A version of this story appeared in our The Guidance newsletter on April 29. Sign up here.

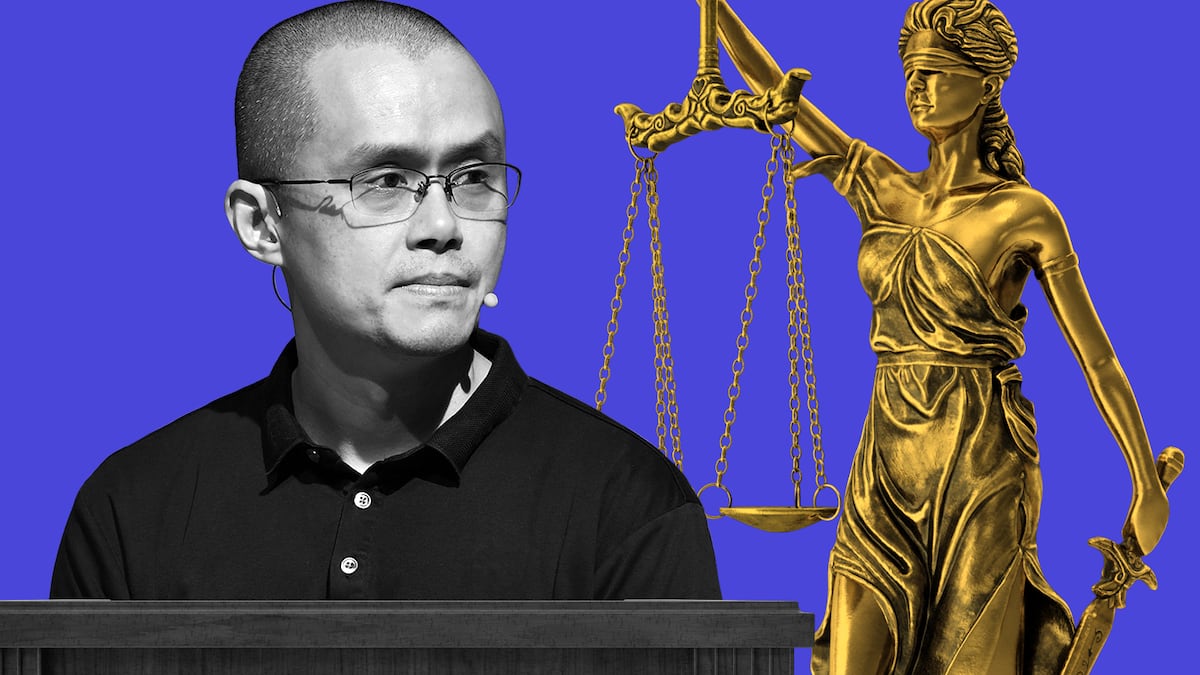

Ahead of Changpeng Zhao’s sentencing on Tuesday, his fans are showing their support.

“Many of us know he has done so many good things for the community and the world,” said one post on X.

And it’s not just the degens.

Family and friends sent letters to the Seattle court to support the disgraced founder and erstwhile CEO of Binance, describing his good character.

His lawyers told the court to consider giving him probation, given that he’s shown remorse, and that he worked with authorities to put in place controls.

But Binance still faces the US securities regulator in a civil suit, which presents a very different picture of Zhao.

The Securities and Exchange Commission said he ran Binance and its purportedly independent US arm with an iron fist, and even hired a consultant to create a plan for sidestepping US laws.

That won’t dent his image among his fans.

Zhao took Binance from a startup to the world’s biggest crypto exchange in just a year. In the process he got very rich, and attained cult figure status among crypto investors.

But what is striking about the securities watchdog’s suit is how — if the allegations are true — it shows that Zhao was prepared to risk the assets of those very investors, lying to, and even trading against them.

The SEC’s case contains a lot of heavy technical terminology that can obscure the seriousness of its allegations.

The regulator alleges that, among other violations of securities law, Binance combined the functions of clearing agency, broker, and exchange.

It also accused Binance of misrepresenting the trade surveillance controls it put on its platform.

Translation?

Binance raked in billions of dollars from US investors, while failing to put in place the kind of investor protections that are standard on traditional exchanges, the SEC says.

Investors’ money — including about $1.8 billion from US customers by the end of 2022 — was not kept safe in a bank, nor did Binance give customers much information about the wallets where their assets were stored.

The exchange was thus free to risk investor assets, moving them around as it liked. And it allegedly did so, even apparently spending mingled funds — $11 million — at a yacht dealer.

Binance also allegedly misrepresented its pricing data on CoinMarketCap, and used two market makers controlled by Zhao to artificially inflate trading volume on the platform.

Those are practices that actively hurt investors.

To be clear, the SEC’s allegations are just that — they have still to be proven in a court of law.

Still, there’s a lesson here.

FTX founder Sam Bankman-Fried’s trial laid bare how crypto founders’ portrayal as genius mavericks whose innovative contributions to society give them a pass on the normal rules mask how they hurt investors.

It’s good to keep that lesson in mind as the SEC case unfolds.

Joanna Wright writes about crypto regulation for DL News. Email her joanna@dlnews.com.