A version of this story appeared in our The Decentralised newsletter. Sign up here.

GM, Tim here,

Welcome back to The Decentralised. Here’s what’s catching my eye:

- Blast’s top investor speaks out amid controversy

- Kyber exploit sparks major DeFi pessimism

- Is Cosmos about to fork into two separate chains?

Blast announcement ‘crossed lines’

Paradigm head of research Dan Robinson has addressed the ongoing criticism levelled against Blast.

Blast is a newly-announced Ethereum layer 2 blockchain created by Blur founder Tieshun Roquerre, known online as Pacman. Venture firms Paradigm, Standard Crypto and more than a dozen angel investors have backed Blast.

There are a lot of components of Blast that I’m excited about and would be interested in engaging with people on. That said, we at Paradigm think the announcement this week crossed lines in both messaging and execution. For example, we don’t agree with the decision to launch the…

— Dan Robinson (@danrobinson) November 26, 2023

In his X post, Robinson criticised the way Blast had promoted itself, primarily the way it is using the promise of a future token airdrop to lure deposits — which are locked until February — before any of the blockchain’s infrastructure has been launched.

Robinson said such a tactic “sets a bad precedent,” and “cheapens the work of a serious team.”

Since its announcement on November 20, DeFi degens have piled over half a billion dollars into a multi-signature wallet connected to the unlaunched blockchain.

Blast has promised token rewards for those who deposit funds before the blockchain launches next year. The hype was also fuelled by Paradigm’s backing and the Blur creator’s involvement.

Keen DeFi participants have pointed out that Blast did not disclose the five people who control the wallet where user deposits are sent. Some consider it a major red flag.

Onchain data shows the four of the five addresses that control the multi-signature wallet were funded from the same initial wallet.

Overall, the announcement appears rushed and designed to generate extreme hype while promising nothing concrete.

And whenever something is hurried out, security always takes a hit.

If what we’ve seen so far is any indication of what’s to come, I wouldn’t want to bet on it.

That doesn’t mean it won’t hit an absurdly high valuation — this is crypto after all.

The ‘most bearish’ DeFi take

The $47 million exploit that hit cross-chain exchange Kyber Network has raised debate about how fundamentally secure the $46 billion DeFi ecosystem really is.

not FTX, not SEC, not even Luna

— mert | helius.dev (@0xMert_) November 24, 2023

this might be the most bearish tweet re: DeFi that I've ever seen

no matter how much you prepare — there are attackers with infinite time and patience trying to rob you pic.twitter.com/NHK6eIS4NT

The gist is that the Kyber Network exploiter was able to find the smallest of gaps in the way the protocol’s code worked, an effort which likely took countless hours.

As @0xMert_ points out, developers only have so much time and resources to audit their code and test it for edge cases and obscure interactions. But once it’s deployed on a blockchain, hackers, on the other hand, have limitless time to try and break it.

Some, such as crypto security researcher Atis Elsts, say that such a take is too pessimistic, and that previously discovered bugs in Kyber’s code were a smoking gun for the exploit.

While developers are always looking to push the boundaries of what’s possible with smart contracts, it would behove many to place a greater emphasis on security.

It’s worth noting that well-established protocols like Uniswap v2 or Lido have proven resilient to attack so far, and, finger crossed, they will remain so.

It may be less exciting than the alternative, but I believe DeFi can still succeed if only the most scrutinised and battle-tested code is trusted.

Development will be slower, but doing so would hopefully increase trust — something essential if DeFi plans to compete with the existing financial system.

Cosmos co-founder proposes fork

A recent proposal to cut staking emissions has divided the Cosmos community and has ended up splitting the blockchain — literally.

Cosmos co-founder Jae Kwon has proposed a fork — using the Cosmos codebase to create a new, separate blockchain.

The reason, Kwon said, is that he and his supporters don’t like the idea of conceptualising staking rewards as money. Now they want to create their own version of cosmos that more closely follows their ideals.

Those in favour of reducing staking rewards cited data from Blockworks Research, which suggests Cosmos is overpaying for security.

As many onlookers were quick to point out, if Kwon does indeed fork Cosmos, it means everyone holding ATOM tokens would receive an equal amount of a new token on the forked blockchain — just as the 2016 DAO hack fork split Ethereum into its canonical and classic versions.

Despite the rift in the Cosmos community, Kwon still wants his fork to integrate with the original version of the blockchain.

It may be that the proposed fork will become one more chain linked up to Cosmos’ Inter-Blockchain Communication Protocol.

