Devilal Vyas had never heard of crypto before May 2021 – and the last time the 72-year-old saw anything on the scale of Covid, it was smallpox in the ‘70s.

But at the height of the Covid pandemic he faced a nightmare as the charity he founded decades ago to combat rural poverty in Dungarpur, in northwest India, pivoted to helping victims of the virus that has claimed nearly 5 million Indian lives.

“Things were so bad there was no place to burn bodies,” he told DL News. “There were dead bodies just stacked up in bags.”

It was around that time that he heard about a new organisation called the Indian Crypto Relief Fund, which gave Vyas’ charity, Jan Shiksha Evam Vikas Sangathan, $51,800. It was a massive amount – a third of his annual budget. He bought generators and equipment to supply medical-grade oxygen, and says the donation helped save at least 20 lives.

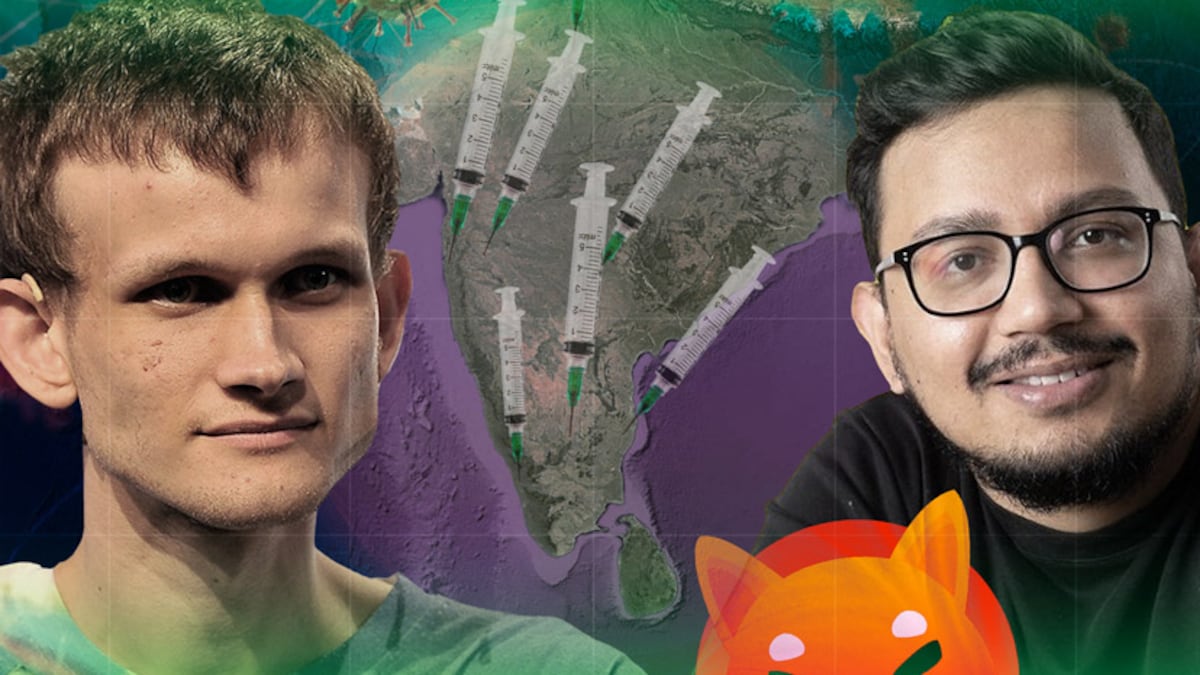

The Crypto Relief Fund’s story is a legend in philanthropy. It gained ground after just one tweet, from Sandeep Nailwal, the CEO of blockchain platform Polygon. Nailwal raised $1 billion, thanks to one of the biggest crypto donations of all time — from Vitalik Buterin, the founder of Ethereum and was for a time the world’s youngest crypto billionaire. The mission: to save lives by quickly transmitting that crypto into cash to Indian charities.

