- The SEC looks poised to approve spot Ethereum ETFs.

- A significant portion of Ether is locked in staking, DeFi protocols, and DAOs.

- The asset could experience a supply crunch.

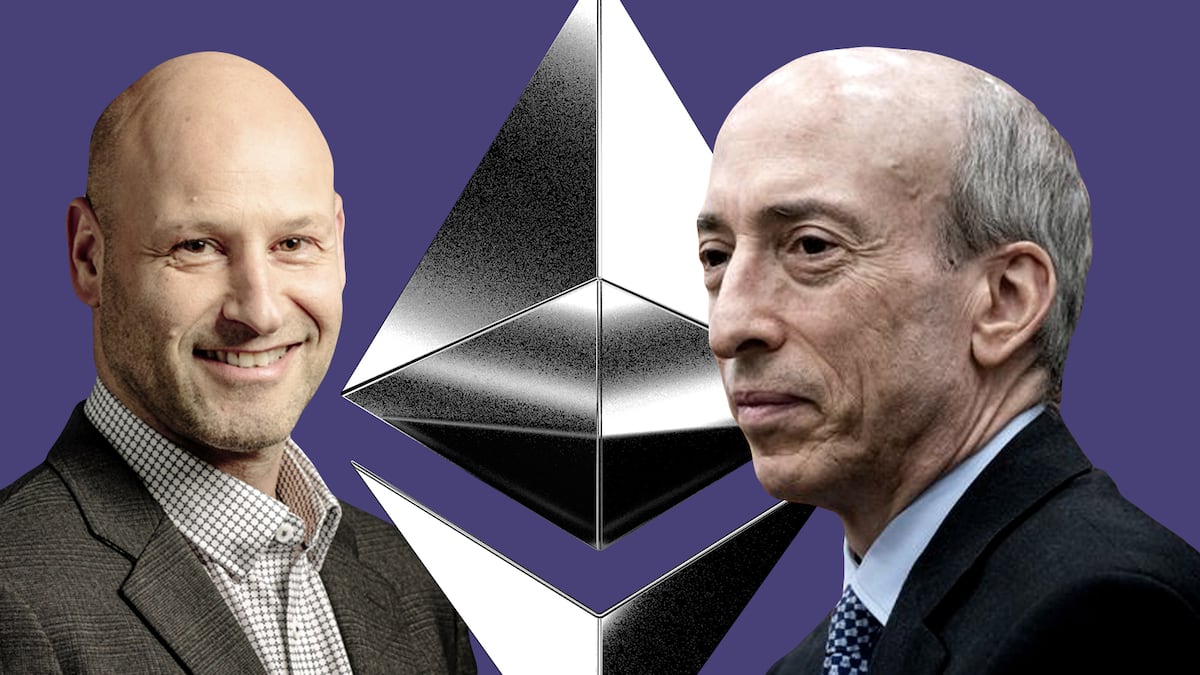

After months of radio silence, the Securities and Exchange Commission looks poised to approve spot Ethereum exchange-traded funds after all.

The resulting “floodgate” of demand for Ether will likely lead to a supply crunch, Joe Lubin, co-founder of Ethereum and founder and CEO of crypto infrastructure firm Consensys, told DL News.

Institutions that have already gained exposure to Bitcoin through the asset’s freshly launched ETFs “will most likely want to diversify into that second approved ETF,” Lubin said.

“There’s going to be a pretty large amount of natural, pent-up pressure to purchase Ether” through the ETFs, he said, but there will be less supply to accommodate that demand than when the spot Bitcoin ETFs were approved in January.

In Bitcoin’s case, authorised participants — the firms contracted to buy Bitcoin on behalf of the ETFs every day new shares are created — could simply purchase idle coins on exchanges or through over-the-counter counterparties.

But onchain data shows that more than 27% of the total supply of Ether is already being staked across the Ethereum network. It’s locked in contracts and earning a yield for its owners.

“Much of the Ether is put to work in the core protocol, DeFi systems, or in DAOs,” Lubin said, referring to decentralised autonomous organisations.

In other words, not only is Ether’s market value lower than Bitcoin’s — making Ether’s price more reactive to inflows — but a significant portion of its supply is unavailable for ETF consumption.

On top of that, renewed activity on Ethereum will cause the network to burn a substantial amount of the existing Ether supply over time, constraining supply further.

Even in Bitcoin’s case, banks were so desperate to purchase coins for the ETFs that they reached out to at least one major Bitcoin mining outfit to acquire some of its Bitcoin holdings, DL News learned. The supply crunch for Ethereum ETFs might be even bigger.

“This could be a pretty profound watershed moment” for Ethereum and the crypto industry as a whole, Lubin said.

Tom Carreras and Liam Kelly write about markets and DeFi for DL News. Got a tip about Ethereum ETFs? Reach out at tcarreras@dlnews.com or liam@dlnews.com