- As DL News turns a year old, we look back — and ahead — at how the big events of our first year tee up big questions for crypto's future.

- Find out what our reporters think will shape the year ahead.

A version of this story appeared in our The Guidance newsletter on January 29. Sign up here.

GM! Joanna, Adam, and Inbar here.

This week, DL News turns one year old!

We launched amid a pivotal time for crypto, as it collided with the mainstream — or, as some might say, sold out.

In just a year, seismic events — the birth of major regulatory regimes, high-profile trials against once-feted founders, the fever-pitch excitement around Bitcoin exchange-traded funds — shook crypto to its core, and presaged a new era of establishment adoption.

To celebrate our birthday, we look forward to some big themes we think will continue into 2024 — and beyond.

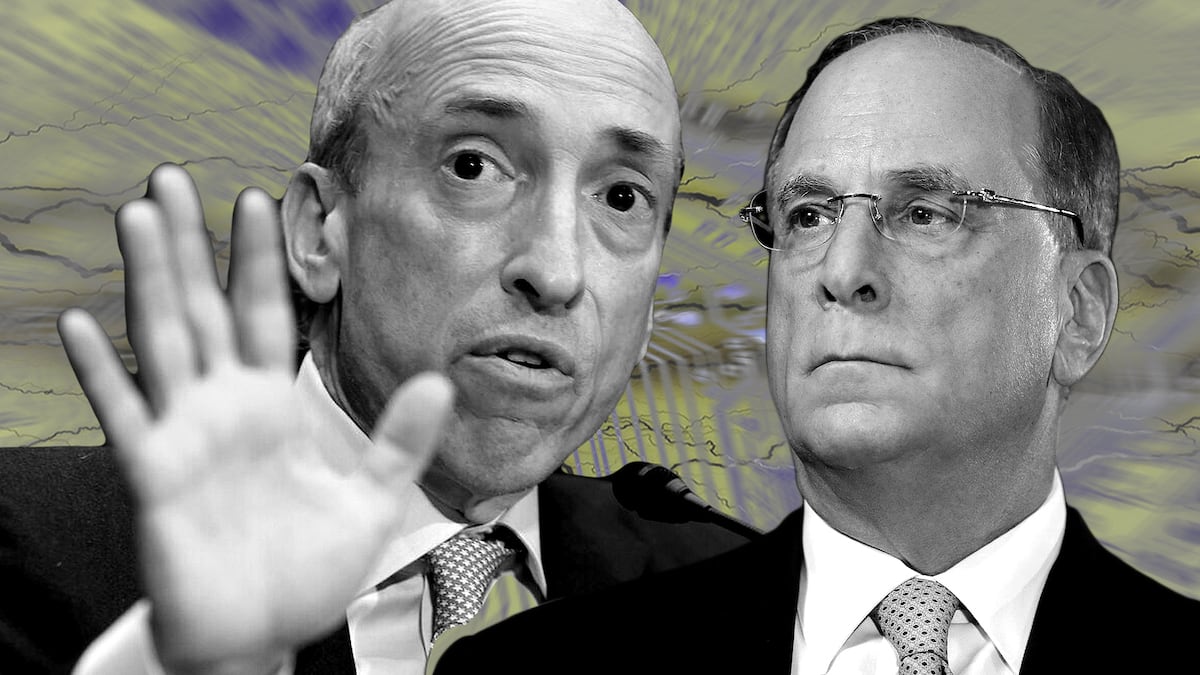

Big theme 1: ETFs see Wall Street muscle into Ether

The market’s attention has turned to Ethereum ETFs.

Heavyweights BlackRock, Fidelity, VanEck, and Ark Invest have all asked for permission to supply these products.

This comes after the Securities and Exchange Commission approved of 11 spot Bitcoin ETFs, which Bitcoin backers saw as ushering in acceptance of crypto among ordinary investors — and attracting inflows into Bitcoin and Ethereum.

But, as DL News’ Sebastian Sinclair reports, analysts say there’s only a 50% chance the SEC will greenlight the Ethereum products by May 23, the deadline for Ark Invest’s application.

And it’s yet to be seen how successful crypto ETFs will be in attracting inflows.

Grayscale’s GBTC has attracted the most trading volume so far, but most of that has been $4 billion in outflows.

GBTC converted to a spot ETF from a closed-ended trust with around $28 billion in assets under management.

One might assume this would give Grayscale an advantage, but its new rivals include BlackRock, which can fight back with lower management fees.

Grayscale’s 1.5% fee versus the 0.12% fee BlackRock charges appears to be discouraging investors.

Big theme 2: Regulatory regimes

The EU’s pioneering crypto framework, the Markets in Crypto-Assets regulation, passed into law in 2023.

Financial regulators are now filling in the finer details of the rules, which will see licensing regimes for crypto issuers and service providers.

The first set of rules for stablecoins goes live in June, and the rest follows in December.

Crypto firms are already deciding where to establish their EU foothold. Coinbase picked Ireland. Circle picked France.

The UK proposed its own comprehensive framework, hoping to get it in place as MiCA goes into full force.

Before it can be finalised, the UK’s financial regulator must put forward its stablecoin rules.

Then, His Majesty’s Treasury will look into regulating crypto exchanges, lenders, and other service providers.

While these rules provide clarity for firms, they won’t be easy to follow.

Heavy hitters like PayPal and Revolut have learned this already, as they pull the plug on their UK crypto services, citing overly complex and technical regulation.

Big theme 3: Privacy’s existential battle

Governments are putting the screws to crypto privacy, arguing it worsens the risk of financial crime.

The US Justice Department’s record-breaking $4.3 billion settlement with Binance will set a precedent for their treatment of crypto in 2024.

The government settled with Binance in November after charging it with allowing dirty money from sanctioned countries to flow through the exchange.

Last year also saw Hamas’ surprise attack on Israel, which spurred lawmakers like Elizabeth Warren to take a stance against crypto’s role in terror financing.

And lawmakers are putting in rules — Europe’s Transfer of Funds Regulation, for example — that require the reporting of personal information of parties to crypto transactions.

Privacy coins, used to obscure the details of crypto transactions, are sinking as exchanges including Binance and OKX delist the assets.

So, will privacy survive 2024 as a virtue of crypto?

Cases like the trial in March of Tornado cash developer Alexey Pertsev will answer that question.

Pertsev will appear in a Dutch court on money-laundering charges over his involvement with the crypto mixer.

The final vote on the EU’s comprehensive Anti-Money Laundering Regulation early this year could also spell the end for anonymity.

The regulation would dub self-custody wallets and crypto mixers as high risk, and ban anonymity-enhancing coins and accounts.

As we kick off our second year, we’d love to hear from you what you’d like to see more of in our regulation coverage generally. Reach out to me at joanna@dlnews.com