NOW READ: How crypto’s zero-knowledge proofs could hit the regulation-privacy ‘sweet spot’

But nearly two years later, that legend may be fizzling out. Less than half of the potential $1 billion was actually raised for Covid Relief.

And of that, only $58 million — just 6% — has so far been given to charities to ease India’s Covid crisis.

Distributing such a mammoth sum in a crisis is a challenge at the best of times.

Compounding the struggle: The logistics hurdles presented by lockdowns, the pseudonymous nature of cryptocurrency transactions, and the challenge of converting massive amounts of a volatile cryptocurrency into cash.

DL News tracked crypto transactions and bank records, spoke to market makers, Indian charities, and dozens in India as well as those linked to the Indian Covid Relief Fund.

In Nailwal’s own words, the story of the Indian Crypto Relief Fund is “batshit crazy”.

Our findings:

- Only $464 million was realised out of the donation initially valued at an estimated $1billion.

- Nearly two years on, $274 million in various cryptocurrencies – the vast majority in dollar-pegged stablecoin USDC remains dormant in the Crypto Relief fund’s wallets.

- About $40 million in fiat is sitting in a Puerto Rican bank account, according to a screenshot of a February 2023 bank statement shared with DL News.

- The final $100 million was sent back to Vitalik Buterin himself, who has created his own philanthropic fund for Covid-related “moonshot” ventures.

- $1.5 million was moved into an Alameda Research wallet at one point.

- From April 2021 until July 2022, the fund supported 60 non-profits, government educational institutions and international aid organisations ranging from $15 million to Unicef for vaccinations, to $16,700 to disability NGO Help Trust in the Indian state of Tamil Nadu.

- In total, only $58 million of the funds raised has so far made its way to charities providing relief work. Of the 60 organisations mentioned above, we managed to trace 57. Those all confirmed that they had received their share of the $58 million.

- The fund has not made any donations since July, according to its official data.

Just hours after responding to enquiries from DL News, Nailwal on January 31 tweeted a “strategic update” – announcing a change in the fund’s mandate and that the remaining $274 million will go to “upgrading healthcare in India.”

NOW READ: Gensler’s history hints at what’s coming next in the crypto crackdown

India’s Covid crisis

In April 2021, Nailwal called for the crypto community to help his country’s citizens. Covid had been ravaging India. More than 4,000 on average died daily, the country’s oldest and largest cemetery was full, and mass cremations were common. “Everybody saw somebody else dying around them,” he told one YouTuber.He tweeted:

Can't take this sitting down anymore, I am going to run a Covid relief campaign in lieu of what’s going on in India.

— Sandeep | Polygon (※,※) (@sandeepnailwal) April 24, 2021

Need help from the Global crypto community.

I will take full responsibility for transparency, funds usage and regulatory compliance

If you want to donate.. 1/n

“Can’t take this sitting down anymore, I am going to run a Covid relief campaign in lieu of what’s going on in India. Need help from the Global crypto community. I will take full responsibility for transparency, funds usage and regulatory compliance.”

A follow-up thread listed wallet addresses for donations.

The timing was fortuitous for fundraising – crypto had just entered a bull market that saw Bitcoin surge from around $10,000 to around $60,000 by the end of the year.

A wave of media hype encouraged Indians to invest in crypto. Exchange companies bet big on the Indian Premier League – a cricket tournament watched by 380 million. Indian crypto exchange app Coinswitch said sign-ups shot up 400%. In July 2021, Indian crypto exchange CoinDCX sponsored the India-Sri Lanka cricket series and became the first crypto company to have a cricket series named after it.

Crypto Relief attracted big-name donors – Australian cricketer and IPL star Brett Lee pledged 1 Bitcoin – then worth $53,000. Buterin donated nearly $400,000 worth of the Maker token on April 24, and 500 ETH ($1.9m) on May 12th.

Surprise $1 billion giveaway

But that all paled in comparison to what happened next:

Buterin then donated a whopping 50.7 trillion in Shiba Inu, or SHIB, tokens – worth $1.02 billion at the time. It was one of the biggest crypto donations in history.