Data of the week

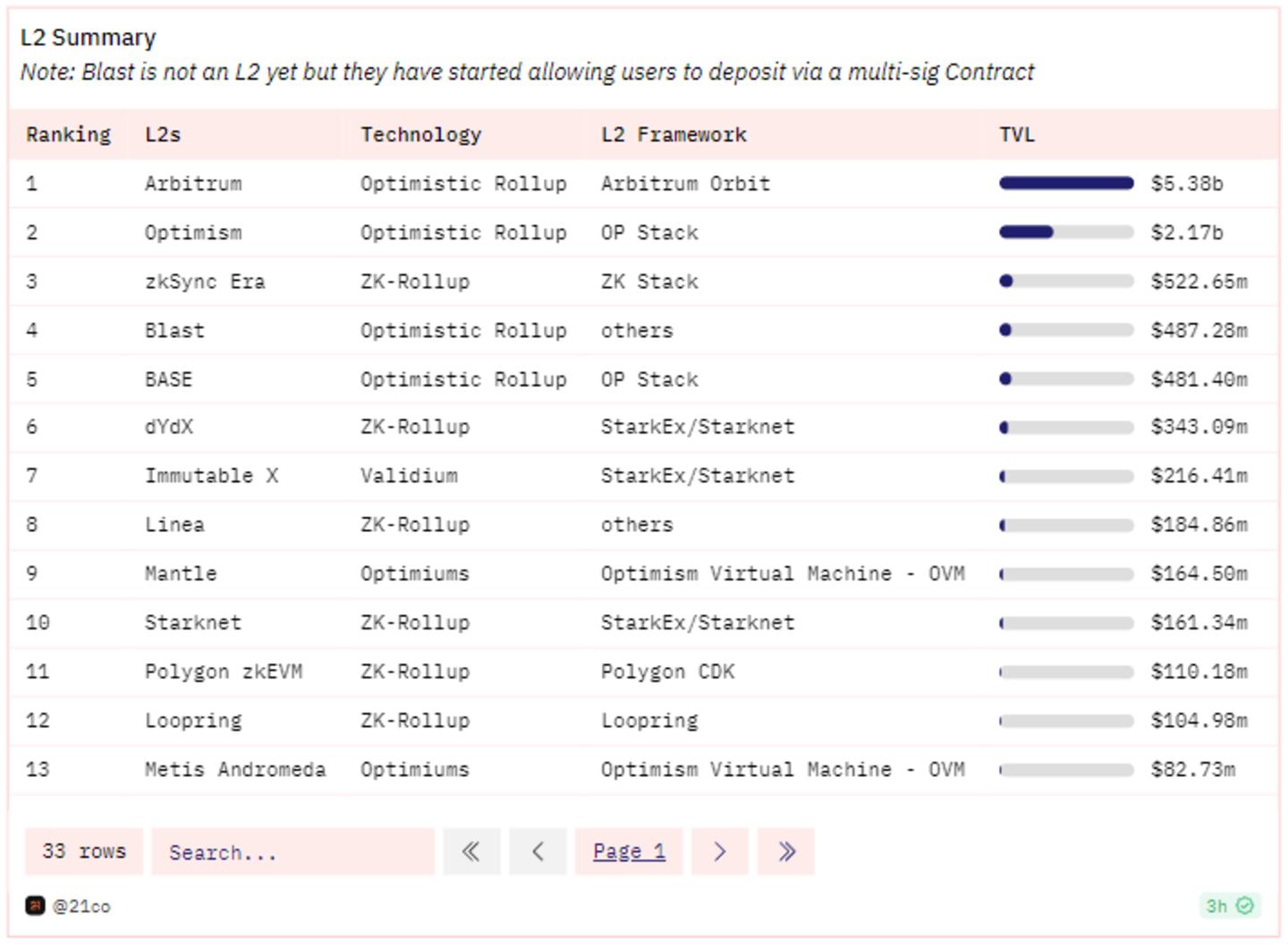

Despite having yet to launch a usable product, Blast has become the fourth-largest layer 2 blockchain by total value locked, surpassing Coinbase’s Base.

This week in DeFi governance

PROPOSAL: Build ApeChain on Optimism’s OP Stack

VOTE: Arbitrum DAO decides on procurement framework for service providers

Post of the week

@CL207 encapsulates the situation with new layer 2 Blast, and respected crypto venture firm Paradigm’s investment in it, with a simple yet pithy post.

"sell me this pen"

— CL (@CL207) November 23, 2023

Pen, backed by Paradigm

What we’re watching

Former Terra blockchain developers are throwing their weight behind Mint Cash — a new stablecoin created using a fork of the original Terra codebase. What could go wrong?

Have you joined our Telegram channel yet? Check out our news feed for the latest breaking stories, community polls, and of course — the memes.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.