Disclaimer: The following is paid partner content. DL News and DL Research have not conducted independent analysis into the content of this article.

Traders and enthusiasts from the global crypto world got together in Dubai for the big TOKEN2049 event in late April 2025. They talked about the newest crypto trends and ideas shaping the future. Big investment companies like BlackRock were there too.

BlackRock, which launched a popular Bitcoin investment product (the IBIT ETF), shared some thoughts. It said that while big investors are getting more interested in its Bitcoin ETF, other coins (altcoins) are seen as a “different type of investment” right now, with less attention from these large firms at the moment.

This focus on Bitcoin ETFs doesn’t mean you should ignore everything else! It actually suggests that smart investors should look for the best crypto to buy now among the many other exciting projects developing outside the ETF spotlight.

Talks at TOKEN2049 about things like artificial intelligence (AI) in crypto and turning real-world items into digital tokens (RWAs) show where lots of innovation is happening.

Projects like the AI-powered memecoin Dawgz AI ($DAGZ) are a great example of the most promising opportunities you can find by looking beyond the main ETF headlines.

BlackRock’s Perspective

BlackRock’s representatives shared some interesting thoughts at the TOKEN2049 event, giving clues about how the huge company sees crypto. Its Head of Digital Assets, Robert Mitchnick, said that big money players (like institutions and wealth advisors) are increasingly buying their Bitcoin ETF, taking over from regular retail buyers. He mentioned that money is flowing back strongly into the ETF, showing lasting demand for Bitcoin.

Another BlackRock executive, Jay Jacobs, talked about how Bitcoin might be starting to act differently from assets like tech stocks. He said it’s becoming a safer place to put money when the economy feels shaky, and has been acting as its own thing lately.

However, Mitchnick made it clear that BlackRock sees Bitcoin differently from altcoins. He suggested that the idea of Bitcoin being a portfolio hedge mainly applies to Bitcoin itself right now, and other cryptocurrencies are a different kind of investment that big institutions aren’t piling into just yet. So, even though there are whispers about BlackRock maybe offering other crypto ETFs later (like Solana or XRP), its main focus for big investors currently revolves around Bitcoin.

But just looking at things through the lens of these ETFs only shows part of the picture. The wider talks and buzz at the TOKEN2049 event revealed lots of exciting innovation and opportunities happening across the crypto market beyond just Bitcoin.

These insights clearly signal that while Bitcoin ETFs are a significant development, they represent just one facet of a rapidly evolving and diverse digital asset ecosystem filled with distinct investment opportunities.

Why look beyond Bitcoin ETFs for the next bull run?

The convenience and regulatory familiarity of Bitcoin ETFs have undoubtedly opened the door for many new investors.

However, limiting exposure solely to these products could mean missing out on substantial potential returns and key technological trends, particularly during a bull run:

- Higher growth ceilings: Altcoins, especially those with smaller market capitalisations, inherently possess higher percentage growth potential compared to Bitcoin. While Bitcoin might aim for a 2x or 3x return in a strong bull run, certain altcoins aligned with powerful narratives could potentially achieve 10x, 50x, or even higher returns.

- Targeted exposure to key narratives: ETFs provide broad exposure to Bitcoin’s price movement. Directly investing in specific high-growth sectors highlighted at TOKEN2049 – like AI, RWAs, DeFi 2.0, web3 gaming, or specific layer 2 ecosystems – requires buying the native tokens of leading projects within those niches. You can’t get targeted AI crypto exposure through a Bitcoin ETF.

- Accessing early-stage innovation: ETFs typically list established assets. Investing directly allows participation in earlier stages, including presales or newly listed tokens like Dawgz AI, capturing potential growth before mainstream adoption or potential future ETF inclusion.

- True diversification: While Bitcoin itself is gaining recognition as a potential portfolio diversifier, diversifying within the crypto asset class is also crucial. Holding a mix of large caps (BTC and ETH) and carefully selected altcoins across different sectors can potentially smooth returns and reduce reliance on a single asset’s performance.

