- Binance’s $3.8 billion in outflows in June and shrinking market share may be just the start of its problems.

- The exchange giant still lures big trades because ‘liquidity attracts liquidity.’

- But that could change. Finance giants are wading into crypto as prosecutors circle Binance.

Binance CEO Changpeng Zhao must be relieved that June is over.

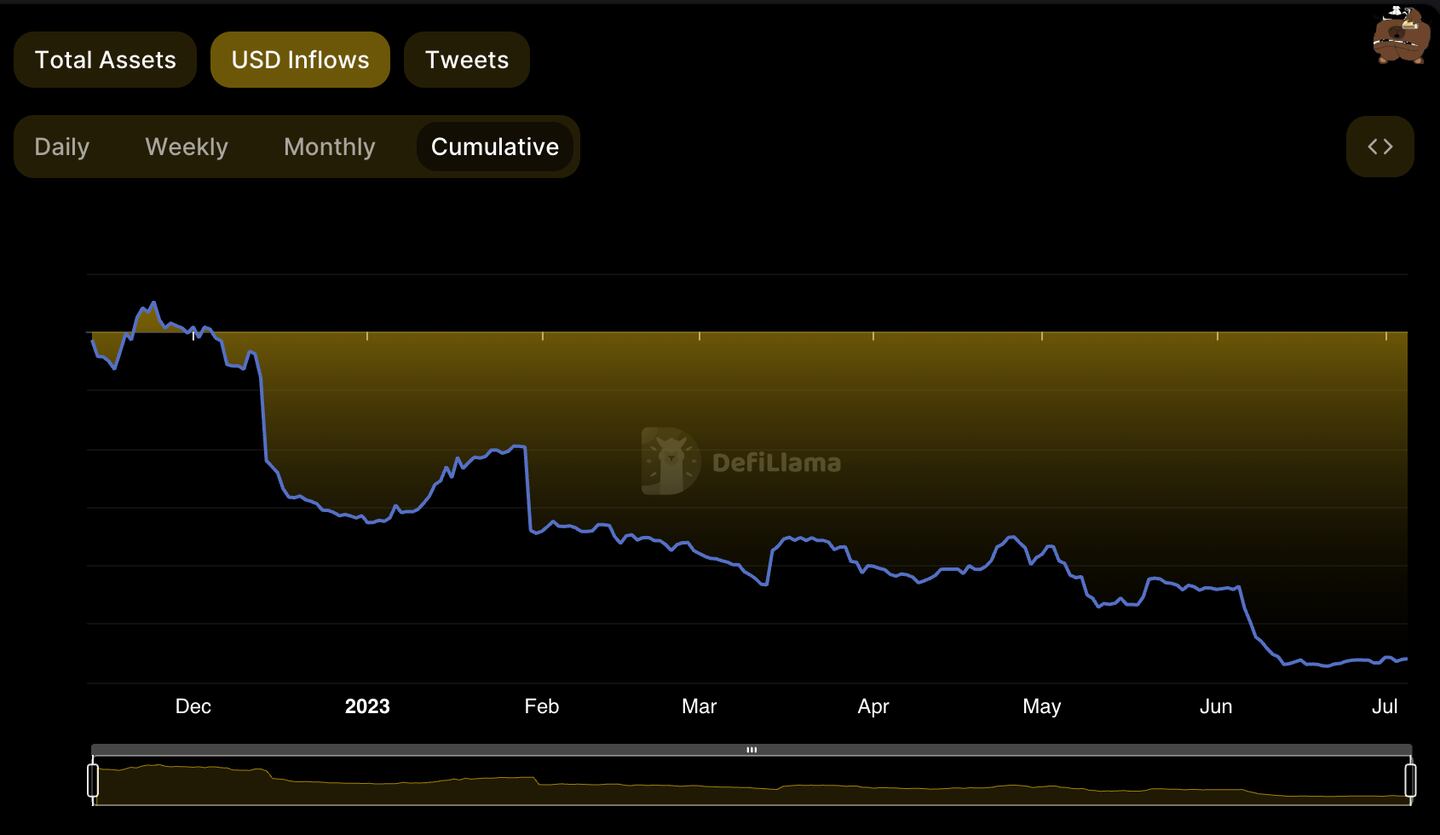

Investors yanked $3.8 billion from the world’s top crypto exchange in June, which was more than double the outflow in May and the worst showing since December, according to DefiLlama data.

Yet there may be no relief in sight for Zhao and his embattled company. Binance is taking fire from US regulators, shuttering operations under pressure from officials across Europe, and bracing for a potential criminal indictment in America.

Walls closing in

If that wasn’t enough, finance giants such as Fidelity, BlackRock, and Charles Schwab are moving to capture a bigger slice of the crypto market.

“It seems like the walls are definitely closing in on Binance and that they’re in real trouble,” Sean Tuffy, a regulation expert and former Citigroup executive, told DL News.

‘It seems like the walls are definitely closing in on Binance and that they’re in real trouble.’

— Sean Tuffy

Still, Zhao does have one thing going for him and his exchange — it’s sheer size. As the go-to marketplace for cryptocurrencies with more than $8.2 billion in daily trading volume and $59 billion in assets, Binance is hard to ignore.

