US prosecutors unseal charges against North Korean official for crypto conspiracy

Unsealed US indictments charge a North Korean banking official for his alleged role in cryptocurrency laundering conspiracies.

The documents, unsealed by a US district court on Monday, lay out the case against North Korean Foreign Trade Bank representative Sim Hyon Sop.

Sop is accused of allegedly laundering funds “stolen from virtual asset service providers” and purchasing goods with them through over the counter crypto traders.

Operatives working out of North Korea stole an estimated $1.7 billion in crypto in 2022 through a string of hacks.

Security experts have long warned that over the counter exchanges play a pivotal role in cybercriminals’ money laundering activities.

However, as DL News reported on Monday, it is just one tool in an ever-growing arsenal used to launder stolen crypto.

NOW READ: Arrest of Turkey’s failed crypto exchange boss kicks off hunt for answers

Binance.US terminates deal to purchase Voyager

Binance.US terminated a deal to purchase bankrupt crypto broker Voyager Digital Holdings on Tuesday.

Binance.US blamed a “hostile and uncertain regulatory climate in the United States” as the main reason for the deal’s termination.

The deal had been in legal limbo for months, with federal regulators determined to halt it in court.

This marks the second time a deal has fallen through for Voyager, which has been locked in Chapter 11 bankruptcy and unable to reimburse customers since 2022.

Pour one out for Voyager creditors

— db (@tier10k) April 25, 2023

FTX gonna save us🙏

FTX implodes 💀

Binance gonna save us 🥳

US blocks sale 😳

Court allows sale to go through 😩🙏

Binance pulls out 🪦 https://t.co/hGPoNeXL93

NOW READ: ‘OpenSea is in big trouble’ as Tiger Global cuts valuation by 76%

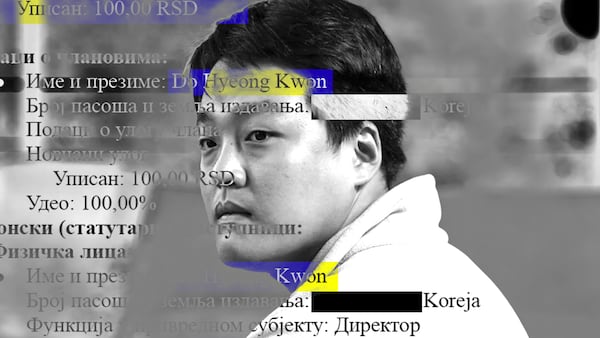

South Korean authorities nab Terraform Labs co-founder Shin for fraud

South Korean prosecutors filed fraud charges against Terraform Labs co-founder Daniel Shin on Tuesday.

He faces allegations of fraud, embezzlement and breach of duty for his role in the $60 billion collapse of Terraform Labs’ stablecoin TerraUSD and its sister token Luna in 2022.

Nine other people linked to the disgraced stablecoin issuer face similar charges.

Shin’s lawyer claimed he had “nothing to do with the TerraUSD” and that he hadn’t been associated with the company for over two years before the crash.

Fellow Terraform Labs co-founder Do Kwon remains in a Montenegro jail, facing forgery charges after his arrest in March.

NOW READ: Fallen crypto king Do Kwon slapped with fake passport charge in Montenegro

Former US Reps to unveil new Bitcoin-focused group in Washington

Two former US Representatives will unveil a new Bitcoin-focused organisation in Washington on Wednesday.

The organisation will aim to educate policymakers and citizens alike about the digital asset and cryptocurrencies in general.

The 501(c)4 organisation is set to be a bi-partison effort, with Ohio Democrat Tim Ryan and Indiana Republican David McIntosh heading up this week’s introduction in the US capital.

It is one of many crypto advocacy groups trying to make waves as Congress is looking at new cryptocurrency rules including a Republican-drafted stablecoin bill.

NOW READ: ‘Regulatory Game of Thrones’ risks derailing crypto rules

US lawmaker praises Europe’s MiCA legislation as ‘ahead of the game’ for crypto regs

US House Financial Services Committee Chair Patrick McHenry lauded Europe’s recently voted-in the Markets in Crypto-Assets regulation in a Tuesday interview, and stated the bloc was “ahead of the game” on web3 adoption.

McHenry is currently trying to pass a stablecoin bill through congress, despite criticism from Democrats who say the bill doesn’t account for lessons learned in the many collapses of crypto firms in 2022.

Nonetheless, McHenry is emerging as a vocal crypto advocate, and gained attention last week when he grilled Securities and Exchange Commission Chair Gary Gensler over what some perceive is a lack of regulatory clarity on the agency’s part.

More web3 news from around the web…

NY Fed policy change could squash stablecoin issuer Circle’s hope for Fed access — CoinDesk

XEN token accounts for 11% of Ethereum gas consumption — The Defiant

Sam Bankman-Fried’s favorite video game is shutting down — Bloomberg