But it’s unclear if it was ever even possible to exchange 50 trillion SHIB into $1 billion of hard cash. After all, SHIB is a meme coin, created as a joke about another satirical crypto token, Doge.

Even at its peak, SHIB tokens were worth a fraction of a penny – the price fluctuating between four and seven zeros after the decimal point and a key feature of memecoins. In March 2021, the price jumped after Elon Musk tweeted a picture of a Shiba Inu pup.

Over the previous six months, Buterin had been sent 50% of the total supply of SHIB by the creator, known only as Ryoshi. It was widely understood as a publicity ploy.

“There are many, many projects that do this kind of thing — make Vitalik a huge part-owner — in the hopes that he legitimises the coin by interacting with it in any way whatsoever,” Eric Wall, a Swedish software engineer and cryptocurrency trader, told DL News.

Anyone can send anyone else coins if they know the person’s wallet address. Developers had sent Buterin tokens before, and he would quickly sell them out of his hot wallet via the decentralised exchange Uniswap.

Shiba Inu’s devs however, sent the coins to Buterin’s “cold” wallet – an address unconnected to the internet — which required a more complicated and slower procedure to get rid of them.

The Shiba Burn

What Buterin did next was astounding.

“The scary part is that, basically, this is more money that I’ve ever had,” he said on UpOnly TV in January 2021. “To get rid of it, I had to follow this really complicated technical procedure – in a way that would probably make a good plot for a James Bond movie.”

He bought a $200 laptop from Target to create a secret cold wallet. He then moved all his other funds – estimated to be worth $1.3 billion, but not the SHIB, from the older cold wallet into the newer one. That left the original cold wallet as the sole access point for half of all existing SHIB tokens.

‘After you sell $1 million worth you’re gonna crash it. I’ll just give them to these groups, and hopefully they’ll do good things with them’

— Vitalik Buterin

From there, Buterin got rid of “billions” of dollars worth of the meme coin by sending 51 trillion – 5% of the coin’s total supply – to Nailwal’s fund, and burning the remaining tokens a few days later by sending them to a “null address,” effectively removing 50% of all SHIB from circulation forever.

Even Buterin had no idea how much they would really be worth.

“On paper, the dog tokens are $7 billion. But in reality, it’s a very illiquid market,” Buterin said in a June 2021 podcast. “After you sell $1 million worth you’re gonna crash it. I’ll just give them to these groups, and hopefully they’ll do good things with them.”

‘We couldn’t sleep for a few nights’

The mood among Crypto Relief volunteers was ecstatic – the fund had raised money before, more than $10 million in donations at one stage. But this was game-changing.

“When the donation came, we couldn’t sleep for a few nights,” Punit Agarwal, who led the fund at the time, told DL News. “We were so excited. We knew it was worth a lot. It would change the landscape of crypto and aid in India.”

But on crypto Twitter, the response was mixed. Disgruntled SHIB investors questioned what would happen to the token once Crypto Relief began selling it. With Buterin’s 40% burned, the fund now controlled about 5% of the remaining supply of SHIB. If sold, it could instantly drive down the price.

On a Discord server used by Crypto Relief volunteers, a SHIB investor with the moniker Aurion wrote: “A community of more than 300,000 people have invested in Shiba… they are now watching the market going down, and their life savings are melted.”

Others felt that Buterin had essentially legitimised a “shitcoin” – SHIB never should have had any value in the first place. SHIB is “less likely to go away as fast as it would have otherwise,” Wall told DL News. “Yes, some money went to charity. But people also throw their money at SHIB now as if it is the Musk-Dogecoin equivalent for Vitalik,” he said.

The liquidity problem

The biggest problem for Nailwal and the fund, however, was what exactly to do with all the SHIB. How do you get a large chunk of cash from such a volatile meme token?

“We didn’t really know what we could do with it,” a Crypto Relief volunteer told DL News.

SHIB was and remains a token with a value better measured in social media clout than dollars. Who was willing to provide $1 billion in exchange for a joke token?