- Yield generation opportunities: Direct ownership often unlocks opportunities unavailable through ETFs, such as staking tokens ($DAGZ, ETH, SOL, ADA, etc.) to earn passive rewards or participating in DeFi protocols (lending, liquidity provision) to generate yield.

Therefore, while Bitcoin ETFs serve an important purpose, a forward-looking strategy often involves exploring the broader market to identify the best crypto to buy now based on emerging trends and technological advancements.

Opportunities highlighted by the market trends

Selecting the "best" crypto requires aligning investment choices with market narratives, technological merit, and individual risk appetite.

Based on the institutional focus highlighted by BlackRock and the innovative trends discussed at TOKEN2049, here could be one of the top contenders to consider in 2025:

Dawgz AI ($DAGZ)

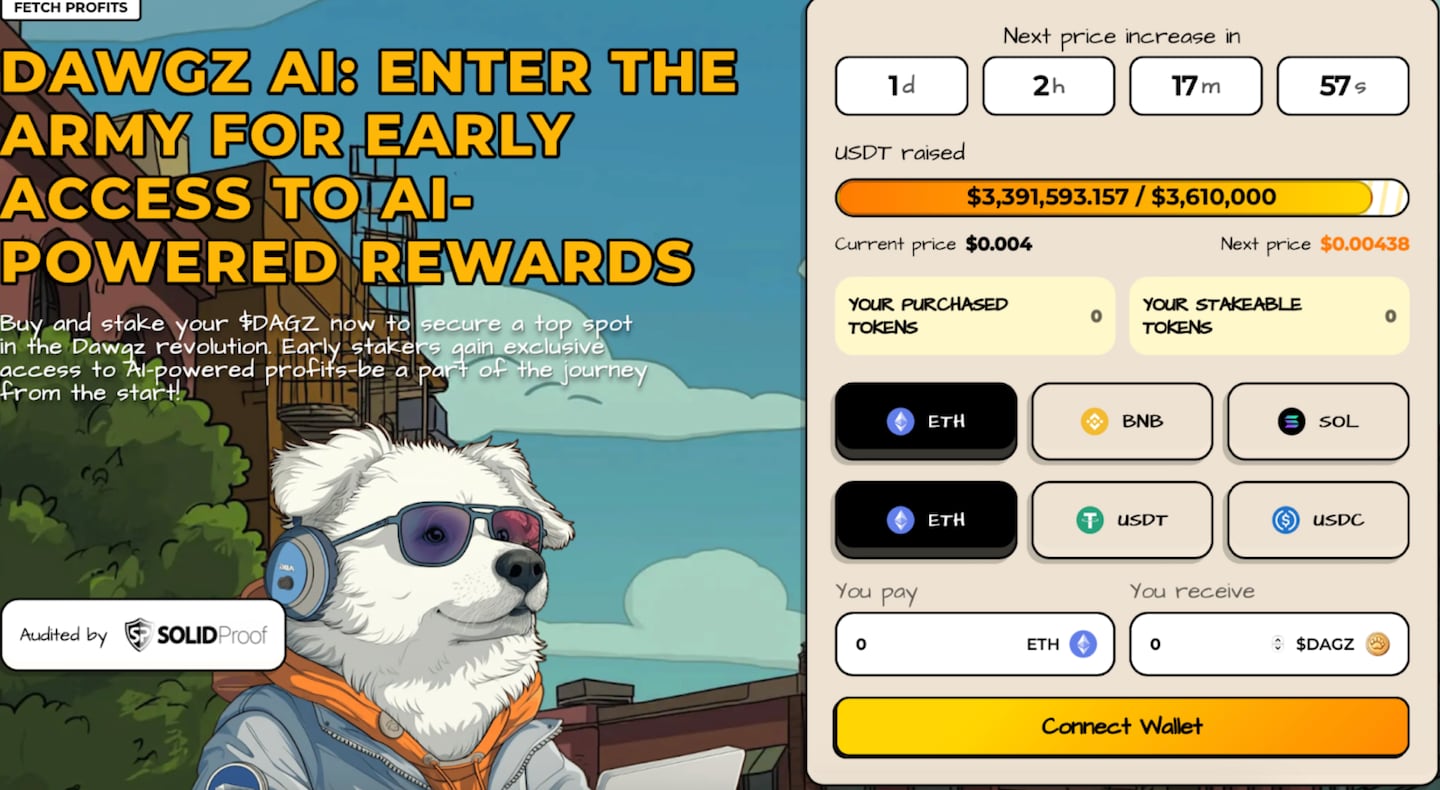

Dawgz AI ($DAGZ) is a perfect example of the opportunities you can find if you look beyond the main crypto ETFs. It cleverly mixes AI technology with fun memecoin culture – two big trends expected to be popular in the next bull run.

Many people think $DAGZ is one of the most promising new crypto projects to buy now because it offers real use cases with its AI features, unlike many memecoins that are just for hype.

The plan is for Dawgz AI to have smart tools like AI trading bots and market analysis to help its holders. It already had a successful presale, which raised over $3 million and showed strong early support. Plus, Dawgz AI uses the power of memes and community building (like its “Dawgz Army”) to go viral.

It also offers staking rewards to encourage people to hold for the long term, and its smart contract was checked for security by SolidProof.

For investors wanting high growth by tapping into the powerful AI trend, while also getting the fun and viral potential of a memecoin, Dawgz AI offers perhaps the best mix of risk and reward outside of the big ETFs in 2025.

Key considerations for 2025’s market

Successfully investing in the current climate, where institutional flows are heavily focused on Bitcoin ETFs but innovation thrives elsewhere, requires a nuanced strategy:

- Balanced portfolio: Consider a core holding in BTC and/or ETH for stability and broad market exposure, complemented by carefully selected, higher-potential altcoins like Dawgz AI that align with strong growth narratives.

