- Coinbase’s Base has seen a flurry of activity over the past two weeks.

- The layer 2’s success could be a revenue boost for the exchange, which has seen market share slide as retail fees rose.

- Base could exceed estimates of $60 million a year, said a Needham analyst.

- Driving early activity on Base is both meme coin trading on decentralised exchanges and a new social media project called friend.tech.

Coinbase’s layer 2, Base, went live this week, and a surprise flurry of activity suggests it could be a revenue boost for the exchange.

Coinbase, facing sliding market share and concerns about rising fees for retail customers, officially launched Base on Wednesday.

But customers were able to pile in earlier. It clocked up nearly $60 million in volume over the last three days, according to DefiLlama. The layer 2 project registered nearly $1.6 million in fee revenue since the beginning of August.

“If Base continues at this rate of activity it could exceed Needham’s estimates of $60 million annual revenue, $15 million net,” John Todaro, a Needham analyst, told DL News. He also noted it’s hard to extrapolate too much just days after launch.

NOW READ: Coinbase earnings flash warnings that market share may shrink further

Base is a so-called layer 2 network, designed to lower gas fees for users making transactions on layer 1 blockchains, like Ethereum. It’s the latest Ethereum layer 2 project connected to a crypto firm, a list which includes ByBit’s Mantle and MetaMask’s Linea, among others.

Coinbase calls Base an “open and permissionless system” and says anyone can build and deploy contracts on the chain. Crypto’s biggest decentralised exchange, Unsiwap, deployed on Base Wednesday.

Needham analysts wrote at the time of Base’s announcement in March that management is “returning to its roots and offering product differentiation from non-crypto native peers, such as Robinhood.”

The bank’s “base case” saw the $60 million total revenue annually for subscriptions and services in the medium term — a revenue line that is in need of a boost as interest income from stablecoin USDC comes under threat.

Coinbase’s total net revenue in the second quarter was $663 million.

NOW READ: Coinbase blockchain Base goes live on public mainnet and plans to ‘decentralise over time’

Early activity on Base is being driven not only by meme coin trading on decentralised exchanges like Uniswap and BaseSwap but also by a new social media project called friend.tech, which allows users to tokenise their Twitter identity.

Coinbase management downplayed the impact in an earnings call last week.

The layer 2 is expected to have a non-material impact in the near term, analysts from investment bank TD Cowen noted after the exchange’s second quarter results.

Losing market share

Despite this week’s successful launch, all is not well at Coinbase.

NOW READ: BlackRock’s aim to make crypto cheaper should scare Coinbase

The firm’s ongoing legal battle with the Securities and Exchange Commission and a drop in trading volumes pose threats to the business. And the exchange is losing ground to rivals.

