- BNB joins Bitcoin, Ether, and Solana in corporate treasuries.

- The firm plans to hold about 10% of Binance’s native token.

- It’s the latest twist in the crypto corporate treasury playbook.

First it was Bitcoin. Then XRP and Solana, and Ethereum.

Now throw Binance’s BNB token into the mix.

On Tuesday, Nano Labs, a Chinese chip maker, released a $1 billion plan to turn BNB into a treasury asset for the company.

The firm said it would raise $500 million through the sale of a convertible note, a debt instrument with the eventual option of turning into equity.

The convertible notes will be unsecured, interest-free, and turn into shares priced at $20 each over the next 12 months.

Preferred stock

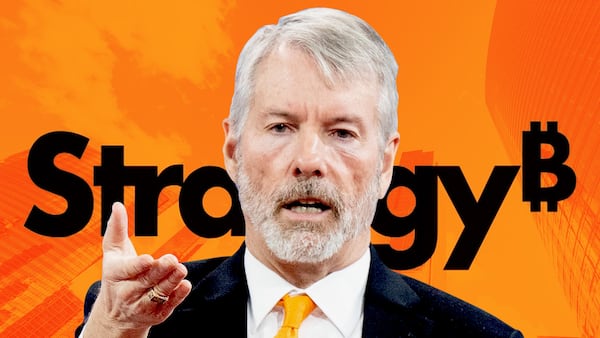

It’s a structure that closely mimics how Strategy, the software firm where Saylor is executive chairman, financed its Bitcoin stack.

Saylor has now pivoted to a preferred stock strategy.

Nano Labs’s goal? To eventually hold up to 10% of BNB’s circulating supply.

With a market value of $93 billion, BNB is the fifth largest cryptocurrency, according to CoinGecko.

This latest deal shows how rapidly companies are stockpiling cryptocurrencies ranging from Bitcoin to Solana to XRP and now BNB.

Companies are no longer just buying Bitcoin as a hedge — they’re also betting on Ethereum and XRP as long-term strategic assets.

SharpLink Gaming, an online casino, said last week that it was spending nearly half a billion on Ether as a primary reserve asset. Consensys CEO Joe Lubin helped ink the deal.

Symbolic buys

XRP is also getting attention.

Chinese ride-hailing startup Webus laid out plans for a $300 million XRP stockpile, while Saudi-backed VivoPower is targeting $121 million in XRP.

Nano Labs isn’t new to the crypto corporate treasury business, however.

By March, it had acquired $30 million worth of Bitcoin through a subsidiary, at an average cost price of $99,700.

In January, the firm picked up 47 of President Donald Trump’s memecoin. It was a symbolic buy, said the company, which cost it a little over $1,100.

BNB, formerly known as Binance Coin, is the native token of the world’s biggest crypto exchange.

Holders get trading fee discounts on Binance and can use the token to pay for transactions on BNB Chain — a blockchain that powers dozens of crypto apps and games.

A large chunk of trading goes through Binance. The platform processed $24 billion in the past 24 hours, nearly six times its closest follower, BitGet.

‘Alarming trend’

While optimism brims the crypto treasuries will pay out big profits for companies, some analysts are sounding a cautionary note.

Noelle Acheson, the influential macro analyst, said the Bitcoin treasury strategy is an “alarming trend,” in that surely this is not a no-risk investment.

“Especially for those getting into the structure at a much higher Bitcoin price.”

That’s because for these firms, said Acheson, Bitcoin is not a treasury diversifier, but rather a speculative base asset that can be leveraged.

Indeed, that’s cause for concern for legendary short seller Jim Chanos who has also taken aim at Strategy by criticising Saylor’s latest move.

Chanos, who has been publicly shorting Strategy, said selling preferred shares designed to rescind dividend payments at any moment is “complete financial gibberish.”

Anyone buying in “must be crazy,” he said.

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.