And investors continue to make markets in their chosen digital assets on its marketplace.

“Binance continues to be a focus for liquidity since liquidity attracts liquidity,” said one institutional crypto trader, who declined to be named discussing Binance publicly.

But this situation may be fleeting. Expectations are mounting that US prosecutors will follow the lead of the US Securities and Exchange Commission and charge Binance with criminal allegations in connection with its US businesses.

The problem is that Binance has not registered with the SEC as an exchange, broker-dealer, or clearing firm.

While Binance, along with Coinbase and other crypto firms, contends it shouldn’t have to register because digital assets are different from stocks and bonds, SEC Chair Gary Gensler disagrees. The agency has sued Binance and Coinbase for failing to comply with the law.

NOW READ: Crypto exchange guardrails are coming whether Gary Gensler wins his crusade or not

In theory, Binance could weather the agency’s civil case, said Riyad Carey, research analyst at blockchain analysis firm Kaiko. Many financial institutions slapped with SEC enforcement actions eventually settle. In February, for instance, Kraken, the Binance rival, settled a lawsuit with the SEC by paying $30 million in disgorgement and penalties and shutting down its staking business.

“The SEC lawsuit is not a death sentence for Binance International,” Carey told DL News. “Maybe they’ll pay a fine or something. That’s generally how it goes.”

Serious Issue

But a criminal indictment is another order of magnitude. “It would definitely be a more serious issue for the exchange going forward,” Carey said.

A Binance representative told DL News the company holds assets on a one-to-one basis and has strong liquidity.

In response to questions about the potential criminal case, a spokesperson referred DL News to comments made earlier this year by Patrick Hillman, the company’s chief strategy officer. “Binance takes the issue of compliance very seriously, and it regularly engages with US law enforcement,” Hillman said.

‘Given the s scrutiny against Binance, institutional investors will be considering their options.’

— Jacob Joseph

Ever since the failure of FTX last year cast doubt on the strength of opaque crypto exchanges, Binance has found it difficult to shore up confidence in its operations. Binance customers have pulled $16.7 billion out of the exchange since FTX’s bankruptcy on Nov. 11, according to DefiLlama. With Binance’s investors and liquidity now in play, the exchange’s rivals are starting to pounce.

OKX, a centralised exchange with about a fifth of Binance’s assets, has doubled its deposits by $4.1 billion since the collapse of FTX, according to DefiLlama.

Here Comes TradFi

And finance Goliaths are looming. Fidelity, Schwab, and Citadel Securities, a market making firm headed by hedge fund billionaire Ken Griffin, have joined forces in a new exchange called EDX Markets.

At the same time, BlackRock, the world’s biggest asset manager with $9 trillion in assets, is racing Fidelity and Cathie Wood’s Ark Invest to win SEC approval for a spot Bitcoin exchange-traded fund.

NOW READ: Fidelity races BlackRock to a Bitcoin ETF — but Cathie Wood’s Ark is first in line

“Given the s scrutiny against Binance, institutional investors will be considering their options,” said Jacob Joseph, a research analyst at CCData.

Meanwhile, Binance is confronting damage in yet another business — its stablecoin, Binance USD. After the SEC in February ordered Paxos to stop issuing BUSD because it was an unregistered security, the token’s circulating supply has dwindled.

The total circulating supply of BUSD has fallen to $4 billion from over $16 billion in February, according to DefiLlama data. As BUSD loses its attraction as a convenient means of converting fiat currencies to cryptocurrencies, that could further turn off investors from the entire Binance ecosystem.

Pressure in Europe

Then there’s the dramatic shift in Binance’s fortunes in Canada and Europe. In May, Binance quit Canada, blaming the country’s new and stricter crypto laws.

In June, Binance abruptly announced it was no longer accepting new customers in the Netherlands after it failed to win approval from Dutch officials.

At the same time, German regulators rejected Binance’s application for a license. The exchange dropped its application in Austria. And it has ceased operating in Belgium after authorities ordered it to stop offering virtual currency services. Binance is also not permitted to offer any regulated activity in the UK.

Meanwhile, French prosecutors have reportedly opened preliminary investigations into Binance’s alleged failure to comply with background checks and anti-money laundering rules.

All this pressure is inflicting a toll. Binance’s share of the spot crypto market has fallen to 42% from around 60%, according to data from The Block Research. Binance’s market share plunged 7% in June alone.

Ronaldo does Binance

Zhao has long insisted Binance is solid financially and complies with regulations. He regularly dismisses challenges and criticism as little more than FUD or fake news.

On Monday, Zhao celebrated Binance’s latest celebrity deal — Ronaldo, the football superstar, debuted his NFT collection on the exchange’s NFT marketplace sporting a Binance jersey.

Yet the big story in crypto isn’t NFTs — it’s Bitcoin’s 87% surge this year. As bullishness breaks out everywhere, Binance’s metrics appear to be going in the wrong direction. And the worst may be yet to come.

Do you have a tip about Binance, exchanges or another story? Reach out to us at eric@dlnews.com and adam@dlnews.com.