- It took Morgan Stanley-backed marketplace Securitize Inc. three years to obtain licenses as a transfer agent, broker-dealer and alternative trading system.

- CEO Carlos Domingo completed the application process after an acquisition.

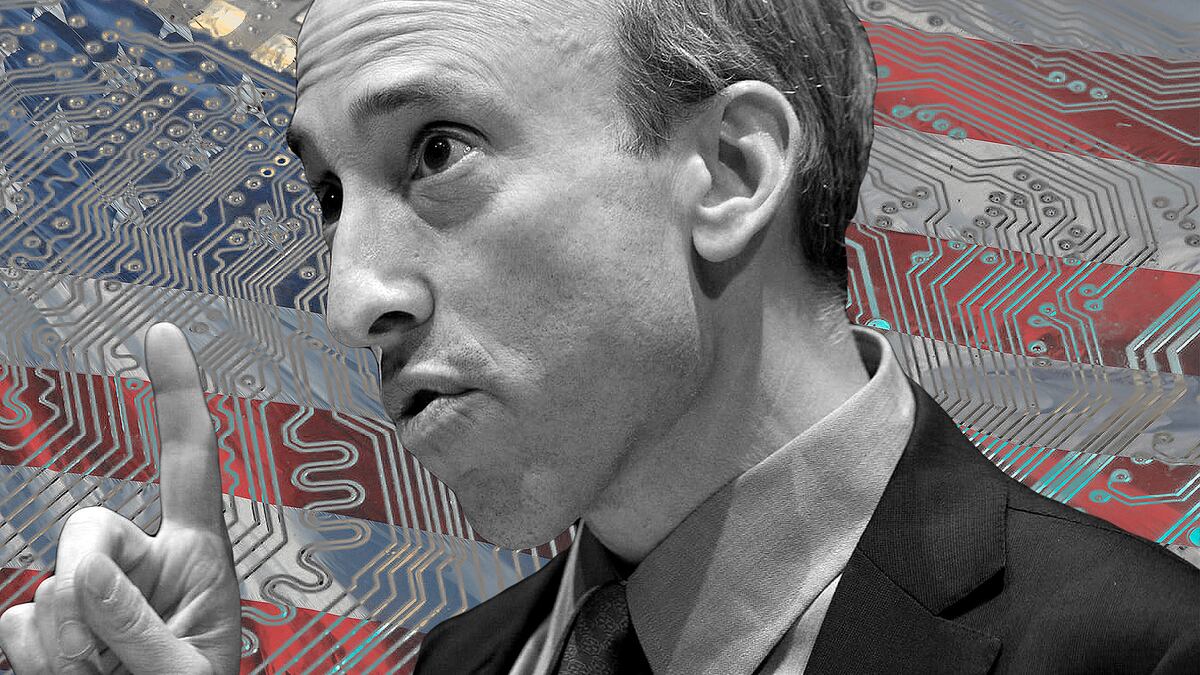

- Critics decry Gary Gensler’s registration demands as unworkable as SEC takes action against Coinbase and Binance.

Three years. Countless meetings. Legal fees. Filings. More meetings. And a fortuitous acquisition.

That’s what it took for Carlos Domingo to comply with Gary Gensler’s wishes. And he’s still not done.

Domingo, the CEO of Securitize Inc., is one of the few blockchain industry executives to register his company with the US Securities and Exchange Commission and hew to the demand that has driven the most intense regulatory crackdown in the sector’s history.

“We took the long, complicated route,” Domingo told DL News. “Our company has grown at a slower pace, but steady, and in a safer environment.”

It paid off — in 2021, Morgan Stanley, the Wall Street investment banking giant, led a $48 million investment round in Securitize.

Bound up in red tape

Ever since Gensler turned his sights on crypto two years ago he’s rung the same refrain over and over again — just come in and register tokens and digital assets businesses the same way TradFi outfits do. That way there will be no problems.

Nonsense, countered crypto industry leaders such as Brian Armstrong, the co-founder and CEO of Coinbase.

They argue that registering, whether it’s a token or as an exchange, is so bound up in red tape it’s virtually impossible to do. Armstrong, for instance, has complained that his exchange engaged with the SEC over months to register its services, only to be slapped with a lawsuit.

NOW READ: The next job for EU regulators: making sure Binance and other crypto giants don’t game MiCA