Up stepped Evgeny Gaevoy, the 38-year-old CEO of the UK-based market maker Wintermute. He volunteered to liquidate the SHIB in several tranches “at cost.”

‘It was pretty unpredictable how the market would react’

— Wintermute's Evgeny Gaevoy

The company could probably, at best, recover about half of the billion-dollar paper price, Gaevoy told DL News. “It was pretty unpredictable how the market would react,” he said. He saw it as an opportunity to test out its trading algorithms, and sold the SHIB through centralised and decentralised exchanges.

The total converted into $463,898,925 of the USDC stablecoin – confirmed in a receipt of transfer from Wintermute to Crypto Relief that was seen by DL News.

It’s a sizable sum – and the feat put Wintermute on the map in the crypto world – but it’s a far cry from $1 billion. Crypto Relief had “lost” more than half the estimated value of Buterin’s original donation before any had even been spent. It’s questionable whether the $1 billion ever existed as anything more than a theoretical value.

The fund was nonchalant.

“We potentially lost a lot of money, but no matter,” a member of the volunteer team told DL News. “The aim was not to maximise profits, but to responsibly convert the tokens into cash.”

$1.5 million goes through Alameda Research

From the offset, Nailwal and his newly assembled team – Punit Agarwal, founder of an east-Indian based crypto tax consultancy called KoinX; Dr Gaurav Singh; and Nagakarthik MP – trumpeted the need for transparency. The Crypto Relief site has a dedicated page that lists all of its donations, the recipients and the date. It also publicly posts its crypto wallets.

Despite the swarm of pro-crypto media in 2021, the Indian government maintained a cautious attitude. Nailwal floated the idea that the fund might work with Indian exchanges. But there are strict rules for donating foreign income in India. By May, Crypto Relief was sitting on half a billion dollars of Vitalik’s SHIB - (as well as nearly $11 million in other donations), but the law effectively prohibited it from spending any of the money in India.

So Nailwal registered a company in the United Arab Emirates, with a fiat account set up by FV Bank, a crypto-friendly institution based in Puerto Rico. He worked with Indian NGOs that had the right paperwork in place – known as an FCRA licence – to disburse the money.

“This entity converts funds into fiat before sending it into India. So the ‘crypto’ from Crypto Relief never touches India,” Nailwal told DL News in an emailed response to questions.

But once the SHIB had been converted to USDC – a cryptocurrency pegged to the dollar — the challenge remained: How to legally and transparently get the money to those who needed it?

Getting cryptocurrency off the blockchain and into cash is known as “off-ramping”, and is done either through centralised exchanges, the most common option, or through private deals with over-the-counter (OTC) trading desks.

At 4pm London time on April 28, Nailwal tweeted a screenshot of $1 million in the newly set up FV Bank account for Crypto Relief:

“BOOM… We got money in the bank! Will be inviting reputed ppl to constantly audit the account. In 3 days we have the entity set & Crypto to Fiat conversion into the bank.”

BOOM

— Sandeep | Polygon (※,※) (@sandeepnailwal) April 28, 2021

We got money in the bank! Will be inviting reputed ppl to constantly audit the account.

In 3 days we have the entity set & Crypto to Fiat conversion into the bank

Ready to roll the immense help from Crypto Community to the people on the ground 🙏

1st Deployment incoming https://t.co/MpvpYiv94n pic.twitter.com/VmGTBjWn6Y

Nailwal told DL News that the Fund off-ramped through a series of deals using institutional “third-party providers,” PayGlobal and FalconX. After the conversion of USDC to fiat, the money was wired into Crypto Relief’s FV Bank account.

On the same day, Nailwal announced the fiat had reached the bank, the transaction can be followed on the blockchain. Receipts of the transaction, seen by DL News, confirm the USDC’s arrival in a PayGlobal wallet. It then went through two unknown intermediary wallets before going into a wallet belonging to Alameda Research, the now disgraced trading house connected to Sam Bankman-Fried’s FTX exchange. A further $500,000 followed the same path two days later on April 30.

“Most of these off-ramp providers used to work with Alameda, which at that point was a major and reputed player,” Nagakarthik MP told DL News.

