would be granted safe passage for their meetings,” Teng wrote.

Following the meetings, the two Binance men were escorted to their hotel, asked to pack their luggage, and moved to a “secure compound,” the blog post continued. The residence was controlled by the Office of the National Security Adviser.

“Their mobile phones were confiscated, and it was made clear to them that they were not free to leave,” Teng said. “Both Nadeem and Tigram had no control over when and with whom they spoke.”

Binance immediately notified the US embassy in Abuja and UK officials about the detention of the two executives, Teng said.

From the outset, Binance stressed to Nigerian officials that Gambaryan was not a “decision-maker” or a “negotiator” for the company, Teng said.

“He was merely acting as a functional expert in financial crime and capacity building in policy discussions,” Teng wrote.

Teng expressed frustration that the Nigerian government has resisted Binance’s offers to collaborate on safeguarding the crypto industry in Nigeria by removing bad actors from exchanges.

“We will work tirelessly with public and private partners to remove them,” he said.

Seeking a licence

And yet hanging over the situation was the fact that Binance had not obtained an operating licence in Nigeria. This was a key tenet in the strategy promulgated by Changpeng Zhao, the co-founder and former CEO of Binance.

Teng vowed to change this policy after he took over from Zhao in the aftermath of the latter’s guilty plea in a US money laundering case in last November.

In the blog post, Teng said Binance “proactively reached out” to Nigeria’s Securities and Exchange Commission in 2022 to seek guidance on the licencing process.

“Binance never received any response from the SEC,” Teng said.

Meanwhile, Nigerian authorities have expanded their investigation to encompass all the peer-to-peer crypto exchanges operating in the nation. For all intents and purposes, Nigeria has declared a legal war on cryptocurrencies.

Gambaryan will stand trial beginning May 17, his 40th birthday, even though he has yet to hear from a judge on whether he can post bail.

Gambaryan’s lawyer has said his client is a “state-sanctioned hostage” held by Nigeria.

Anjarwalla managed to elude his guards on March 22 and escape Nigeria. He is now the target of an Interpol Red Notice.

With reporting by Osato Avan-Nomayo.

Updated on May 7 to report additional details from Teng’s blog post.

Edward Robinson is DL News’ story editor. Have a tip? Contact him at ed@dlnews.com.