- Maple Finance makes Solana comeback after a $36 million loan default linked to FTX.

- The crypto lending protocol will offer its cash management solution on Solana.

- DAOs and web3 companies will be able to access US Treasury yields via Maple’s Solana deployment.

Maple Finance is back on Solana.

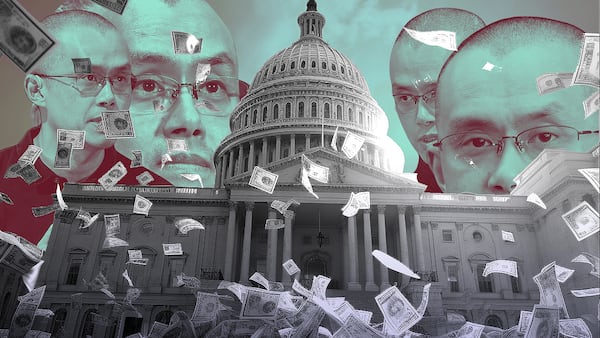

News that the private crypto credit marketplace, which has issued over $2.2 billion in loans, is getting back on Solana hit the wire on Monday — months after it pulled out of the blockchain network in the wake of FTX’s collapse.

The crypto exchange’s founder, Sam Bankman-Fried, frequently lauded Solana. Disclosures by Solana developers and companies owned by Bankman-Fried showed the two were intertwined. The association with FTX proved a drag for the blockchain network.

Maple was one of the many crypto firms shaken by the shockwaves of FTX’s November crash. It suspended all its lending pools on Solana in January.

Crypto arbitrage trading firm Orthogonal Trading, which had funds stuck on FTX, defaulted on eight loans on Maple to the tune of $36 million in December. These bad loans impacted between 30% and 80% of investors in the affected lending pools.

Crypto credit firm M11, whose lending pools were most affected in the debacle, stopped lending on Maple before resuming the service in April. Maple eventually cut ties with Orthogonal Trading.

At the time of its pause on Solana, Maple had processed $125 million in loans issued on the blockchain in partnership with stablecoin issuer Circle, institutional credit infrastructure company Credora, and digital assets financial firm Genesis.

NOW READ: How arrival of Ethereum futures ETF may trigger ‘brutal fee competition’ between fund providers

Monday’s launch will see Maple open its cash management solution on Solana.

The new products provide on-chain treasury management solutions to clients like decentralised autonomous organisations and web3 companies. The cash management solution offers simplified access to US Treasury bill yields.

Maple secured an exemption from the US Securities and Exchange Commission on August 9 to offer Treasury yields to investors in the United States

NOW READ: Crypto lender Goldfinch faces bumpy road after motorbike company defaults on $5m loan

Solana-based protocols like stablecoin issuer UXD, perpetual swaps protocol Drift, and DeFi lending protocol Solend have committed to using the lending pool, according to the announcement.

DeFi interest in private credit deals, and US Treasury bills in particular, is on the rise.

The growing popularity of these assets can be seen in the size of the tokenised Treasuries market growing from $113 million at the start of the year to $641 million, according to data from real-world asset analytics platform RWA.xyz

Maple’s return to Solana comes as the blockchain’s network DeFi market has flatlined for all of 2023 amidst a prolonged crypto bear market.

Solana currently ranks ninth among blockchain networks with a DeFi market with the chain attracting $305 million from investors, a 97% crash from its $9.9 billion peak in November 2021.

Ethereum layer 2 networks like Arbitrum and Optimism have overtaken Solana in attracting interest from investors.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.