- Grayscale is losing its liquidity advantage in the spot Bitcoin market.

- JPMorgan analysts say it’s behind BlackRock and Fidelity on key metrics.

- The investment bank previously said an additional $10 billion could leave GBTC if it loses this lead.

Outflows from Grayscale’s spot Bitcoin exchange-traded fund could pick up as bankrupt firms sell and it loses its liquidity advantage to rivals.

Bankrupt crypto trading firm Genesis will seek approval from the Southern District of New York court on Thursday to sell nearly $1.4 billion in Grayscale’s GBTC. This follows FTX’s near $1 billion redemption from the fund in January.

Over $6 billion has left the fund since it converted to an ETF on January 11, and while the bleed has stemmed in recent days it could pick up again due to several reasons, JPMorgan analysts wrote in a note on Wednesday.

Without “meaningful cuts to fees,” JPMorgan analysts said more money will leave Grayscale’s GBTC.

Newly created ETFs, like BlackRock and Fidelity, will capture investors fleeing Grayscale’s 1.5% management fee — which is currently as much as 150 basis points higher than some competitors.

BlackRock charges just 0.12%. Fidelity charges 0.25%. Cathie Wood’s Ark Invest’s fund charges zero fees, which will rise to 0.21 after the first six months.

Grayscale’s woes aren’t limited to fees. The digital asset manager is behind BlackRock and Fidelity on two key liquidity metrics, JPMorgan said in the report.

Liquidity is the ability to sell an asset for cash. Less liquidity poses a risk for investors as they could find it hard to sell their shares.

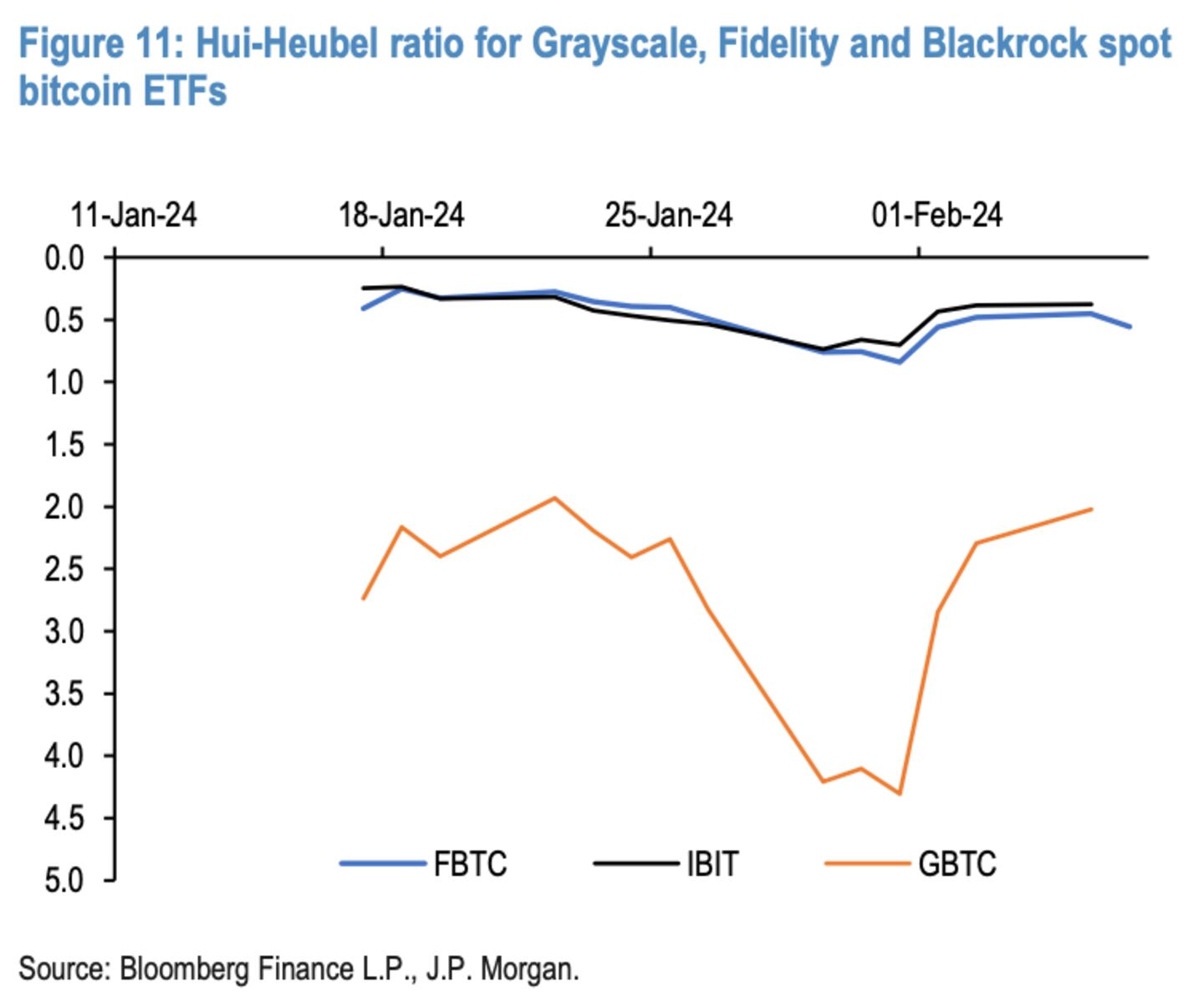

BlackRock and Fidelity’s Bitcoin ETFs are more resilient when it comes to market breadth, or the sensitivity of prices to volumes.