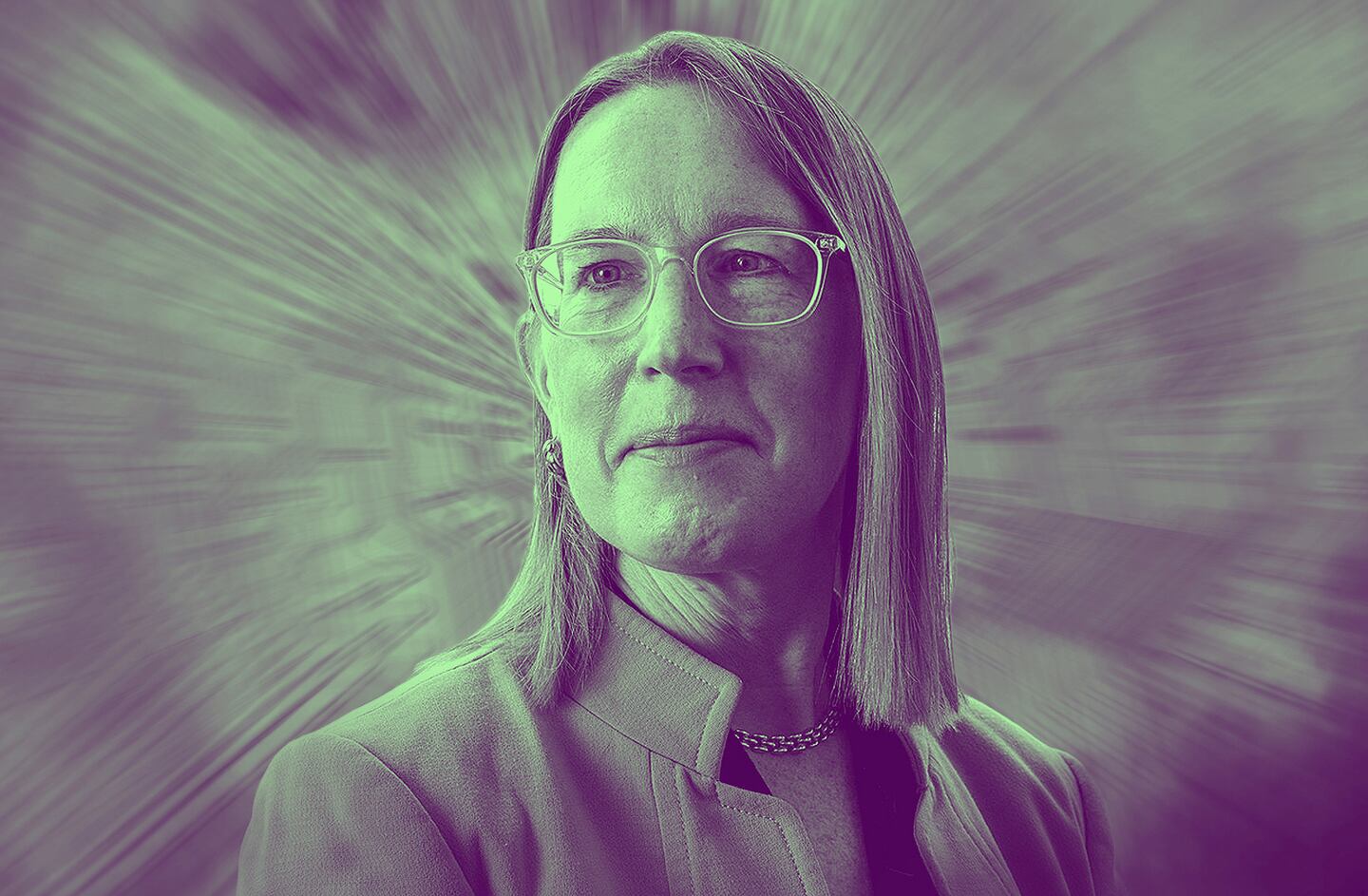

SEC Commissioner Hester Peirce agrees registering is easier said than done.

“Today’s commission tells entrepreneurs trying to do new things in our markets to come in and register,” she said recently. “When entrepreneurs find they cannot, the commission dismisses the possibility of making practical adjustments to our registration framework to help entrepreneurs register, and instead rewards their good faith with an enforcement action.”

As Domingo’s Securitize business shows, some blockchain industry entrepreneurs are going through the painstaking process set out by 90-year-old laws.

With the SEC, along with its sister agency, the Commodity Futures Trading Commission, taking action to force crypto firms to comply or be closed down registration has become an urgent and yet little understood process.

The first thing crypto folk have to understand is how those old laws are shaping the future of crypto in the US, and beyond.

Two key laws

Passed to address the recklessness and fraud of the Crash of 1929, the Securities Act of 1933 regulates the issuance of stocks and other securities in primary markets. When the SEC charged Ripple Labs with failing to register its XRP token, it did so under this act.

The Securities Exchange Act of 1934, meantime, regulates the secondary markets where traders deal in securities that have already been sold to investors. It was this law that created the SEC, headed by a chair who is nominated by the president and confirmed by the Senate. When the SEC sued Coinbase for allegedly failing to register as an exchange it did so under the 1934 act.

Earlier this year, the CEO of crypto exchange INX told DL News it took 953 days and 15 rounds of negotiations with the SEC to be approved.

“The Gensler era has not been easy on this space,” INX CEO Alan Silbert said.

NOW READ: Coinbase, a16z among firms amping up policy hires amid ‘critical’ SEC battle

But what about registering for secondary market trading? That’s where Domingo comes in.

He spent much of his career in the telecoms industry. After a friend got him into crypto, he watched the initial coin offering boom in 2016 with excitement. Domingo realised that ICOs presented a fascinating opportunity for venture capital funding.

Domingo also realised they were probably illegal, he told DL News.