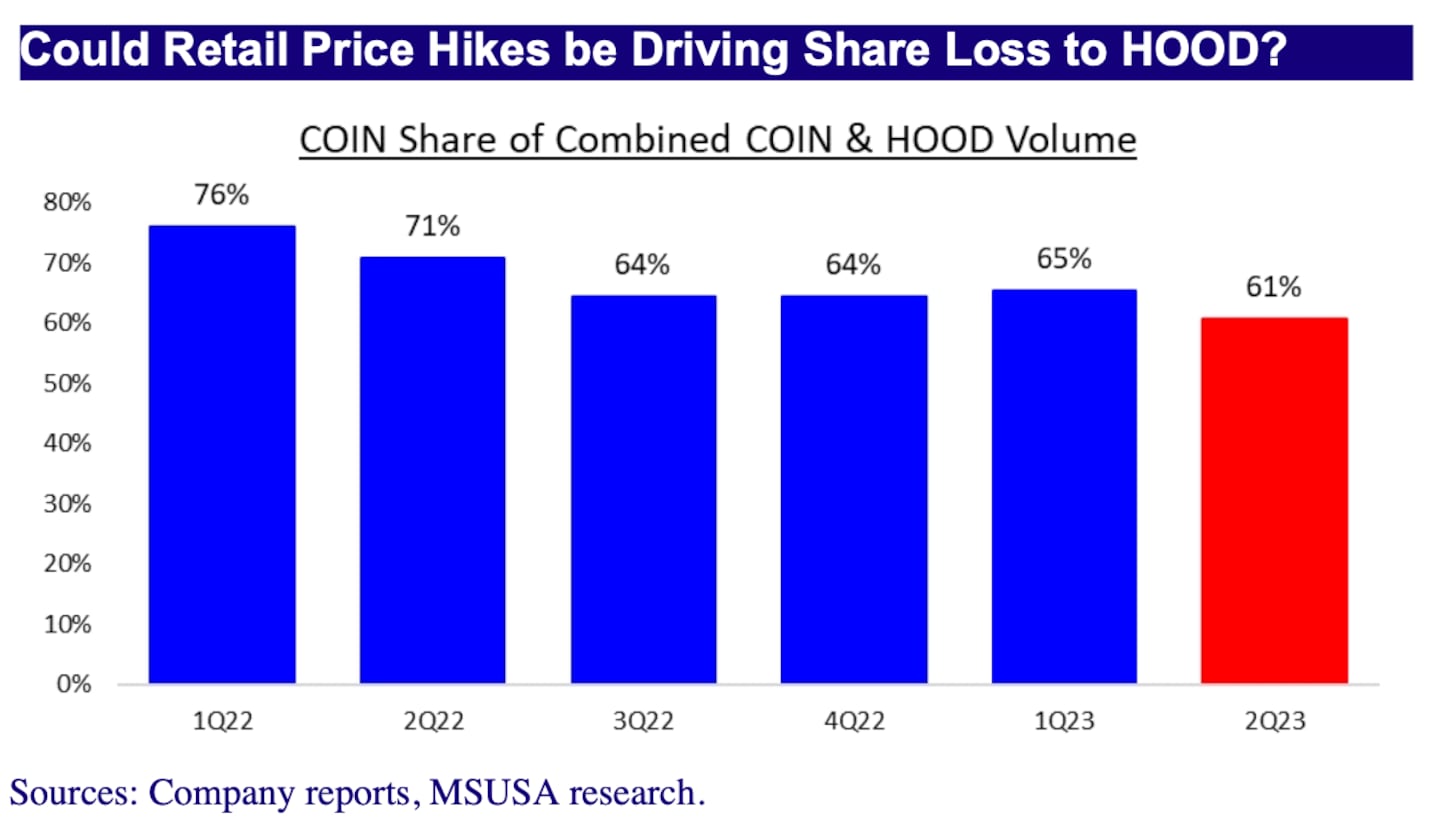

The crypto exchange’s combined volume with Robinhood fell to 61% last quarter, down from 65% in the first. This could accelerate market share losses on the retail front, analysts at investment bank Mizuho said.

High retail prices could explain why Coinbase is losing market share.

The exchange raised retail prices from the first quarter, according to Mizuho, which found that fees rose to an average of about 2.2% in the second quarter from about 1.7% in the first three months of the year.

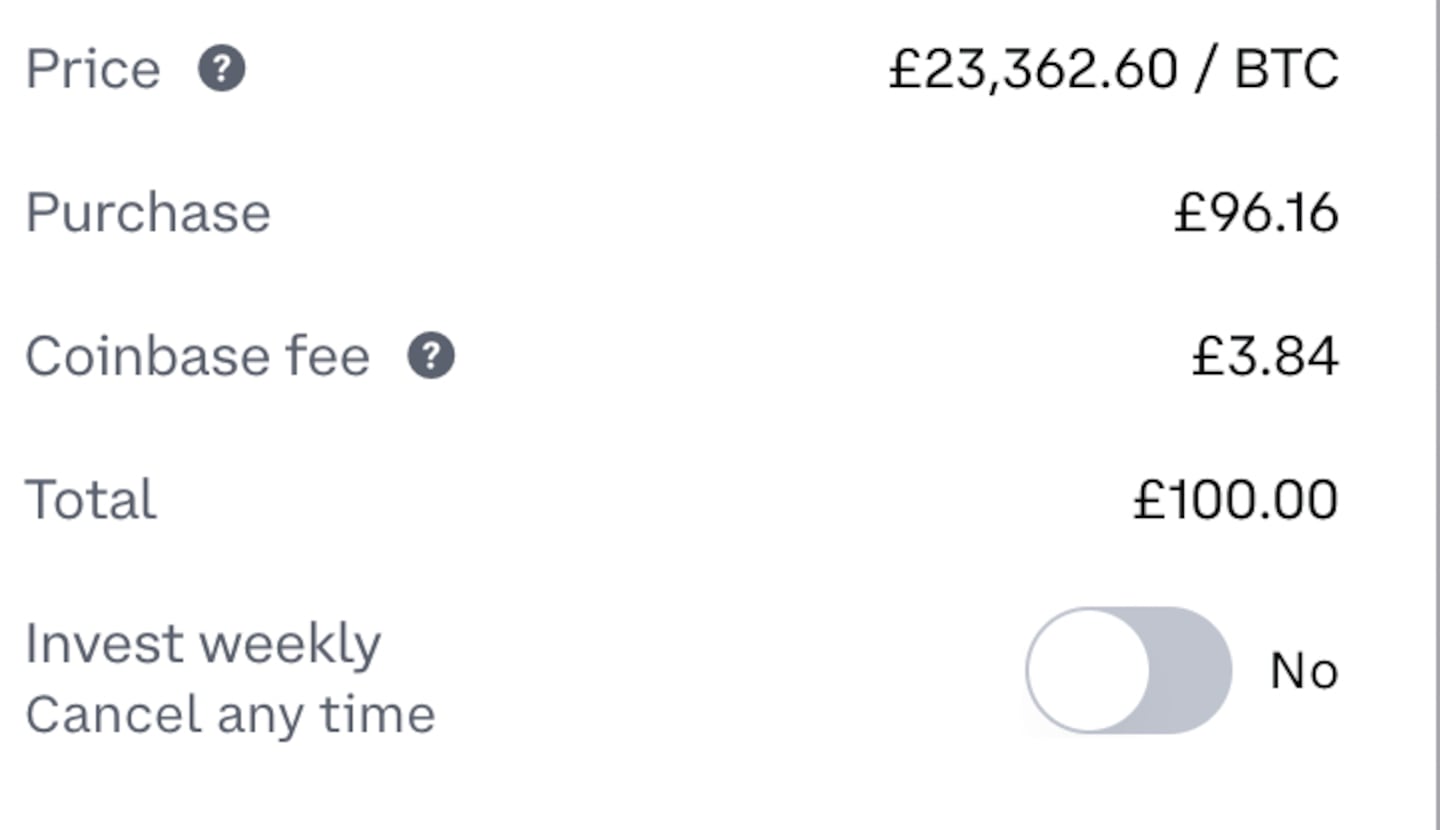

The fee on a retail transaction for a British user looking to buy £100 in Bitcoin was 3.84% on Thursday evening, in a test transaction run by DL News.

The transaction also included a 1% spread on the price of the Bitcoin bought, meaning it cost about £230 above market price.

Update, the story was corrected to include ByBit’s Mantle as an example of a layer 2 network.

With reporting from Osato Avan-Nomayo.

Adam Morgan McCarthy is a London-based markets correspondent for DL News. To contact him with story tips, reach out at adam@dlnews.com.