- Bitcoin held by ETFs in the US have unseated Grayscale.

- The speed at which they’ve done so has exceeded expectations.

- Grayscale still holds a considerable amount of Bitcoin.

New US spot Bitcoin exchange-traded funds have blown past Grayscale’s total assets under management as investors continue to chase cheaper fees.

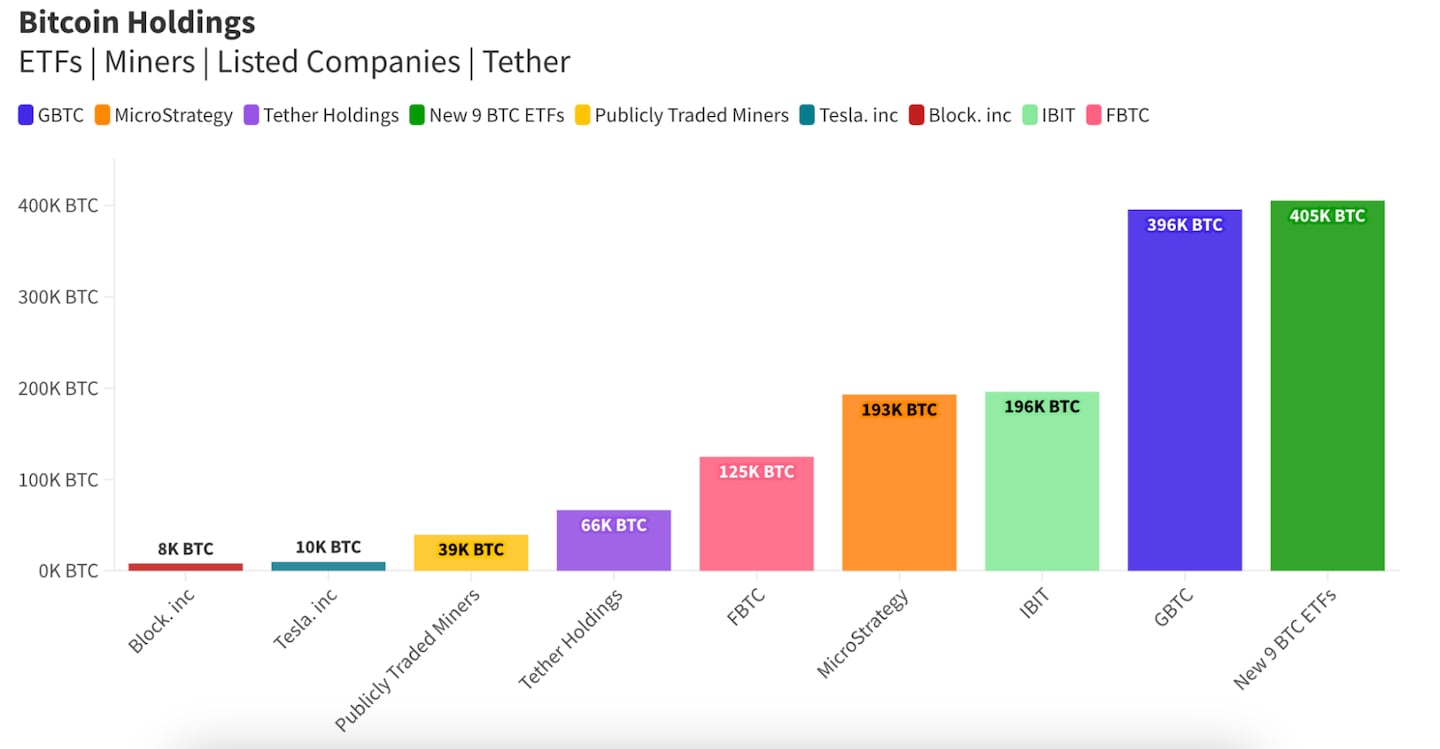

The total Bitcoin held by the nine other US funds has topped 405,000, worth about $28.9 billion.

That exceeds Grayscale’s Bitcoin Trust’s 396,000 Bitcoin, valued at about $28.2 billion, according to Apollo data.

”All this was bound to happen, but not in eight weeks. Scary fast,” Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, said in a Saturday post on X.

The shift comes as Bitcoin tops $71,000, surpassing its 2021 record of about $69,000.

ETFs from BlackRock, Fidelity, Ark Invest, and others have attracted unprecedented levels of new investment, breaking records for the asset vehicle’s 31-year history.

Balchunas pointed to a chart shared by individual investor Fred Krueger, which also shows that BlackRock’s IBIT fund has surpassed MicroStrategy’s holdings by 3,000 BTC.

“Wall Street is now in control,” Krueger said in a post on X.

To be sure, Grayscale’s fund still holds a much larger portion of Bitcoin than publicly traded miners, as well as holdings from Tether, Tesla, Fidelity, MicroStrategy, and Block.

That’s despite its fees remaining the highest in the industry.

The asset manager currently charges a rate of 1.5% per year for investors looking to buy into its fund.

That’s 125 basis points higher than its closest rivals, Fidelity and BlackRock.

Grayscale’s total Bitcoin holdings have declined roughly 36% since it was greenlit for trading on January 10, dropping from 619,000 BTC to 396,000 BTC in two months, Apollo data shows.

Even with the outflows, Bitcoin’s rising price has managed to maintain the asset value of Grayscale at a roughly even level.

As of Sunday, the fund is down by about $700 million from $28.4 billion seen on Tuesday to $27.7 billion, DefiLlama data shows.

Based on those figures, Grayscale’s implied annual revenue generated from fees stands at $415.5 million.

BlackRock and Fidelity are expected to garner a little over $30 million in fees this year.

“Bitcoin’s recent price surge has essentially offset the fund’s massive outflows,” Nate Geraci, president of financial advisory firm The ETFStore, told DL News last week.

It’s possible Grayscale had banked on the approval of a spot Bitcoin ETF that would “create a new wave of demand,” and drive up Bitcoin’s price, Geraci said at the time.

“If so, that looks smart right now,” he said.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.