‘I don’t think we ever worked with Alameda directly’

— Sandeep Nailwal

“I don’t think we ever worked with Alameda directly,” Nailwal told DL News. “I don’t remember the timelines exactly. But around that time, we had a huge influx of queries on disbursing funds, and finally I had secured the off-ramp deal. And our banking partners FV Bank were kind enough to give us the credit on our bank account because of the situation of Covid in India. Everyone wanted to help.”

PayGlobal is a UK-registered company, run by Nitin Agarwal and Miles Paschini. Agarwal and Paschini are the CRO and CEO of FV Bank, respectively.

“FV Bank and PayGlobal are bound by privacy policies, client confidentiality, and data protection regulations,” said a response on behalf of both companies to questions about the transfers put to Agarwal. “Neither entity is permitted to divulge confidential information relating to customer data, accounts, or financial transactions. We can, however, confirm that FV Bank does not have a presence in the United Arab Emirates and that PayGlobal did not have Alameda Research as a customer.”

It’s an insight into how convoluted transactions in crypto can be – even though each transaction can be followed on-chain, they only tell part of the story.

It is unclear then who was responsible for off-ramping the $1.5 million through Alameda Research.

So where is the money?

Of the potential $1 billion for emergency Covid relief in India, to date, the fund has converted just shy of $100 million into fiat.

According to the Crypto Relief’s page, only $58 million of the total funds so far reached NGOs. The agency lists a total of 83 separate donations to 60 non-profits, government educational institutions and international aid organisations.

They range from $15 million to UNICEF for vaccinations, to $16,700 to Help Trust, a disability organisation in Tamil Nadu, southeastern India, which went to “ration kits.”

DL News traced 57 of them and confirmed Foreign Contribution Regulation Act licences for 53 of those organisations, which confirmed that they had received their share of the $58 million. Several have filed receipts of the funds to India’s Ministry of Home Affairs.

The Indian Institute of Technology Madras, the Centre for Infectious Disease Research at the Indian Institute for Science, Unicef, and one organisation based out of Kuwait, do not require FCRA licences.

This leaves about $40 million left in fiat in the fund’s FV Bank account. Nailwal provided a screenshot of an FV bank statement to DL News. The statement, from February 1 to February 15 of this year, shows no transactions, and a balance of $40,869,785.33

In comments to DL News at the end of January, Nailwal said: “As we move to a more structured and long-term approach, we recognise the importance of maintaining that same level of transparency and accountability. We are working with a major audit firm to provide external auditing of our financials to ensure that we continue to operate with the highest level of integrity and accountability.”

Punit Agarwal said on February 15 that the fund is in “talks with some big audit companies,” but that no agreement has been signed.

Vitalik’s $100 million ‘moonshot’ fund

In January 2022, Nailwal announced the fund will “return” $100 million USDC to Buterin – who the fund said would be able to distribute the funds quicker given he was a “non-Indian citizen.”

In May, Vitalik announced the first round of recipients of funding from his newly launched Balvi Foundation. It is run by a group of volunteers based out of Singapore, a recipient of funds from the foundation told DL News.

According to declared donations via Buterin’s Twitter account, his foundation has given away $38.4 million to Covid and pandemic-related research projects. Only two Indian organisations have been named as recipients – $1 million has been doled out to a company that makes air filters and the second makes covid-tests.

The Balvi Fund’s wallet shows just less than $4 million is left of the original $100 million in USDC.

Buterin did not respond to DL News requests for comment.

Nailwal’s Covid Relief Fund is now being restructured to tackle new projects – “virology and institution building, environmental and wastewater surveillance, and health-system strengthening,” Nagakarthik MP told DL News.

“We will be prioritising state and district-level partnerships and capacity building of grassroots organisations,” he said, as well as providing grants and “supporting health innovation through hackathons.”

Going forward, Nailwal said his tasks will include an “auditing, review and transparency role, ensuring that the fund adheres to the Web3 values.”

― Additional reporting by Mohit Rao