- The SEC told recent applicants to refile with more information, the Wall Street Journal reported.

- The SEC wants to know what exchange will be used for pricing any potential spot Bitcoin ETF.

- John Reed Stark, a former chief at the SEC Office of Internet Enforcement backed the decision

Dreams of a spot Bitcoin exchange-traded fund just hit a roadblock.

The Securities and Exchange Commission wants to know where asset managers will pull Bitcoin prices from.

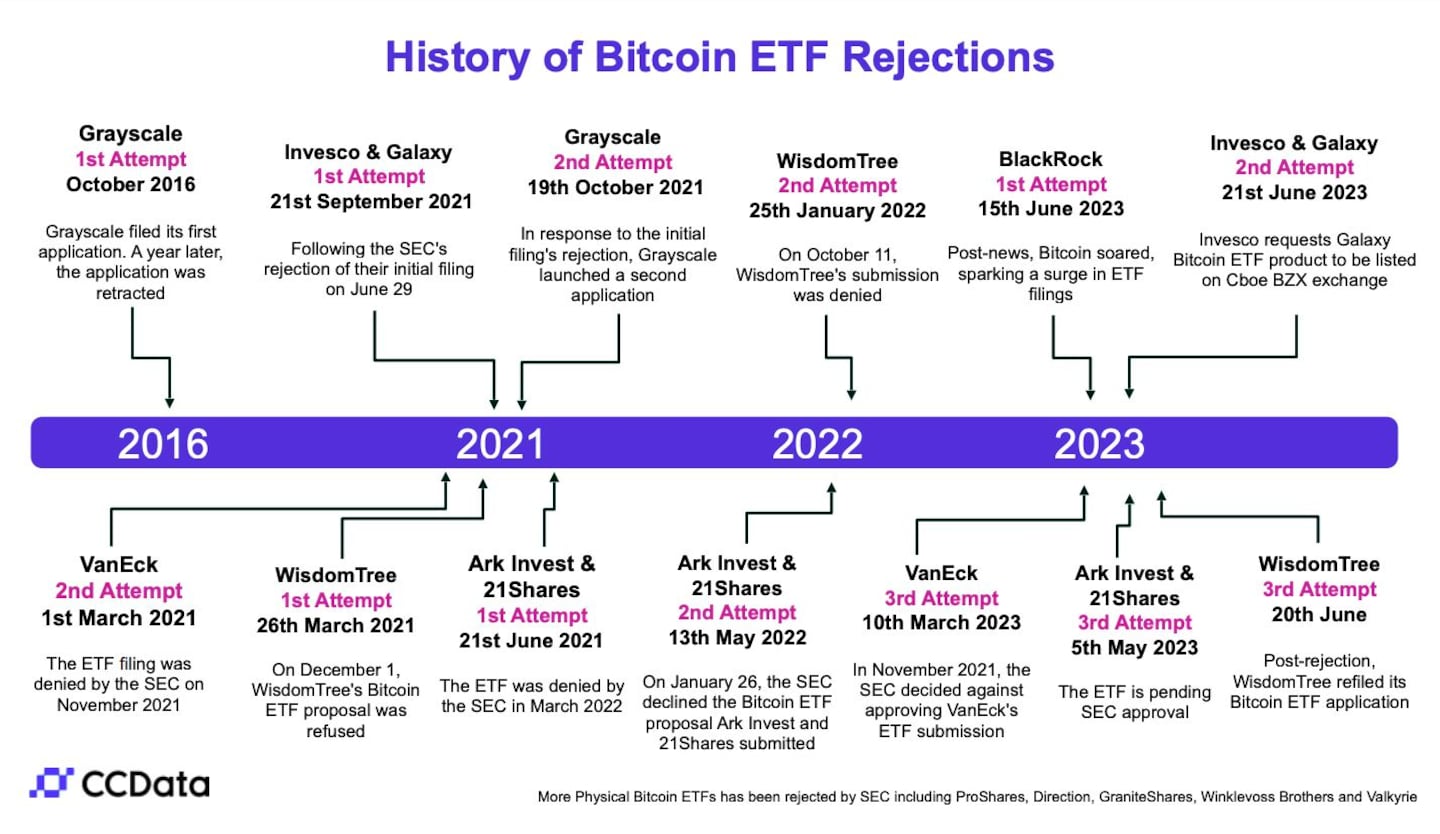

That’s according to a Wall Street Journal report. This means Ark Invest, BlackRock, and Fidelity need to refile and say which exchange they will use for pricing.

The regulator’s rationale is spot-on and its argument “keeps getting stronger and more compelling,” said John Reed Stark, a former SEC chief at the Office of Internet Enforcement.

The argument? That Bitcoin is subject to price manipulation on unregulated platforms.

NOW READ: Fidelity may beat hiring goal for a 500-strong crypto unit in finance land grab

Reed said that Binance, the largest crypto trading venue, is “rife with manipulation and fraud,” while Coinbase is “operating unlawfully and engaging in multiple registration failures.”

Both exchanges have hit back at SEC allegations.

Hopes that this time was different were dented following the report. Bitcoin traded down on the news, plunging below $30,000. Bitcoin is up about 71% this year, helped as investors piled in on the ETF filings.

CBOE told the WSJ that it plans to refile the recent applications. Fidelity joined a crowded field hoping to gain approval for a spot Bitcoin exchange-traded fund this week.

Fidelity’s application follows similar filings from BlackRock, WisdomTree and Valkyrie. The applications come as more financial firms seek to widen their crypto offerings.

NOW READ: Fidelity races BlackRock to a Bitcoin ETF — but Cathie Wood’s Ark is first in line

Bank giants and asset managers are on a hiring spree in digital assets amid projects in trading, payments and tokenisation.

The SEC rejected Fidelity’s last application in early 2022. No application has been successful to date.