- Binance is blocked in the Philippines and charged with money laundering in Nigeria.

- Former CEO Zhao will be sentenced on April 30 for violating US banking law.

- Binance's market share in crypto trading dipped in the last month.

When Binance co-founder and CEO Changpeng Zhao resigned in disgrace in November, his successor Richard Teng pledged a new era was dawning for the world’s largest cryptocurrency exchange.

Disregarding regulation was out. And compliance was in.

With Zhao, 47, set to be sentenced on April 30 for violating US banking law, delivering on that promise is proving to be problematic.

Throughout its seven-year history, regulators around the world have steadily faulted Binance for operating in their markets without the necessary licences.

While Zhao painted Binance as a new breed of company that didn’t play by old rules, his approach bucked deeply rooted practices for protecting investors from fraud, and the financial system from dirty money.

Even as Teng changes course — and he’s had some success — some regulators are finally catching up with Binance. And the toll is running high.

Knocking out Binance app

In March, officials in the Philippines blocked Binance after the exchange failed to get licenced following months of warnings. Now authorities are going so far as to work with Apple and Google to remove Binance from their app stores.

Meanwhile, Nigeria’s anti-corruption agency has charged Binance with money laundering and tax evasion. The efforts are part of a wide-ranging investigation into allegations the company is facilitating illicit financial transactions on its platform.

Nigerian authorities have also charged two Binance executives with the same allegations, and one, Tigran Gambaryan, has been detained for almost nine weeks pending bail and a trial.

The case follows the same contours as the action brought by multiple US agencies last year.

On November 21, Binance pleaded guilty to violating US banking law by failing to prevent criminals and sanctioned entities from using its platform to conduct illicit transactions.

The company paid $4.3 billion in penalties, and Zhao, who also pleaded guilty, resigned as CEO.

This week, US prosecutors asked a federal court in Seattle to sentence Zhao to a three-year term. Zhao’s lawyers countered by pleading for probation for their client.

Next Tuesday, the onetime crypto chieftain will learn his fate.

Binance has denied the allegations in Nigeria and Gambaryan pleaded not guilty to the charges. The company has not responded to DL News’ multiple requests for comment on the situation in the Philippines.

Media representatives also did not respond to a request for comment on this article.

Meanwhile, Binance’s market share of the spot crypto trading market dropped three percentage points, to 35%, in the last month, marking its lowest point since January, according to CCData.

Yet it remains the leading centralised crypto exchange globally, with a dominating 42% share across spot and derivatives market, the data provider said.

A regulator’s CV

With a stint as a former regulator at Singapore’s central bank, Teng would seem ideally suited to steer Binance onto safer ground.

To that end, he said on April 9 that Binance will establish a global headquarters, and where it will be is anyone’s guess. The move will reverse Zhao’s determination to have Binance based nowhere.

Teng also peppers his speeches with phrases such as “compliance focused” and acknowledges that adhering to regulatory realities under the previous regime was “inadequate.”

And Binance has made progress. It obtained an operational licence in Dubai from the Virtual Assets Regulatory Authority last week.

Reports indicate Binance is planning to re-enter the Indian market — though it may have to pay a $2 million fine to do so.

And in Thailand, it has re-entered the market through a venture with a local partner following a criminal complaint filed by the country’s SEC in 2021 for operating in the country without the correct licenses.

Yet Binance’s regulatory crises in Asia and Africa overshadow these steps.

In Nigeria, the central bank and state security officials blamed the exchange — and peer-to-peer crypto trading platforms more broadly — for tanking the nation’s fiat currency, the naira, early this year.

Authorities said Binance ran an illegal foreign exchange market that allowed users to trade naira for Tether’s stablecoin, USDT.

Investigators concluded that racketeers used Binance to manipulate the naira’s exchange value, according to people familiar with the probe.

Talks break down

In February, Binance dispatched two executives to Abuja, the nation’s capital, to address the issue.

When talks quickly broke down, Nigerian authorities detained Gambaryan, Binance’s US-based head of financial crime compliance, and Nadeem Anjarwalla, its Kenya-based regional head.

The situation escalated in the weeks to come when Anjarwalla eluded his guards and escaped Nigeria with a second passport he had not surrendered.

‘This is purely state-sanctioned hostage-taking.’

— Mark Mordi, attorney for Tigran Gambaryan

Then Nigeria’s Economic and Financial Crimes Commission, the country’s anti-corruption police, charged Binance and Gambaryan and incarcerated the executive in a prison.

The former agent for the US Internal Revenue Service won’t learn whether he’ll be released on bail until May 17.

“This is purely state-sanctioned hostage-taking,” Mark Mordi, Gambaryan’s lawyer, said in court proceedings on Tuesday monitored by DL News.

Hefty fine

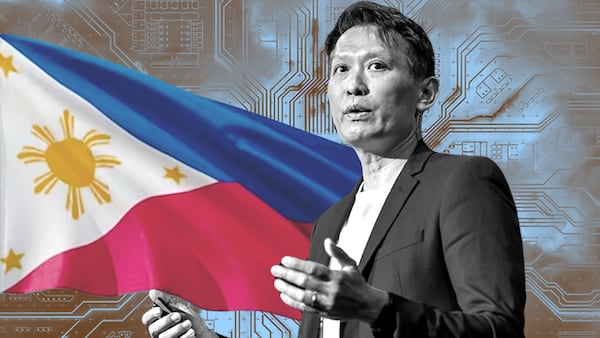

Meanwhile, the Securities and Exchange Commission in the Philippines said just days into the start of Teng’s tenure last November that Binance was not licensed in the country.

It vowed to ban access to the site and warned promoters that they could face a hefty fine and up to 21 years in prison for encouraging citizens to use the platform.

That ban came into effect at the end of March when the government blocked access to the website.

SEC Chair Emilio B. Aquino called continued access to Binance’s platforms “a threat to the security of the funds of investing Filipinos.”

But according to users in the Philippines, Binance is continuing to support Filipino users as long as they can access the site with a VPN.

Indeed, for all of Teng’s efforts it remains unclear precisely where Binance does operate.

According to its website, the exchange’s services are available in more than 100 countries but it only lists 45.

The Philippines is still listed among them despite the ban.

With reporting assistance by Osato Avan-Namayo.

Callan Quinn is DL News’ Hong Kong-based Asia Correspondent. Get in touch at callan@dlnews.com. Edward Robinson is the story editor at DL News. Contact him at ed@dlnews.com.