- Narrative awareness: Stay informed about the dominant market narratives (AI, RWAs, L2s, etc.) discussed at events like TOKEN2049. Timing entries into projects leading these trends can be crucial, but avoid chasing hype without understanding fundamentals.

- Risk management: The potential for a bull run doesn’t eliminate risk. Use dollar cost averaging to make consistent entries, set realistic profit targets, consider stop-losses for volatile altcoins, and never invest more than you can comfortably afford to lose.

- Deep dive research: Don’t rely solely on ETF news or conference headlines. Investigate the specific technology, team, tokenomics, community, and competitive landscape of any altcoin before investing. Look for audits and transparent communication.

- Trading vs. holding: Determine your timeframe. Are you trading short-term narrative shifts or holding for the long term based on fundamental conviction? This impacts which coins you buy and your entry/exit strategy. Utilise reputable exchanges with good liquidity.

Conclusion: Should you trust the headlines?

TOKEN2049 Dubai offered a valuable snapshot of the crypto industry’s trajectory in 2025. While institutional giants like BlackRock understandably trumpet the success of their Bitcoin ETFs and highlight Bitcoin’s evolving role, the conference also underscored the immense innovation happening across the broader digital asset spectrum.

Themes like AI integration, RWA tokenisation, and layer 2 scaling point towards significant growth potential far beyond what current ETFs capture.

For investors seeking the best crypto to buy now, looking beyond the ETF narrative is essential. It requires diligent research and an understanding of emerging trends.

Projects like Dawgz AI ($DAGZ) exemplify this opportunity, strategically positioning themselves at the confluence of powerful narratives (AI and meme culture) while focusing on utility, community, and security. It represents a promising, high-potential investment for those willing to explore beyond the mainstream headlines.

As the market continues to build momentum, a balanced approach incorporating both established leaders and innovative altcoins, backed by thorough research, will likely be key to navigating the next crypto cycle successfully!