The two traditional giants’ ETFs “exhibit significantly more market breadth than GBTC,” JPMorgan’s report said, using the so-called “Hui-Heubel Liquidity ratio” to measure this.

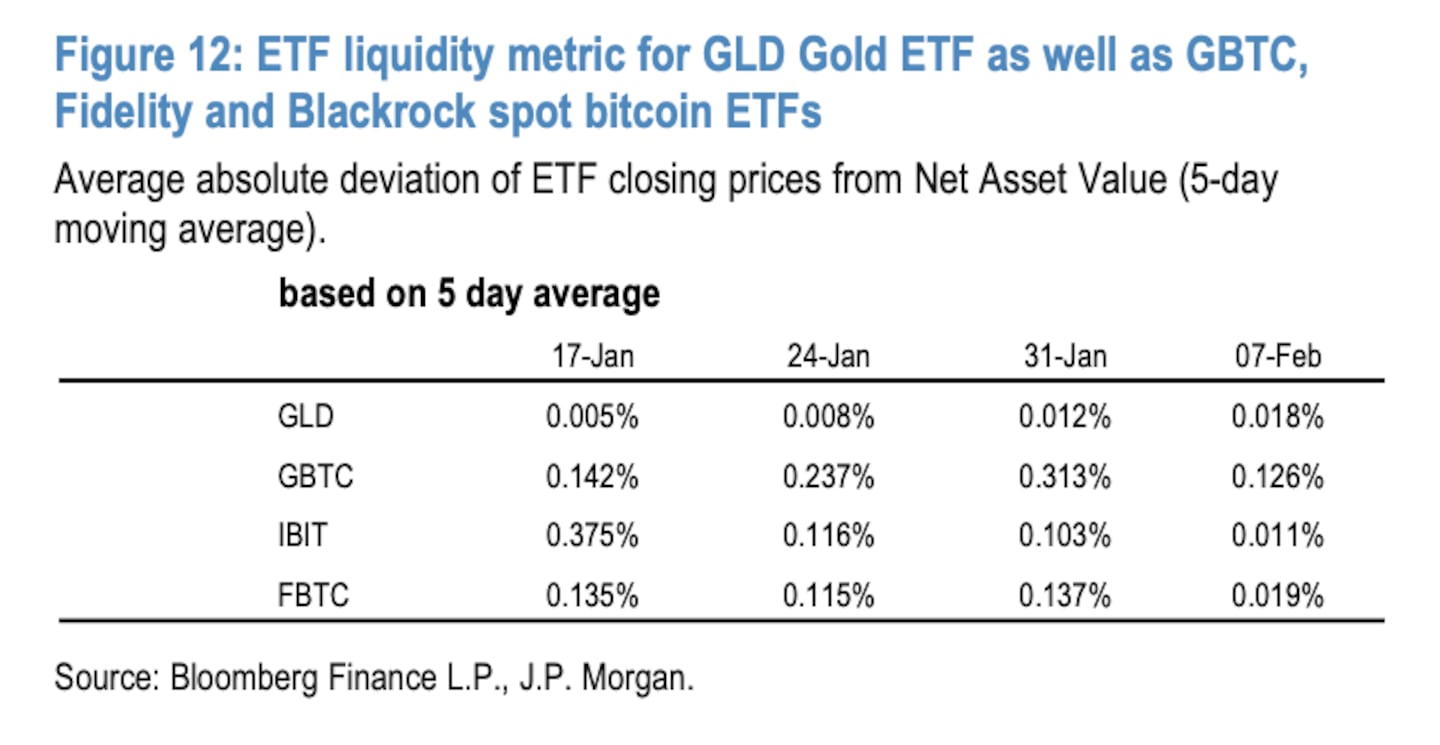

Grayscale is also behind BlackRock and Fidelity when it comes to another key metric — the difference between share price and the net asset value per share at market close.

A low average deviation between the ETFs price compared to the amount of Bitcoin the shares represent implies high liquidity, JPMorgan analysts said.

“In theory, the arbitrage process to bring ETF prices closer to NAVs should be faster and more efficient in periods of higher liquidity, low transaction costs and low volatility when arbitragers are more likely to make money from exploiting ETF mispricings,” the report said.

Blackrock and Fidelity’s Bitcoin ETFs now closely match gold ETF on this metric. This implies “a significant improvement in liquidity,” JPMorgan said.

Meanwhile Grayscale’s ETF has remained higher, “implying lower liquidity,” the analysts wrote.

While these two metrics don’t capture “all dimensions of market liquidity and in particular market depth (i.e. the ability to execute a large order without moving prices too much against you),” the investment bank said Grayscale is already losing its liquidity advantage.

JPMorgan said last month that an additional $10 billion could leave GBTC if it loses its liquidity advantage.

Adam Morgan McCarthy is a markets correspondent for DL News. Have a tip? Contact the author at adam@dlnews.com.