- Analysts say banks post too much collateral to satisfy regulators.

- Tokenisation of financial instruments could free this locked-up liquidity, regulators said during an event hosted by DL News.

Bitcoin spot exchange-traded funds have seen billions of dollars in inflows since they launched in January.

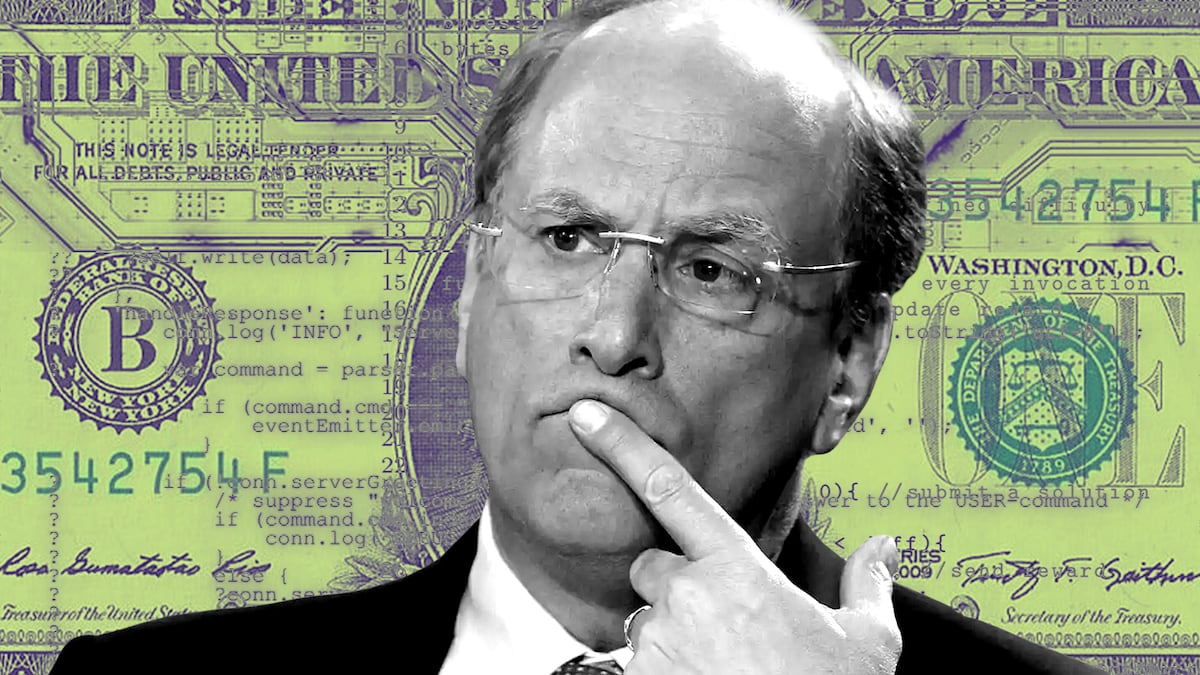

But — as BlackRock CEO Larry Fink believes — that’s just the beginning for digital assets’ foray into the world of high finance.

The ultimate goal for Wall Street is the tokenisation of every financial asset.

Fink is not alone. Governments are also beginning to explore how blockchain tech offers high finance an opportunity to tap into new efficiencies.

Tokenisation — trading financial instruments on a blockchain shared by investment banks and their clients — could unlock trillions in capital that’s “just sitting there, not used,” Peter Kerstens, an adviser at the European Commission, said during an event in Brussels hosted by DL News.

Kerstens cited figures from an industry report from the Global Financial Markets Association that evaluated the potential and risks of distributed ledger technology on financial markets. The May 2023 report found that as much as $19 trillion of collateral is currently outstanding across the short-term loans that investment banks make with one another.

“Even for us as regulators, that’s big money, that’s a big amount,” Kerstens said during the inaugural DL News event, “The future of crypto in Europe.”

Robert Kopitsch, secretary general of Blockchain for Europe, agreed.

“This is a giant that’s sleeping. It just needs to be unleashed,” Kopitsch said. “And I totally agree that this is the next big thing in financial services.”

So how would tokenisation help?

Global investment banks do a lot of short-term borrowing with one another to fund their trading activities.

These loans are often unsecured, so these banks must also prove to regulators that they hold enough high-quality assets to pay out if something goes wrong.

Banks don’t like holding on to these assets, as it represents an opportunity cost — they could be putting them to work and making revenue off them.

Tokenisation proponents say digitised versions of these high-quality assets could automate the processes by which investment banks post collateral, making it faster and more capital efficient.

That could free up billions annually to be redeployed in generating returns, according to the report.

“If you tokenise assets, and you have those transactions on blockchains, you can release $100 billion in liquidity yearly,” Kerstens said.

“So, is the traditional financial industry going to move into crypto? They are — crypto and tokenised assets.”

Tokenised collateral is not yet being done at scale, but Wall Street is increasingly testing the concept.

JPMorgan’s blockchain platform Onyx, for instance, allows users to complete short-term lending transactions in minutes using smart contracts to tokenise cash and collateral.