ICOs are securities

In 2017, Domingo helped set up SPICE VC, a venture capital fund that tokenised partner interests in its fund. This tokenised security offering was one of the first to be compliant with SEC regulations.

Good thing, too, because that year the SEC published an investigative report that found that ICOs did indeed constitute securities. Domingo decided there was a need for an approved platform for trading these tokens. So in 2018, he spun out the technology from SPICE to create Securitize.

And in January 2019, one of Securitize’s subsidiaries applied for a transfer agent licence with the SEC for digital assets. It began a regulatory odyssey.

‘There are instances of more novel stuff that don’t fit well into existing regulations.’

— Carlos Domingo

Transfer agents stand between issuers of securities and the owners of those securities and keep track of ownership and distribute dividends. Securitize uses its own blockchain tech to digitise these functions.

As SEC registration processes go, getting a transfer agent licence was not particularly onerous, Domingo told DL News.

Little experience

Securitize had to submit a filing to the agency detailing who would be involved in the business. It also described its activities, and explained where it would operate.

But there were difficulties, he added. Securitize was one of the first businesses to contemplate bringing blockchain to transfer agency functions, so it educated a regulator with little experience in the technology.

“If you’re going to operate as a transfer agent with digital asset securities, you have to explain to the SEC how you’re going to keep track of the assets in more detail than a normal transfer agent,” Domingo said.

Domingo consulted with former SEC market structure officials as the process commenced. By July 2019, he had his transfer agent licence.

But for Securitize, this was just the beginning. Domingo also wanted to provide a platform where digital asset securities could be traded. In the US, this can be done on an electronic exchange called an alternative trading system. And he would need a licence for that business as well.

Sharing business plans

These systems have a lighter regulatory burden than top tier exchanges such as the Nasdaq. Even so, prospective ATS outfits must register as a broker-dealer. That isn’t easy.

An aspiring broker-dealer must prepare a broker-deal form with the SEC that provides details on ownership, directors, main officers, and links with other businesses.

Firms must also apply with the Financial Industry Regulatory Authority, or Finra, a self-regulatory organisation that watchdogs brokers at the behest of the SEC. Applicants have to share business plans, agreements with custodians and clearing agents, and internal rules. Some employees might need to take qualifying exams.

NOW READ: Coinbase short seller losses hit $1.3b in July as stock soars

It’s difficult to put a figure on what this process costs for applicants. FINRA data shows that application fees for a broker-dealer range from $7,000 to $55,000, depending on the applicant’s size.

This doesn’t include the lofty legal and consultant fees companies pay to shepherd their applications.

As the costs stack up, it’s often more convenient to buy a company that has already gone through that registration process. This is exactly what Securitize did.

In the fall of 2020, the company acquired Distributed Technology Markets, a broker-dealer and ATS that had already registered with the SEC and Finra and won approval to handle securities.

Protected accounts

The following year, the SEC made a game-changing decision for ATS platforms handling digital asset securities. It said broker-dealers must keep client assets in specially protected accounts, or deposit them in a bank.

But as onerous as that sounds, it was good news for Securitize. The SEC said that digital asset ATS platforms would be allowed to hand securities to buyers and payment to sellers — a process known as settlement — by connecting automatically to the banks where customer assets were held.

NOW READ: Powerful central bank group says crypto ‘amplifies’ risks and contributes nothing to society

The decision, known as the “three-step process,” made settlement less cumbersome for everyone involved, and leveraged the benefits of instant settlement on the blockchain.

Securitize applied to be able to run this so-called “three-step process.”

It wasn’t until September 2022, that Domingo finally had an end-to-end service: a transfer agent, investor accounts with identity management and know-your-customer controls, and the broker dealer-ATS platform.

Regulatory journey

His three year regulatory journey was done. Or sort of.

Securitize now has tokenised securities providing exposure to investment funds in private markets and alternative assets like real estate and art.

Even after it’s registered, an ATS still has ongoing quarterly reporting and disclosure requirements, and it has to submit to inspections and audits from the SEC and FINRA.

Still, the firm has completed a process many other blockchain firms have dared not endure. Changes may be coming. Domingo said there are still gaps in the securities laws where clarity is needed.

NOW READ: Celsius staff knew ‘value was fake,’ allege Feds in multiple legal cases against Alex Mashinsky

“There are instances of more novel stuff that don’t fit well into existing regulations,” he said. “We, for instance, debate whether we can use public blockchains for tracking securities, but there is no guidance about which ones I can use or not.”

The SEC has made some efforts to smooth the path for the industry, like bringing in its special purpose broker dealer licence, or allowing settlement to happen in three steps rather than four.

But Timo Lehes, co-founder of Swarm Markets, a tokenised securities platform in Germany, said the US system remains very much a work in progress.

If most cryptocurrencies are securities, he said, then every entity that touched them will have to register as an ATS or custodian, forcing them into existing traditional financial architecture and infrastructure.

“It’s slowing down blockchain innovation significantly in the US,” he said.

Have a tip about crypto regulation? Contact the author at joanna@dlnews.com.